Altria Stock Price: Altria Group – The Tobacco Company’s Diverse Future

Omri Elani is a Junior Business Developer & Research Analyst for I Know First. Also a frequent contributor for Seeking Alpha

Omri Elani is a Junior Business Developer & Research Analyst for I Know First. Also a frequent contributor for Seeking Alpha

Altria Stock Price Summary:

- The tobacco and cigarette giants had an impressive year.

- The booming e-cigarette industry and how Altria are capitalizing.

- The benefits of being an Altria shareholder.

- Is the future with beer?

- Analysts are confidently predicting MO share to rise.

- I Know First algorithm is currently bullish on Altria Group

Altria Group Inc (NYSE: MO) – With many countries taking extensive measures to aggressively discourage smoking such as excise taxes, restrictions on labeling and advertising, and public bans, it is impressive to see how Altria has managed to remain unharmed. The company has for decades led the industry with its Marlboro brand which has dominating market share among U.S. smokers. CEO Martin Barrington successfully navigated the firm to impressive results in 2015 as demonstrated by the firm’s rising stock prices. So how will next year pan out for the tobacco giants?

Altria Head Quarters, Source: Advisor Analyst

Year review 2015

At the beginning of the year, many investors were skeptical on how well Altria will do due to the upcoming merger of Reynolds American and fellow tobacco rival Lorillard. The merger was thought to have devastating impacts on Altria, as the new player would now have higher bargaining power and increased economies of scale.

However, Altria came out unscratched as evident by the company’s fundamental analysis in 2015. In the first quarter of 2015, revenue jumped 5% as the company managed to boost both prices and volumes. Altria’s second-quarter results continued this upwards trend, as illustrated with a sustainable 3% rise in volume sales up almost 6%. The third quarter also saw decent results with roughly a 5% rise.

The success of Altria could be due to the stocks resembling the behavior of a fixed income security, as it had modest growth potential and high dividend, resembling the coupon payouts of a bond. Thus, as the market was preparing for the rise in interest rates, Altria shares suffered. However, in the second half of the year as these fears seemed to diminish Altria performance improved.

The E-cigarettes boom

Altria future lies in its ability to capitalize on the growing e-cigarettes market. The increased desire among consumers to quit smoking tobacco is the primary driver for the growth of this market. Moreover, the e-cigarettes have more lenient resections and are thought to be less dangerous when comparing to tobacco smoking. In addition, e-Cigarettes are cheaper than traditional cigarettes due to the lack of legitimate taxation on their sale, thus fueling demand.

According to Forbes, e-Cigarettes have surpassed $1billion annuals sales worldwide as of 2013. The graph below depicts the rapid increase in sales from 2008. While reports that the European e-liquid market is expected to grow over $11 billion by 2025. These figures help to emphasize the massive expansion of the e-Cigarettes sector.

E-cigarette sales worldwide.

Altria has realized the need to capitalize on this changing market. They have therefore entered into the e-Cigarettes category through its Nu Mark subsidiary, which operates the MarkTen brand. Until recently, MarkTen was only available in two U.S. states, Indiana, and Arizona, but after successful test results, the company is broadening MarkTen’s horizons. Although, some argue that this strategy is not right for Altria. Claiming the e-Cigarette market is still very small and Altria should focus more on protecting their exciting tobacco industry from price inclinations and advertising censorship, in order maintain itself in the long run.

Mark Ten, Source: Medical Daily

It’s good to be an Altria shareholders

The tobacco giant’s current business model is based on little capital expenditure, due to its labor intensive industry and high returns on capital. This in turns leads to a high amount of cash inflows. The high amount of cash is actually passed onto shareholders through share buybacks and dividends. .

Such evidence shows the benefits one can gain from owning an Altria stock. Moreover, there are no suggestions that Altria will divert from being so generous to its shareholders. Yet, high dividends may often come at the cost of future growth. As every dollar paid in dividend is a dollar not reinvested back into the company.

Altria bought back $192 million worth of its own stock in the first quarter and paid $1 billion in dividends. The reasoning behind this was as it helped boost their EPS. Last quarter, Altria repurchased approximately 3.6 million of its own shares at an average price of $53.03.

Is the future with beer?

Altria has seen its stocks rapidly increase as of late due to the news that beer brewers Anheuser-Busch InBen is slowly but surely cementing its merger acquisition with SABMiller. Although Altria is not directly involved with one of these two firms, they do own roughly 27% of SABMiller’s ordinary shares outstand. Thus, it is only natural for Altria’s shares to increasing following the announcement.

The acquisition has a long-term implication for Altria’s on multiple fronts. The acquisition helps to diversify the tobacco company’s revenue stream and help to spread the risk across other sectors. Even more important, is the fact that SABMiller has consistently delivered considerable profits to Altria’s bottom line quarter after quarter. Moreover, Altria can adopt a different approach and cash out of its SABMiller holder and receive a high influx of revenue.

Whichever path Altria takes, the acquisition should definitely benefit them in the long run.

Source: CBC News

Analysts Opinion

The company’s stock prices are valued at 57.44$ as mentioned earlier. According to data provided by Thompson/first call, the mean target price is $64.00 and the median target price is $65.00 both significantly higher than the current share price.

Additionally, it is important to note that the mean recommendation for the past two weeks sits at a slightly favorable value of 2.1.

| Recommendation Summary* |

| Mean Recommendation (this week): | 2.1 |

| Mean Recommendation (last week): | 2.1 |

| Change: | 0.0 |

* (Strong Buy) 1.0 – 5.0 (Sell)

Source: Yahoo finance

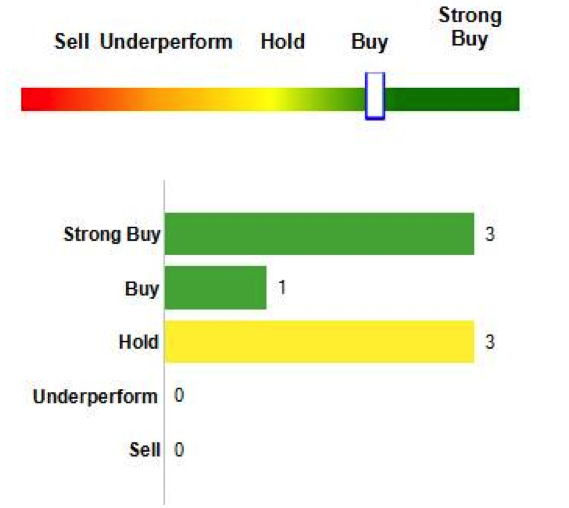

Analysts seem to be optimistic on the firm’s future, with 3 recommending the stock as a strong buy, 1 as a buy, and 3 as a hold.

Source: Nasdaq

Source: Nasdaq

Algorithmic Analysis

I Know First supplies financial services, mainly through stock forecasts via its predictive algorithm. The algorithm incorporates a 15-year database and utilizes it to predict the flow of money across 3,000 markets. The algorithm has more data to forecast within the long term and, naturally, outputs a more accurate prediction in that time frame.

The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

With so much on the horizon, I Know First is bullish on this stock in the one-month, three-month and one-year, which support the fundamental analysis of Altria.

One-month, Three-month and One-Year Algorithmic Forecast Updated December 22, 2015.

Conclusion

With dividends still rising and fundamental strength in its financials, it’s won’t be surprising if Altria continues its strong gains into 2016. Although, with the recent FED increase in interest rates, investors may want to keep on eye how the firm reacts in the long run. However, with the company delivering surprising growth in 2015, Altria could well have some more surprises up its sleeve to impress investors next year and beyond. With this insight, it seems as though MO would be a fruitful addition to adding to one’s portfolio.