AMAT Stock Forecast for 2018: Applied Materials Inc. Shows Double Digit Growth In 2 Months And Keeps On Rising

The article was written by Gleb Zinkovskii, a Financial Analyst at I Know First.

“Our broad portfolio of capabilities and products puts us in a great position to outperform our markets and we’re confident that each of our three major business segments can deliver strong double-digit growth in 2018.”

– Gary Dickerson, president and CEO of Applied Materials

AMAT Stock Forecast for 2018

Founded in 1967, Applied Materials, Inc. is the leader in materials engineering solutions used to produce virtually every new chip and advanced display in the world. The Company operates through three segments: Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets. The company serves manufacturers of semiconductor wafers and chips, liquid crystal and other displays, and other electronic devices. Applied Materials, Inc. has its HQ in Santa Clara, California.

Summary:

- Record quarterly revenue of $4.20 billion, up 28 percent year over year

- GAAP EPS of $0.13; record non-GAAP EPS of $1.06, up 58 percent year over year

- Doubles quarterly dividend and increases share repurchase authorization by $6.0 billion

What Are The Drivers Behind AMAT’s Super Performance In Q1 2018?

Compared to the first quarter of 2017 financial year, Applied Materials’ net sales grew by 28% to $4.20 billion. At the same time, the company increased gross margin by 1.6 points to 45.7% (GAAP basis) and grew operating income by 48% to $1.20 billion or 28.4 percent of net sales. However, earnings per share declined to $0.13 due to a one-time charge related to recent U.S. tax legislation that reduced earnings per share by approximately $0.94.

It is worth to note that the company increased cash flow from operations by 85% year over year to $1.47 billion and returned $888 million to shareholders through dividends of $106 million and $782 million in share repurchases.

What Investors Can Ask At The End Of The Year?

Recently, Company’s Board of Directors approved a doubling of the quarterly cash dividend on the common stocks to $0.20 per share that will be payable on June 14, 2018 to shareholders of record as of May 24, 2018. Also, a cash dividend of $0.10 per share will be paid on March 14, 2018 to shareholders of record as of February 21, 2018. Finally, the Board approved a new $6 billion share repurchase authorization which is incremental to $2.8 billion remaining in the previously approved authorization.

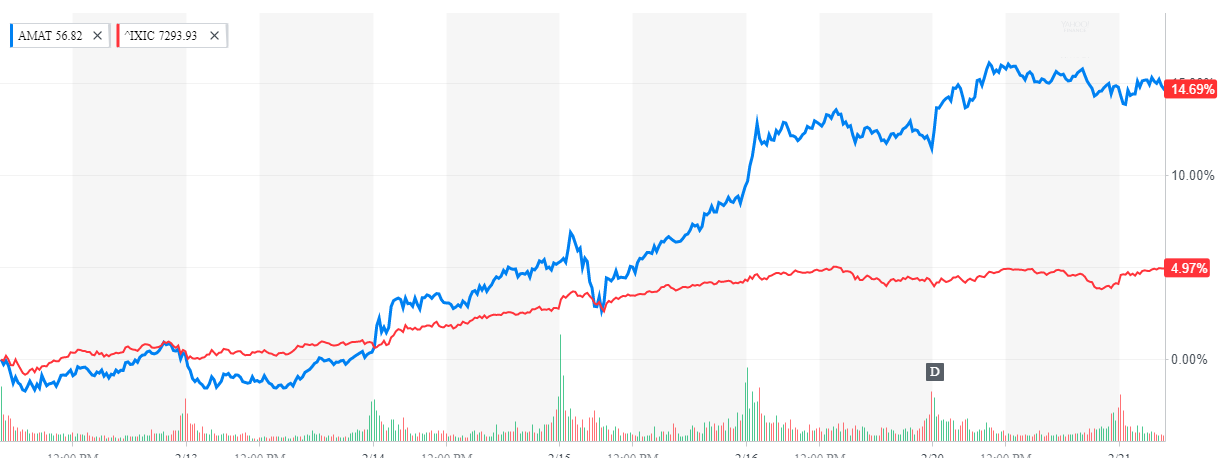

During the company’s webcast dedicated to the company’s results for Q1 2018 held on February 14th, 2018, Dan Durn, Senior VP and CFO stated that “the dividend increase and additional repurchase authorization reflect Applied’s confidence in the underlying strength of our markets along with our company’s technology leadership and strategy to deliver profitable growth and increase shareholder value.” That said, the company’s shares reacted to that statement positively pushing the stock price up by 13.9% in 7 days following the announcement and dividend payment on February 20th. This is reflected by the stock price performance graph for this time period below:

What Is The Future Investment Outlook Of The Company In The Coming Year

In the second quarter of 2018 financial year, Applied Materials expects net sales to be in the range of $4.35 billion to $4.55 billion; the midpoint of the range would be an increase of approximately 26% yearly. Non-GAAP adjusted diluted EPS is expected to range from $1.10 to $1.18 with the midpoint of approximately 44% yearly. This outlook for non-GAAP adjusted diluted EPS excludes known charges related to completed acquisitions of $0.04 per share and includes the normalized tax benefit of share-based compensation of $0.01 per share, but does not reflect any items that are unknown at this time, such as any additional charges related to acquisitions or other non-operational or unusual items, as well as other tax related items, which we are not able to predict without unreasonable efforts due to their inherent uncertainty.

Conclusion

So, is AMAT stock forecast positive or negative and is it the best available option to invest in a semiconductor industry company now? Based on the information that was presented in the above and during the Applied Material’s webcast dedicated to Q1 2018 results it seems that the company’s management set ambitious targets, although reachable ones. So far, the company’s key performance indicators were either in line with the industry’s average or above it. We see that the company continuously invests in R&D in the fields that are going to grow or accelerate the growth in the nearest future. This enables the company not just to pay back those investments but bring more cash inflows and provide shareholders with value. That is in line with the actual perfomance of the company’s stock price as we see 14.69% growth since the last time I Know First analysed AMAT:

Finally, the analyst consensus is that 20 out of 22 analysts took buy positions in respect of this stock.

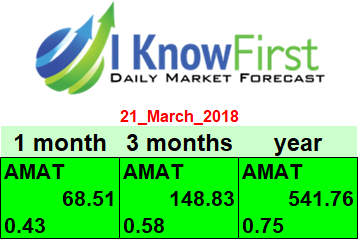

I Know First has a very bullish one-year algorithmic forecast score for AMAT. I submit to this positive endorsement and rate AMAT as a buy. I Know First has a very high one-year predictability score for AMAT, 0.75. It means I Know First has a long history of accurate 1-year predictions for Applied Material’s stock.

Past I Know First Success with Applied Materials

In a forecast dated January 28th, 2018, I Know First’s algorithm indicated strong growth for AMAT. On February 28th, 2018, AMAT returned 4.08%, showing the accuracy and precision with which, I Know First has recommended AMAT in the past.

Current I Know First subscribers received this bullish forecast of Applied Materials on January 28th, 2018.

To subscribe today click here.