Amazon Stock Forecast For 2019: Two Emerging Important Tailwinds for Amazon

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- Amazon’s stock has significantly dropped since December 3. It is now more affordable to own.

- Amazon is a must-have investment for your 2019 portfolio. Aside from its growing presence in India, Amazon can now cater to online shoppers in more countries.

- Investors can turn more optimistic on Amazon when the company starts showing better international net sales.

- Non-U.S. citizens/residents can now shop on Amazon.com and pay using local currencies at Western Union remittance/money transfer partner outlets.

- Amazon also has another obvious tailwind from its decision to sell its own brand of toys. The global toy industry’s revenue last year was $83 billion.

Investors are turning more bearish on Amazon (AMZN). Since December, AMZN’s price has notably dropped from $1,772.36 to $1,343.96 (from December 3 to December 24). However, I see this as an opportunity to find cheaper buy-in windows to own more AMZN shares. In spite of the current negative market emotion over AMZN, my fearless 12-month forecast is that it can beat its 52-week high of $2050.50.

The average 12-month price target for AMZN (made by 37 Wall Street analysts) is $2,150.74. My 12-month PT for AMZN is $2,250.

(Source: TipRanks)

The logic behind my optimism over Amazon is from two upcoming sizeable tailwinds. First of these tailwinds is its new cross-border payments processing partnership with Western Union (WU). Western Union partner agents/outlets in more than 200 countries will eventually start accepting local currency payments for good purchased on Amazon’s U.S. online marketplace.

The ‘Buy global, pay local’ campaign by Amazon and Western Union will help more non-U.S. residents become long-term customers of Amazon.com. Like it or not, there are millions of people like me who do not like using our credit cards/debit cards to purchase items online. It is much safer to go to the nearest Western Union partner agent and pay in local currency for Amazon purchases.

(Image Source: Western Union)

The great thing about using this payment option is that Western Union will not charge any additional fee on goods purchased on Amazon.com. This partnership will help Asians (like me), Latinos, and Africans buy more affordable U.S. items that are usually priced higher by local (country-specific) online e-commerce operators like Lazada or Shopee.

The Long-Term Benefit From Western Union

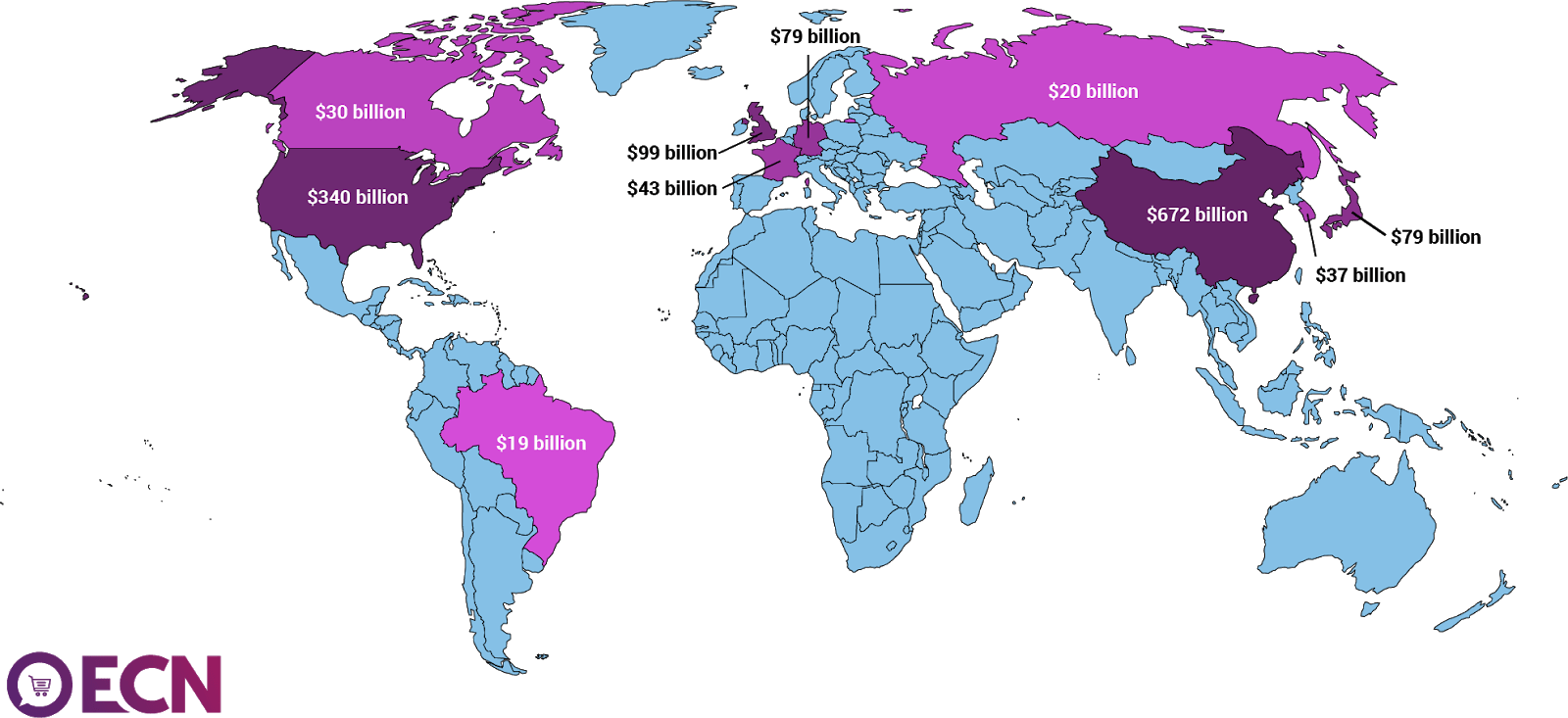

The ‘Buy global, pay local’ partnership with Western Union will help Amazon increase its revenue from outside the U.S. and Europe. Amazon cannot maintain its current revenue growth momentum if it continues to rely on North America and Europe.

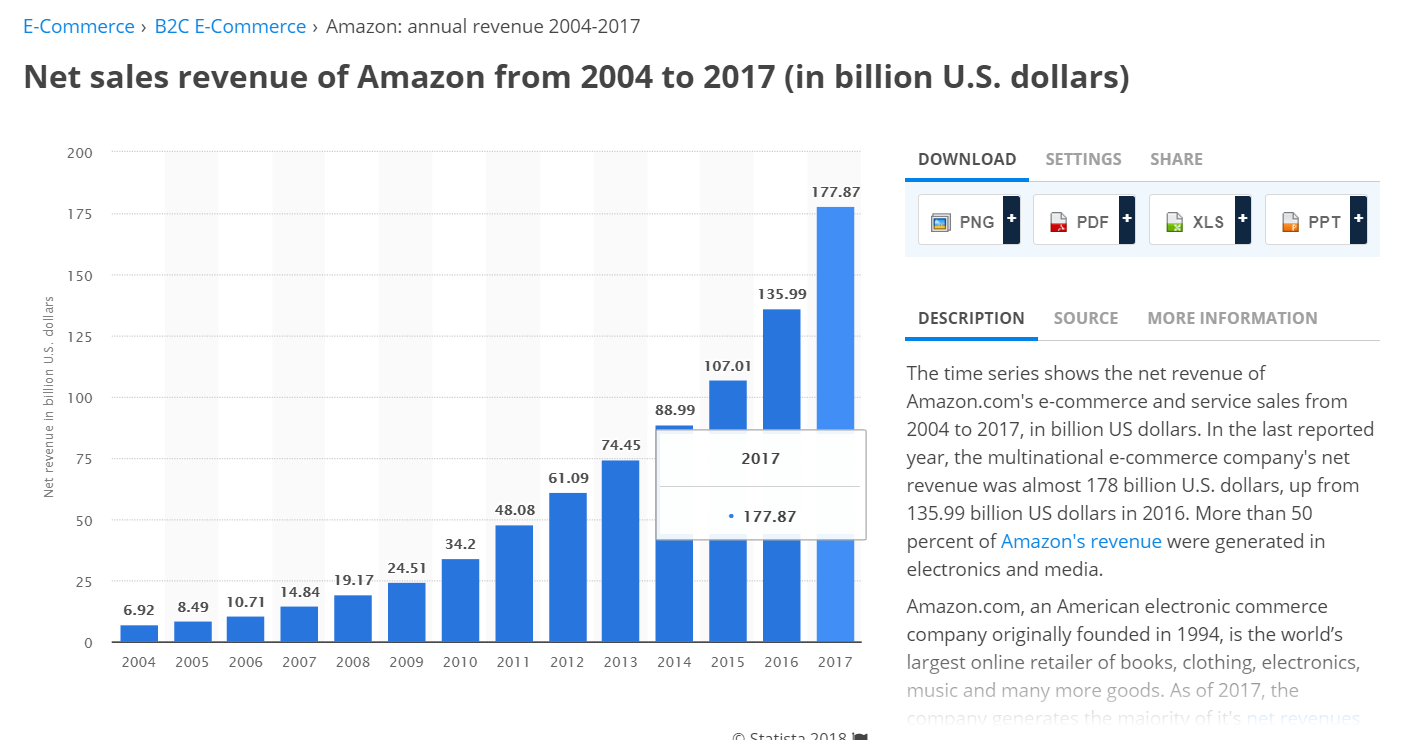

As you can see from the chart above, Amazon’s amazing growth over the last four years was overly dependent from its business in the United States. Amazon’s net revenue from the U.S. in 2017 was $120.49 billion. Excluding Japan, Germany, and the UK, Amazon’s net revenue outside the U.S. last year was only $17.15 billion. This is less than 10% of Amazon’s net annual revenue of $177.87 billion last year.

The weak International sales performance was in spite of Amazon being the no.2 e-commerce player in India. Amazon clearly needs more foreign customers to boost its international e-commerce reach. Western Union’s position as the undisputed leader in global remittances/cross-border money transfer services gave it more than 500,000 partner outlets in more than 200 countries.

Western Union has many agent locations found in countries that have the fastest-growing online retail industries. Indonesia, Mexico, and the Philippines are top 3 countries with the highest annual growth rate in e-commerce sales. These countries could help double-up Amazon’s international net revenue by 2023.

By letting Asians pay in local currencies at Western Union agent locations, Amazon can disrupt the fast-growing Southeast Asian e-commerce industry currently dominated by Lazada (owned by Alibaba) and Shopee (owned by Tencent). Southeast Asia’s ecommerce industry is expected to grow to $200 billion by 2025.

Further, Western Union has more than 22,000 agent location inside China. This can help Amazon improve its almost-dead presence in China. By letting Chinese customers pay in renminbi to shop on Amazon.com, Amazon might steal long-term customers away JD.com and Alibaba (BABA). China is the largest e-commerce market and Amazon has less than 1% market share.

Top 10 E-commerce Markets 2018

Investors can turn more bullish again on AMZN when the company starts reporting bet net sales numbers from outside America and Europe. Amazon reporting $30 billion in international net sales (excluding Europe) can likely inspire institutional investors to push AMZN’s price to $2,250.

Amazon-Branded Toys

The other important tailwind for AMZN is its decision to sell its own brand of toys. Amazon is now filling up the huge void left by the 2017 bankruptcy of Toys ‘R Us. There’s better margins possible from Amazon selling its own line of toy products than hosting third-party toy vendors on its website.

The toys industry’s market size in the U.S. last year was $27 billion. The global toy industry’s estimated revenue in 2017 was $83 billion. Going forward, Western Union can help Amazon become the top global online vendor of toys.

Final Thoughts

The partnership with Western Union and selling its own brand of toys can add $10 billion – $40 billion in new annual net revenue for Amazon starting next year. These two tailwinds are sufficient reasons why we should go against the current market pessimism over AMZN. Amazon and Western Union only needs to market their ‘Buy global, pay local’ service to let more people know about it. I noticed they are only advertising this online shopping payment service via SMS notifications and on Facebook newsfeed ads.

The convenience and safety of buying products from Amazon.com without the need for a credit/debit card or PayPal (PYPL) is a very cheap way to increase its international customers. I suspect Amazon will only pay a very tiny fee to Western Union for every payment process it does.

Taking a contrarian view and buying AMZN while it trades below $1,400 could possibly turn out judicious. My bullish stance on AMZN resonates with the positive long term forecast from I Know First Artificial Intelligence Algorithm.

Past I Know First Forecast Success with AMZN

I Know First has been bullish on AMZN shares in past forecasts. On June 8, 2017, an I Know First algorithm issued a bullish 1 year forecast for AMZN with a signal of 44.38 and a predictability of 0.46, the algorithm successfully forecasted the movement of the AMZN share. Since then, AMZN shares have risen 67.25% within 1 year in line with the I Know First algorithm’s forecast. See chart below.

(Source: Finance Yahoo)

This bullish forecast for AMZN was sent to I Know First subscribers on June 8, 2017.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.