I Know First Reviews Weekly Algorithmic Performance: November 20th, 2016

I Know First Reviews

On November 20th, 2016, our weekly newsletter was sent out to all our I Know First subscribers, which can be found here. Below, find the I Know First Reviews, highlighting the algorithm’s performance for this past week.

I Know First sends a weekly newsletter every Sunday to all the I Know First subscribers, highlighting the past week’s performance in all the covered financial markets, i.e. equity positions, currencies, and commodities. Additionally, the weekly newsletter includes analysis and updated news reports regarding prominent firms such as well Apple, Yahoo, Baidu, and more. The I Know First algorithm maintains a bullish stance of the firms analyzed, and our subscribers are able to utilize these tools for their investment strategies. The in-depth analysis is provided by the I Know First financial analysts, who are often times as well top rated authors for prominent financial sites such as Seeking Alpha.

In general, the algorithm is made up of a system that is a predictive stock forecast algorithm based on Artificial Intelligence and Machine Learning with elements of Artificial Neural Networks and Genetic Algorithms incorporated in it. This means the algorithm is able to create, modify, and delete relationships between different financial assets. Based on the relationships and the latest market data, the algorithm calculates its forecasts. Since the algorithm learns from its previous forecasts and is continuously adapting the relationships, it adapts quickly to changing market situations.

For a more detailed explanation, regarding the algorithm, click here.

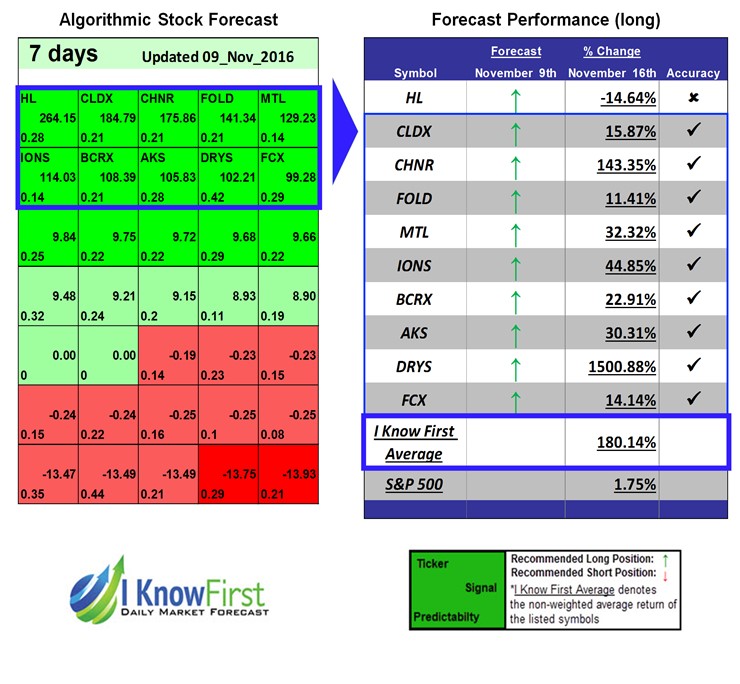

As highlighted in the newsletter, our subscribers had seen superb returns, whether long-term or short-term. Our investors are able to tackle the market head on with all its recent uncertainties, and achieve premiums well over those offered by institutional and classic fund managers. For example, our state of the art algorithm tracks Most Undervalued stocks, on November 21st, 2016, a 7 day long forecast was published. Within the span of 7 Days, DryShips Inc. (DRYS) gave returns of 1500.88%. The algorithm had predicted 9 out 10 stocks correctly in a bullish manner, for the 3 day time horizon.

Every week the top performing financial instruments are highlighted, as shown below from this past week’s newsletter.

1. Returns Reach Over 500% In Just 3 Days

During the past week, I Know First’s top forecasts came from these 3 day forecasts. The most successful forecast had been this Fundamental’s Low P/Sales Stock forecast with an overall average of 57.36% and returns reaching 513.36% in just 3 days. This Risk-Conscious Stocks forecast was amongst the top algorithmic forecasts for 3 days with a market premium of 48.81% and returns at almost 437%. Additionally, I Know First’s self-learning algorithm had successfully forecasted high returns for this Small Cap Stocks forecast, which saw returns at over 513% and an overall average of almost 53%. The algorithm had as well successfully forecasted returns reaching almost 18% for this Top 10 Stocks forecast.

2. Forecasts Achieve Over 15X ROI In 7 Days

This Fundamental Low P/E Stocks forecast had achieved returns at over 1,500% in 7 days, as well as saw an overall average of 180.14% during the same period. Additional superb 7 day returns came from this Small Cap Stocks forecast, which saw a alpha above the S&P 500 Index of 159.13% and returns reaching 1486.96%. I Know First’s machine learning algorithm had successfully forecasted high 7 day returns for this Top 20 Stocks forecast, with returns reaching almost 61%. This Risk-Conscious Stocks forecast, that offers subscribers exposure to higher risk and returns equity investments, had a market premium of 156.16% in 7 days. Additionally, equity investors seeking opportunities with stocks under 10 dollars had seen high returns with this Stocks Under 10 Dollars forecast, which saw an overall average of 23.43% and returns reach 143.35%.

3. 14 Day Forecasts Triple Investments

The top 14 days forecast came from this Small Cap Stocks forecast, which had seen returns reach over 151% an overall package average of 28.02%. Furthermore, this Bank Stocks forecast had seen high returns reaching a market premium of 11.33% and returns reaching almost 24% in 14 days. The I Know First AI-based algorithm had as well successfully forecasted returns reaching almost 152% in this Transportation Stocks forecast, that had an overall average of 24.54%.

4. Monthly Returns Reach Over 130%

I Know First’s algorithm had forecasted many superb monthly returns during the past week, with this Fundament Low P/Sales Stocks forecast being the top forecast. The forecast had returns reaching almost 97% in 1 month, with a 13.81% alpha above the market’s return. In addition, equity investors who invest in low priced stocks under 10 dollars had seen high returns reaching over 96% in 1 month with this Stocks Under 10 Dollars forecast. This Small Cap Stocks forecasthad as well an excellent monthly overall average of 13.28% with the algorithm correctly predicted 100% of the stocks in a bullish manner. For investors seeking global exposure, this European Stocks forecast had superb returns reaching almost 132% along with an overall average of 17.61% in 1 month.

5. Quadrupling Returns In 90 Days

I Know First’s algorithm’s top performing forecast had been this European Stocks forecast, which had saw returns reach 221.67% and a market premium of 27.02% in 3 months. Furthermore, investors seeking exposure to the energy sector had seen high returns for this long and short position Energy Stocks forecast. The overall average for the long position and short position had been 22.65% and 11.97%, respectively. Overall, the forecast had seen returns acheive almost a 112% return over 3 months.

6. Returns Reach Over 140% In 1 Year

During the past week, this 1 year Tech Stocks forecast had seen the highest returns for the past year. The forecast had an overall average of 42.25% with returns reaching 140.51%. The same forecast had given investors a 35.84% market premium during the year. Additionally, another 1 year Tech Stocks forecast had as well excellent returns reaching 90.70%. The forecast had seen a market premium of 35.07% during the same period, providing investors with a large spread between an alternative passive investment strategy.

7. Swing Trading Strategies Reach Almost 70%

I Know First’s short-term trading strategies had reached a 62.76% alpha above the S&P 500 Index’s return of 6.84% from January 2016 till the end of October 2016. Read the full report for a more detailed analysis with charts and graphs, depicting a high reward to risk payoff with low Betas and high Sharpe Ratios.

Article Summaries

- On July 5th, 2016, one of I Know First’s top analyst had written a bullish analysis, in accordance with I Know First’s self-learning algorithm, regarding Apple Inc. She had discussed AAPL’s continual success in global expansion and how the iPhone 8 would in fact help Apple grow sales. Since the algorithms and the analyst bullish recommendation on AAPL, the stock has risen 14.76% to date.

- Before Advanced Micro Devices had posted it’s Q3 2016 earnings results, an I Know First analyst had written a positive outlook on October 17th, 2016, in line with I Know First’s AI-based algorithm, on AMD. The analyst had explained the mass turnaround the company was able to obtain throughout the past year had helped investors achieve huge returns. Furthermore, the soon to be released Zen technology should help AMD continue to increase its market share in the CPU and GPU arena. Since the article was published AMD shares have risen by 29.04% to date, just as the algorithm had successfully forecasted.

- Last month, I Know First had published a quick win on the algorithm as a result of its superb performance and capabilities for a certain forecast. This quick win for VOXX, from October 31st, 2016, had saw a return of 10.13% in 7 days. Since then, the algorithm had continued to forecast bullish predictions for VOXX for a mid-term outlook. To date, VOXX shares have risen 31.40% since the algorithm’s forecast.