Algorithmic Trading Market: Booming Evolution and Bright Future

This algorithmic article was written by Yutong Li – Analyst at I Know First, Master’s candidate at Brandeis University.

This algorithmic article was written by Yutong Li – Analyst at I Know First, Master’s candidate at Brandeis University.

Highlights

- The global algorithmic trading market has risen tremendously these years, and algorithmic trading has dominated more than 80% of the stock market nowadays

- Benefits of algorithmic trading today include the elevated speed of execution, reduction in transaction time, lower risk of errors, free of human bias, etc.

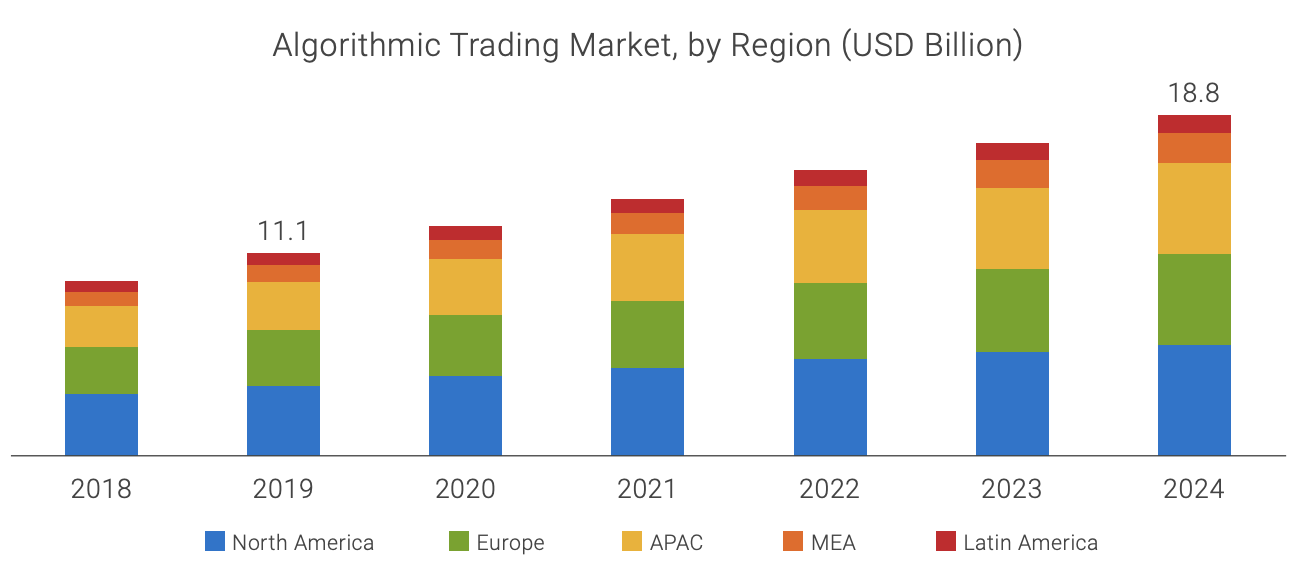

- The total algorithmic trading market is projected to touch $18.8 billion by 2024

What Is Algorithmic Trading?

Nowadays, we have probably seen this term – algorithmic trading (or algo trading for short) frequently. But what does this term mean exactly? Algorithmic trading is defined as a process of trading that utilizes computer algorithms to execute trades and make profits with no human intervention in the transaction. In other words, pre-programmed machines are given instructions on when to sell or buy, based on the historical and current market patterns and volatility captured by algorithms. Understanding how this process works might be too technical, but implementing this automated process is simple and fast. And there is a lot of well-developed software out there for people to trade in minutes. This serves as one reason why the algorithmic trading market is growing progressively today with more traders getting engaged. In this article, we will be recognizing more advantages of using algorithmic trading as one strategy and study why it becomes so popular. Referring to the statistics collected in this article, we are also going to discuss the main tendency of algo trading nowadays as well as its perspectives and potentials in the future.

Algorithmic Trading Market Today: Perks & Benefits Offered

The use of algorithmic trading has grown dramatically since the turn of the century and has become prevalent across the world today. By an analysis from Seeking Alpha, as of early 2000 in the U.S. stock market, algo trading accounted for only 15% of the market volume, however, more than 80% of trading now is attributed to algo trading. Here, we can also point out the development of High-Frequency Trading (or HFT) as one typical example during the thriving evolution of algorithmic trading. This article states that, by the year 2001, HFT only had an execution time of several seconds. By 2010, this had lessened to milliseconds, even microseconds, and subsequently nanoseconds in 2012. In 2020, the global HFT server market size was estimated at USD 387.9 million according to this report. Thus, we can see how technology is evolving and being advanced constantly to facilitate algo trading across time.

Moreover, algo trading also furnishes a wide range of asset classes including equities, commodities, futures, options, and fixed income. Based on the figure below, equities have the largest share in algo trading in 2016, then followed by futures subsequently. And the market share of algorithmic trading for all asset classes has been persistently increasing since 2004.

Given the above statistics on how popular algorithmic trading is today, let’s take a look at the benefits that algorithmic trading brings to traders and the stock market in more detail.

Elevated Speed of Execution

This advantage of algorithmic trading is very straightforward to put forward. Since all algorithms are preprogrammed, people can execute the trading process easily using machines, which is faster than human trading to a large extent. Thus, this allows people to trade with higher frequency, allowing for more opportunities and better prices.

Reduction in Transaction Time

Using algo trading, investors don’t have to spend as much time monitoring the markets, and all the trades can be executed without human intervention. Accordingly, algorithms can handle this by buying shares and checking the markets instantaneously, which saves a large amount of time that humans spend on supervision.

Lower Risk of Errors

The risk of errors can also be reduced using algo trading. Human errors containing execution errors or skill-based errors can be fought using a completely automated process on machines. Moreover, as for the algorithmic errors, since they are more predictable and trackable, once the mistakes could be found out and addressed in the system, the same type of errors can be avoided forever.

Free of Human Bias and Emotions

As human beings, we tend to make irrational decisions controlled by our emotions, and this always results in poor decisions and wrong strategies. With the use of algo trading, a computer will only follow instructions and rules programmed beforehand, and thereby this source of error can be eliminated.

To sum up, we have discussed many benefits that drive investors to select algorithmic trading as one powerful strategy to make decisions and create more profits. There are many more advantages of algorithmic trading in the stock market as shown here, including arbitrage strategy, index fund rebalancing, etc.

Algorithmic Trading vs COVID-19 Pandemic

The global market has experienced a significant change during the pandemic. The overall economy is under threat, and consequently many industries are heavily impacted by COVID-19. This also happens to financial markets. Investors are suffering huge losses from plunging stock prices and market volatility.

Fortunately, COVID-19 has actually triggered the widespread usage of electronic trading strategies. As people are working from home electrically now, there is also a rising number of trading orders placed online. According to data from Tradeweb, the average daily volume in April 2021 for Tradeweb was $896.8 billion, indicating a 17.5% increase year-over-year. Furthermore, algorithm trading, as one subset of electronic trading that can be executed through robots or Expert Advisors (or EAs), is also used pervasively. As is shown in the statistics provided by Analyzing Alpha, 23% of the institutional investors reported an increase in algo trading during the COVID-19 phase. Therefore, we can notice that COVID-19 has actually led to a surge and brought huge potentials in E-trading and algo trading. This trend towards more automated and electronic trading strategies is also very promising to continue in the foreseeable future.

The Bright Future of Algorithmic Market

As we discussed earlier, algo trading contributes many benefits to traders, and historical growth and the current tendency of this algorithm market have been very encouraging. Hence, we can now be positive to project a continuous and thriving growth in this new trend of trading, since algo trading will be developed further and give traders more options and powers to complete more accurate trades faster in the near future. To support our outlook, we can use some key statistics to further demonstrate. According to Mordor Intelligence, algorithmic trading is growing at a CAGR of 11.23% between 2021-2026. Another analysis by Dell Technology also states that the total algorithmic trading market is likely to touch $18.8 billion by 2024. As we mentioned earlier, equities possess the maximum share in algo trading, and they are likely to contribute $8.61 billion in algo trading market share in 2027 claimed in this report.

In addition, algorithmic trading can also be very high-demand in the job market. Based on data from ITJobsWatch, there are 99,833 permanent vacancies with a requirement for process and methodology skills in algo trading within these 6 months in the UK. Plus, salary.com also reported, in May 2021, an annual salary range of an algorithmic trader in the US is from $48,640 to $53,925. All in all, the global algorithmic market is expected to witness a bright blossom in future years.

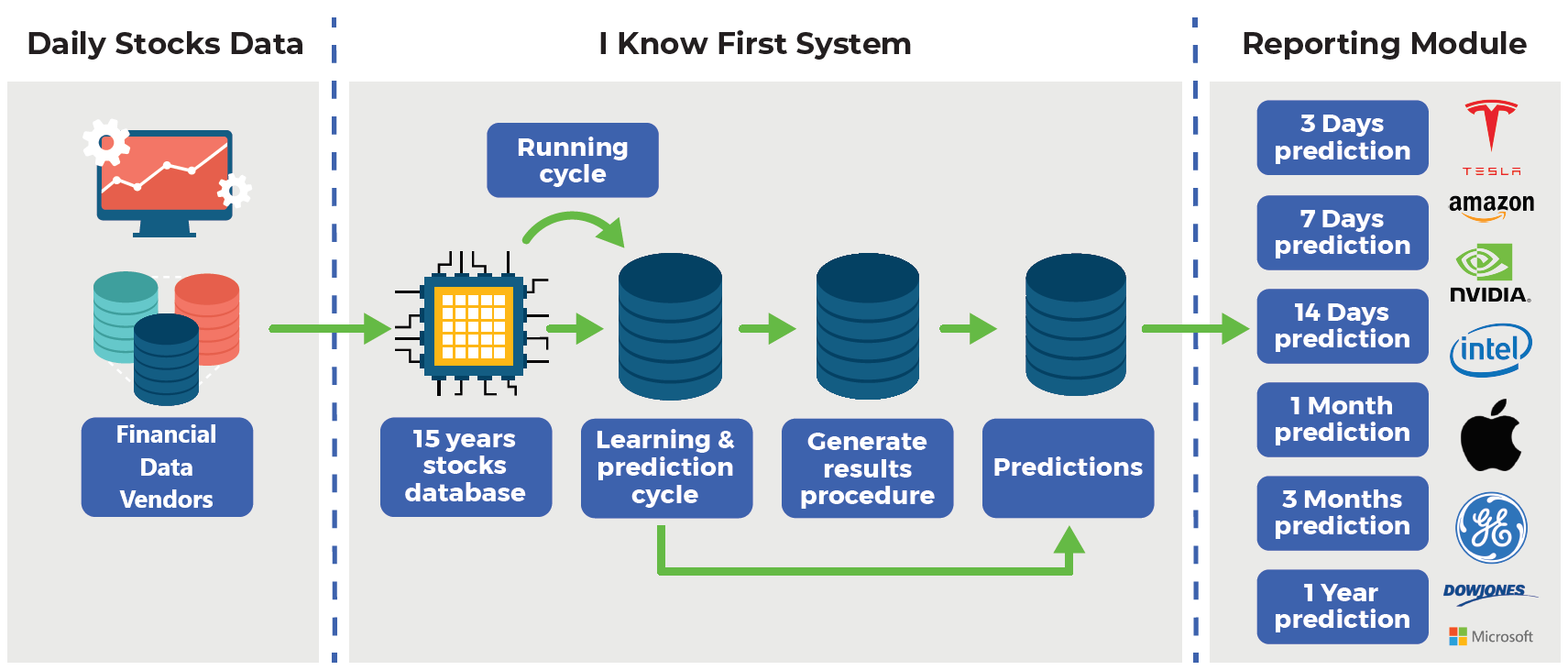

I Know First’s Position in Algorithmic Trading Market

I Know First is one of the leaders in this algorithmic market. It has effectively utilized AI and Machine Learning based algorithms to provide daily forecasts and facilitate trading for over 10,500 financial instruments. More specifically, the I Know First Market Prediction System identifies waves in the stock market and generates forecasts in a heatmap format. Even though the algorithm is complicated, its displaying results are very straightforward to interpret. The system outputs the predicted trend as a number, positive or negative, along with the wave chart that predicts how the waves will overlap the trend. This gives simple instructions and helps the trader decide which direction to trade, at what point to enter the trade, and when to exit.

Great success has been achieved by using I Know First’s algorithm shown in the below performance evaluation summary of top US market index forecasts for long-term horizons. We can see the best hit ratio on a 1-year time horizon has reached 100% for the Nasdaq index and its ETF QQQ, as well as SPY, followed subsequently by S&P 500 and Dow Jones Industrial Average at a return of 99%. The average hit ratio for this time horizon also got to 97.2%. Even during the pandemic year, all the long-term horizon forecasts below have performed splendidly with more than 62% accuracy. With all figures presented, we can find how well I Know First’s algorithm has done for traders as trends and forecasts were identified accurately.

Conclusion

In a nutshell, in this article, we have seen the substantial evolution and growth of algorithm trading and how it has become such a popular trading strategy in the 21st century. It also enables a more efficient, accurate, and profitable trading experience to traders as of the benefits we have talked about. Besides, the impact of COVID-19 did not appear to impede the growth and enlargement of the algorithmic market but actually triggered a rising trend in electronic trading as a broader set of algorithmic trading. Furthermore, we can be optimistic about the global algorithmic market having a bright outlook in the near future.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.