Amazon Stock Forecast: Bet On India Is Another Reason To Buy AMZN

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer

on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Amazon Stock Forecast

Summary:

- Jeff Bezos plans to invest $3 billion to grow its business in India.

- Amazon is now the No.2 online marketplace in India. Flipkart is still No.1.

- India’s online retail industry is predicted to grow to $75 billion by 2020.

- The $3 billion investment will help improve Amazon’s network of distribution centers in India.

- AMZN still has positive short and long-term algorithmic forecasts.

Amazon (AMZN) intends to spend $3 billion more in its quest to become the top online marketplace in India. Amazon initially spent $2 billion to jumpstart its presence in India two years ago. I can confidently say that Amazon’s recent big-spending spree in India is to erase the memory of how Amazon lost China to Alibaba (BABA). Amazon simply wants to make sure Alibaba will not outplay it India.

Bezos made a big mistake when he did not immediately challenge Alibaba’s rapid rise in China five or ten years ago. Fortunately for Amazon, India is going to be its next expansion market outside its old bastion of North America and Europe. Amazon is already the no.2 online retailer in India, surpassing Snapdeal. Alibaba contributed to the $500 million fund raising of Snapdeal last year.

Allocating $3 billion more to grow its India business will allow Amazon to catch up with India’s current top online marketplace firm, Flipkart. Alibaba is also trying to buy a stake in Flipkart. The $3 billion investment in India will hopefully checkmate any alliance between Alibaba and Flipkart.

India’s online retail industry is a growth story that is predicted to grow with a 44% CAGR (Compounded Annual Growth Rate). Forrester Research predicted that India’s online retail marketplace will be worth $75 billion by 2020. Such golden promise from India is enough explanation why Amazon wants to be number one in that country.

Consequently, I’m endorsing a Buy rating for AMZN. The aggressive expansion plan in India confirms that Bezos is still on the warpath to challenge Alibaba’s growing Asian presence. Amazon’s YTD performance is only +4.19%. I think more institutional investors will go bullish on Amazon once they appreciate the impact of Amazon spending $3 billion on India.

(Source: finbox.io)

Amazon Needs India to Slow down Alibaba’s Expansion in Asia

Amazon needs India not only because its North American and European markets are slowing down. Amazon needs to be number one in India to make up for its mistake when it let Alibaba buy controlling stake in Lazada. Alibaba paid just $1 billion to take control of Lazada. Lazada is often called the Amazon of South East Asia.

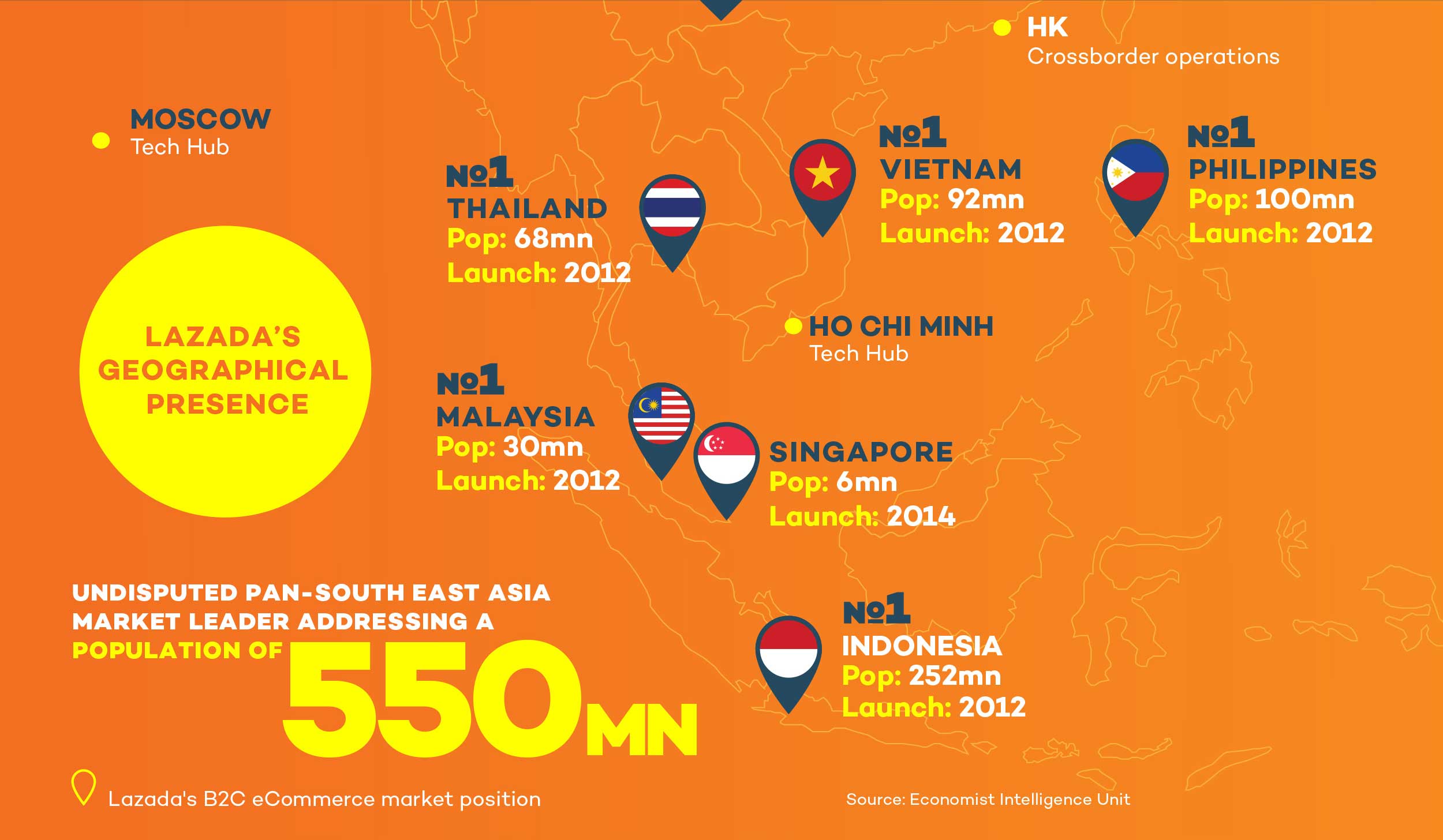

Lazada pioneered Cash-on-Delivery (COD) here in the Philippines and in other South East Asian countries. Alibaba outplayed Amazon in South East Asia. Lazada now gave Alibaba access to the 550 million people of five growing South East Asian countries. Alibaba, through Lazada, became the No.1 online marketplace provider in the Philippines, Indonesia, Thailand, Vietnam, and Malaysia.

(Source: Lazada)

India is the only battleground left where Amazon can outplay Alibaba. Lazada is already too entrenched in South East Asian countries. Amazon will have to laser-focus on India and hopefully that country’s 1.3 billion people will make up for its blunder in not buying Lazada.

Conclusion

Amazon can afford to outspend and outgrowth the distribution networks of Flipkart. Flipkart is still a money-losing entity that reported a massive 2,000 crore ($298.69) in FY 2015. Flipkart only lost 715 crore ($106.78 million) in 2014. Unless Flipkart accepts outside investors like Alibaba, that Indian company will eventually run out of money. There’s been no update whether Flipkart’s March drive to raise $1 billion from new investors was successful.

A $3 billion expansion drive will certainly help Amazon become No.1 in India within 1-2 years. Amazon has more than $15 billion in cash & equivalents. Should Alibaba tries to help Flipkart, I’m sure Bezos will consider increasing the $3 billion expansion for India.

My bullish rating for AMZN is supported by the still positive algorithmic forecasts from I Know First’s machine-learning supercomputer. Amazon’s predictive scores for 1 Month, 3 Months, and One year are all positive. There is little probability that AMZN will greatly fall from its current price levels of $700+++.

The bullish algorithmic forecasts are also aligned with the Strong Buy signals from the long-technical indicators of AMZN. The compute power of my brain, I Know First’s deep-learning neural network computers, and Investing.com’s technicals tracking computers are all in agreement that AMZN is a gem that everyone should have in their growth-focused portfolios.

(Source: Investing.com)