ALGN Stock: Be Confident With ALGN Stocks Like The Smile It Offers

The ALGN stock prediction article was written by Chloe Peng, Analyst at I Know First. Master of Science of Finance candidate at Brandeis University.

The ALGN stock prediction article was written by Chloe Peng, Analyst at I Know First. Master of Science of Finance candidate at Brandeis University.

Summary

- Align technology surpasses its competitors by advanced technology, high-quality products, active consumer marketing and good services.

- The company is hurt by COVID-19 and is looking for a recovery; analysts are confident with its future growth potentials.

- I make a BUY suggestion for the company based on fundamental analysis and also the result generated from I Know First’s predictive AI.

Company Overview

Align Technology, Inc is a medical device company engaged in the design, manufacture and marketing of clear aligners and intraoral scanners, and services for orthodontics, restorative and aesthetic dentistry. It was founded in 1997 in California with the single mindset of developing a technology that straighten people’s teeth.

Align has two major products: the Invisalign system and iTero scanner and services.

The Invisalign system is used for straightening teeth with a series of custom-made aligners for each patient. It is a combination of proprietary virtual modeling software, rapid manufacturing processes and mass customization, and custom-made aligners with patented aligner material. The system has helped over 8.3 million patients including over 2 million teens.

iTero intraoral scanners are designed to deliver speed, reliability, intuitive operations, and outstanding visualization capabilities for general practitioners or orthodontists. It is digital innovation that is transforming practices around the world and visualize better practices.

The 2 major products are welcome by dentists and patients for high quality and new technology and when it comes to revenue growth of the 2, Invisalign (Clear Aligner) grows faster and more stable than iTero (Scanner & Services).

COVID-19 Impact And The Company’s Plans For Recovery

The coronavirus has been affecting the global economy for months and there’s no exception for Align Technology. According to the Align’s 2020 Q1 report, in early March, China was progressing in line with the company’s original guidance for Q1, which included approximately 20-25K fewer cases and $30-35 million less revenues for Invisalign and iTero products due to China’s shutdown, but other regions were performing ahead of Q1 outlook. However, the situation quickly changed in mid-March as most governments in EMEA and North America closed non-essential businesses and initiated stay at home orders.

As a result, the vast majority of Invisalign practices shutdown and the business operations are largely interrupted. The company estimates that the incremental impact of COVID19 for Q1 results in approximately 50K fewer cases and $85 million less revenue for Invisalign and iTero products. The table below shows Align’s sales and earnings for Q1 2020 on a quarter-to-quarter basis and a year-to-year basis comparison.

Although up to now there’re still countries experiencing shutdowns, China and some cities in US and other many countries have reopened their businesses. While it’s still early in the recovery process and the situation is different in every city and for every practice, the company is working closely with doctors to support their current needs. With the company’s ongoing effort, the sales volume of its main product Invisalign in Q1 2020 still increased compared to the previous years.

I selected the above 3 US competitors, Smile Direct Club, Henry Schein and Dentsply Sirona to show you how Align Technology performs among peers. Smile Direct Club and Align ended partnership on the beginning of 2020 due to increasing tension of the last one. Up to now, we see that Align is outperforming Smile Direct Club by positive net income. Among the four, Henry Schein has the longest operating history and the largest in size. However, though Henry Schein and Dentsply Sirona have the higher revenue, they have much lower profit margins due to their other businesses except dental. This is further presented in the following table indicating that Align has significantly higher margins than its peers.

ALGN Use Active Consumer Marketing To Attract Customers

The company is operating in a highly under-saturated sector where according to Align itself, only 3% market share was seized by the company. There’s much more opportunities in the market, among which teenagers’ dental issues have the most potential. We know that teens use social media a lot and Align is using consumer marketing strategies to attract teenager customers. In the following table, I’ll show you how Align actively manages its social media profile compared to its peers.

Based on the above table, we can observe that Align has the most twitter followers and has been managing its social media very actively, which is in line with the company strategy of connecting customers and deliver a best in class experience. No wonder why people are always aware of Align Technology’s Invisalign when they think about straightening their teeth. Consumer marketing is also stated clearly in its company strategy and is working well so far.

ALGN Stock Prediction: ALGN Is Currently Undervalued

Analysts are confident with Align’s earning ability and give the following estimation on the company for 2020 and 2021, taking the COVID-19 crisis into consideration. Most of them gave a BUY suggestion for the potential of the company.

I believe that the current decrease in revenue and negative quarter by quarter growth rate is only temporary. With its constantly developing technology and satisfying services, it will overcome the current difficulties and grow even better.

Based on my financial model of ALGN and the Discounted Cash Flow Model, I become even more certain that the stock will perform well in the future. I’ll explain to you my main assumptions for the model as shown in the graph below.

For the growth rate of 15%, I used analysts’ estimation of 20% and took coronavirus impact into account. I used the general GDP growth rate as its terminal growth rate since no company can outgrow the GDP in the long-run. The discount rate is calculated as weighted average cost of capital, or WACC, based on cost of equity, cost of debt and the company’s capital structure. Based on these assumptions, my ALGN stock prediction indicates a fair value of $350.17, which is 42.5% above its current stock value and thus, a strong BUY.

Conclusion

Although Align Technology is hurt by the coronavirus, its business plans on consumer marketing and targeting on teenagers will surely make the company grow faster in the future. Based on the financial model and DCF model I built for the company which indicate that the stock is largely undervalued, I suggest investors to BUY ALGN stocks. Moreover, my high enthusiasm for ALGN is also due to its stock’s bullish one-year ALGN stock prediction from I Know First. The predictive AI algorithm of I Know First gave ALGN a one-year forecast of 617.39. This score is a clear bullish signal for ALGN.

Past Successful I Know First ALGN Stock Prediction

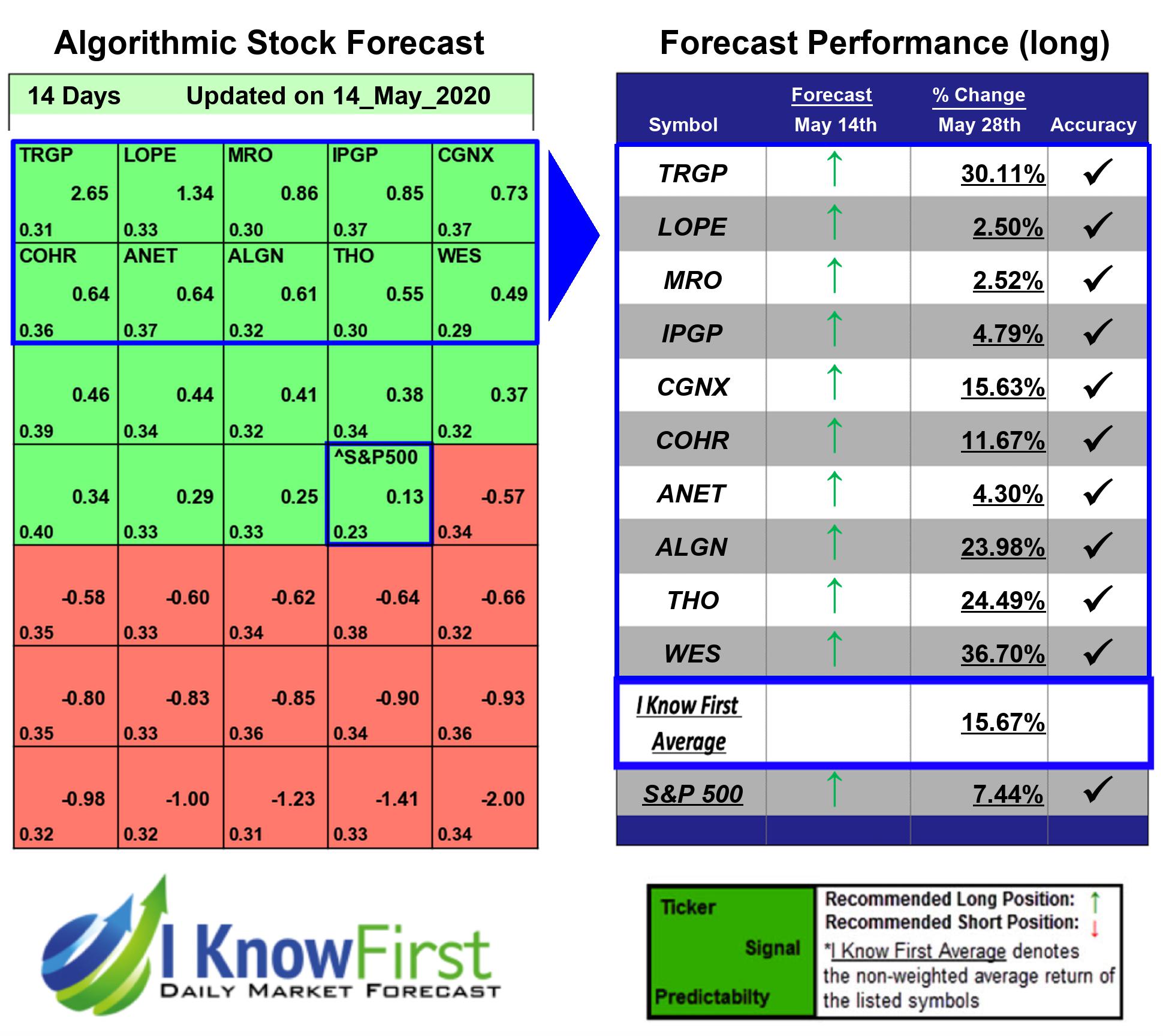

I Know First has been bullish on ALGN stock in the past and we successfully predicted price changes based on our AI Algorithm. During our 14-day forecast period, from May 14 to May 28, 2020, ALGN grow by 23.98%.

Here at I Know First, our AI-based algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we have been providing daily stock market predictions, gold prediction, forex forecast, oil prices forecast, and, in particular, Apple stock news. Today, we are producing daily forecasts for over 10,500 assets. These forecasts generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.