ALB Stock Forecast: Lithium Demand Drives Stock Price

This ALB stock forecast article was written by Nicole Shammay – Analyst at I Know First.

This ALB stock forecast article was written by Nicole Shammay – Analyst at I Know First.

Highlights:

- New Innovation center reduces costs by 50%

- 2021 outlook drives demand for lithium

- I project a target price of $215 on a year-horizon

Overview

Albemarle Corporation (NYSE: ALB) is a North Carolina-based chemical manufacturing company specializing in lithium for electric vehicle batteries. ALB develops, manufactures, and markets advanced products for consumer electronics, flame retardants, metal processing, plastics, contemporary and alternative vehicles, pharmaceuticals, agriculture, construction, and custom chemistry services. With leading positions in lithium, bromine, refining catalysts, and applied surface treatments, ALB is known globally. While actively pursuing a sustainable approach to their endeavors, ALB also creates value-added and performance-based solutions that enable a safe and more sustainable future.

New Innovation Center

ALB has announced the opening of its Battery Materials Innovation Center – otherwise known as BMIC. It was opened in June and has been in full operation since the beginning of July. The center is equipped to synthesize new materials, properties, analyses, and performance testing. This lab allows ALB to learn and further ideas and innovation in a new and powerful way. The BMIC is also creating cell-phone-sized batteries to exhibit crucial components of battery performance and expedite the processing of new products and give them to customers quicker.

The new facility is furthering technological growth and manufacturing products that will transform the industry. For example, the new facility is developing lithium metal anode technologies meant to boost battery energy density through the employment of lithium metal rolling. This product is supposed to be so small that it is comparable to one-fifth of the average thickness of human hair.

These advances provide practical and relevant cell building information, technology and elude possible future capabilities. The data generated by the center is paving the way for next-gen battery material design. ALB is crafting the future of batteries and founding new ways to manufacture and maximize materials usage. The Chief Technology Officer, Dr. Glen Merfeld, even said that “we will be equipped to optimize our lithium materials for a drop-in solution for customers that help them deliver high-performing cost-effective batteries for the rapidly growing electric vehicle market.”

ALB is the only U.S based producer of these lithium materials, and they are certainly making strides. These developments will enable the next frontier of battery performance and offer the potential of doubling energy density while simultaneously reducing cost by as much as 50%. These advancements are not just steps but skip across technologies. ALB is disrupting the current battery market by proving the effectiveness of high-capacity lithium batteries.

ALB Growth Outlook

As ALB is a chemical company specializing in lithium for electric vehicles, it is important to understand the different product companies, analyze their past year’s sales, and project necessities in 2021. ALB’s product category of lithium generated $1.145 billion in sales for 2020 and an adjusted EBITDA of $393 million in 2020. ALB specifically used it for electric vehicle batteries, electrical grid energy storage, and electronics. Due to the coronavirus pandemic, the growth outlook may not be as high as expected due to the volume being slightly increased and prices decreased. Lithium is the company’s key growth driver so there is certainly a level of optimism that can be shared, especially as annual lithium demand is expected to nearly quadruple by 2025.

Because of the growing demand for lithium, suppliers’ inventory will deplete, leading to a complementary demand/supply context for providers. This will enable a shift in the current demand/supply balance which was adjusted due to the pandemic which halted the production of new vehicles. For example, industry forecasts expected ALB to produce 10 million electric vehicles in 2020 and 2021 combined – 4.1 million in 2020 and 5.9 million in 2021. But only 3.2 million electric vehicles were actually produced. However, they still expect 5.9 million to be produced in 2021.

Furthermore, company management has argued that only around 68% of total lithium output is consumed by batteries right now. But the demand in the future will account for 85% by 2025, and 92% by 2030. This growth of lithium demand is spectacular for sales momentum and drives progress and excitement regarding electric vehicles as ALB is a top lithium producer.

Revenue Growth Attracts High Valuation

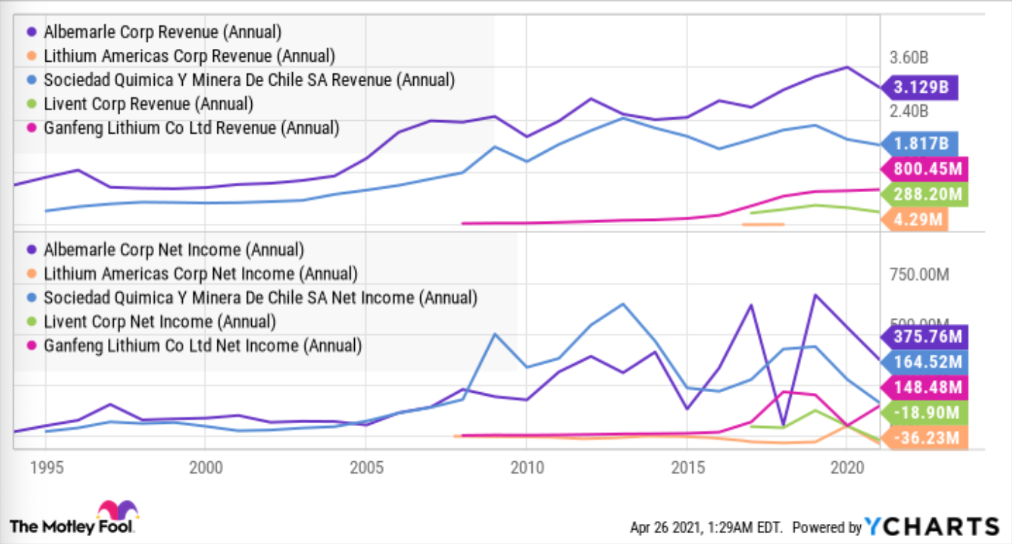

As shown in the chart below, ALB has had a steady increase in revenue growth for over two and half decades. This is probably due to their diversified operations and strongly focused productions. Lithium accounts for 37% of revenue, bromine accounts for 31%, and ALB’s catalysts business accounts for 26% of revenue. Since the catalyst business accounts for several products, this enables the company to earn a lower margin.

Another aspect of Albemarle that is diversified is the geography of its sales. North America, Asia, and the Europe/Middle East/Africa region account for 26%, 48%, and 24% respectively. Furthermore, ALB has generated lots of cash from operations as shown below. This cash enables the company to expand through research and trials such as the new center discussed earlier. This cash will propel the company as its findings will improve efficiency and drive their technological products. This cash puts them ahead of other competitors as they can only leapfrog ahead of others if they continue to penetrate boundaries.

ALB’s performance has been impressive thus far. And with its plans announced and set in motion, the stock price has begun to surge. Though one could argue that the price rose from excitement and will subvert soon, the plans ALB has for growing its lithium business such as the BMIC paired with the growing demand for lithium will surely enable strong growth.

Conclusion

I recommend the ALB stock has a moderate buy as I am confident in their progress within the lithium industry as well as the advancements I foresee from the BMIC. Thus, I assume a target price of $215 on a one-year horizon.

Finally, my prediction for the ALB stock is particularly supported by the algorithmic forecast shown above by I Know First. With a high one-year trend signal of 169.84, the forecast represents a secure trigger to buy as well as a positive increase in the stock price on a one-year horizon.

Past Success With ALB Stock Forecast

I Know First spotted an upward trend for the ALB stock this past week. On July 21st, 2020, the I Know First algorithm recommended ALB as part of the Top Stock Picks Based on Algorithmic Trading. The AI-driven ALB stock forecast proved successful on a one-week horizon resulting in a 118.54% gain since the original forecast date.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.