AI Revolution In Finance: Global Investment In AI Fintech Fuels The Flame

This article was written by the I Know First Research Team.

This article was written by the I Know First Research Team.The recent boom of artificial intelligence tech has shaken the world, transforming businesses and whole industries. The financial sector is no exception to this: it has already seen a broad range of initiatives in introducing AI in a whole variety of its spheres. Where we are today, however, is only the dawn of the era of AI in finance, as its implementation is picking up the pace. This disruption comes on the back of gargantuan investment poured into AI by a multitude of major players: banks, for example, are projected to dish out a whopping $300 bln. into AI by 2030. A large share of this can be expected to come in the shape of investments into lucrative startups, not just in-house projects. This would only speed up the glorious AI revolution in finance, a titanic change that’s about to take the finance industry on a whole new level.

Partnerships with small tech-savvy companies are set to be a boon for megabanks and other giants, because this business format has its own distinctive features that make it well-adjusted to the highly competitive high-tech sphere. Small to medium-sized versatile teams focused on a single (and, more often than not, niche) product can work at a speed that is beyond the capacities of a gargantuan company and have the know-how it may not have. What they often lack, however, is the expertise that comes with decades in operation and the resources comparable with budgets of a small country.

Does it sound like a match made in heaven? Well, that’s because it is. And if you are still not convinced, keep reading, as we are about to go across the globe to see how the push for AI plays itself out – and how small players with big ideas fit into this craze.

The United States: All Aboard The AI Train

While some are saying that the US is losing the fintech war in AI, this confrontational perspective is largely outside the scope of this article. We could say that not everything is a zero-sum game in today’s globalized world, or point at other reports suggesting that the US businesses lead the world in implementing machine learning solutions, but that would still lead us astray from the key point… And the key point is that US banks have a lot of love for AI, and they are seeking to implement it in a wide variety of areas.

Wells Fargo, for example, has established a dedicated Artificial Intelligence Enterprise Solutions team to work on payments and customer experience. It is also running an AI-driven chatbot that will talk to its customers on Facebook and is investing in the most promising startups through its Accelerator program. Its current members include Ascent RegTech, which utilizes AI in compliance and regulation, and Open Risk, which runs its AI-driven derivatives collateral and liquidity management platform.

Citibank is another major player with an appetite for all things AI. Its investment arm, Citi ventures, has made some impressive moves to set up a network of six Citi Innovation Labs, which bring together fintech companies from all over the world. Its partners include Feedzai, a company utilizing artificial intelligence to counter various forms of banking and financial fraud, and Clarity Money, which has developed an AI-based personal financial assistant. In 2018, it was acquired by Goldman Sachs after raising over $14 mln. in financing.

Goldman Sachs itself is no stranger to the AI industry, by the way. Apart from using AI to assist its traders, it also seeks lucrative partnerships with ambitious startups woring on artificial intelligence algorithms. For example, a few years ago it teamed up with Kensho, a startup that used Ai for complex financial analysis and was recently acquired by S&P Global at a historic $550 mln., making the most expensive AI startup acquisition ever.

We should also mention JPMorgan Chase – this bank is very much in the AI game as well, setting up an Ai platform for document analysis and rolling out an AI-based virtual financial assistant. It has also developed a predictive AI that delivers stock market forecasts at impressive accuracy rates. Its partners among AI startups include Volley, a company that automates training content generation.

Asia: Dragons Spread Their Wings

AI investment is picking up the pace among Asian majors as well. In this respect, many eyes are, of course, in the Middle Kingdom, given the current tensions on the global arena. There are reports saying that China is doing better in terms of AI implementation in business than Europe; there are also reports saying that China is outgunning the US in this respect. Regardless of whether you share this competitive approach or not, the key takeaway is that Chinese companies are exploring AI – and this exploration is in full swing, although the venture capital has shrunk due to slowdown and trade war recently.

China is home to world’s most valuable AI company – SenseTime’s current valuation stands at $4.5 bln. The company’s clients and partners include giants like Alibaba, Japan’s SoftBank and government services as well; for example, the Chinese police rely on its facial recognition algorithms. Megvii, another top Chinese AI startup which kicked off with facial recognition tech, has also been wildly successful, with CHINA CITIC BANK and CapitaLand among its customers.

Understandably, China’s commercial banks are embracing the era of high-tech finance. In 2018, the China Construction Bank became the first Big Four state-owned bank to set up an in-house fintech innovation house. Similar units have already existed in Ping An Bank, China Merchants Bank, China Everbright Bank, Industrial Bank and China Minsheng Bank. Ant Financial, another fintech major and Alibaba subsidiary, is closely working with Everbright Bank to help it in its transformation.

Japan’s SoftBank is also active on the AI scene; we have already noted that it took part in TimeSense’s rise to prominence, but that is only part of the story. The bank is launching its AI revolution fund, aimed at bringing together the leaders in the sphere, growth companies dominating their niche markets. Interestingly, the fund dropped Saudi Arabia as one of its members amid the controversy over the assassination of a Saudi dissident in Turkey.

In Singapore, an ambitious startup called Silot has recently raised as much as $8 mln. It has developed an AI-driven system that streamlines the siloed data collected by banks and trains a decision-making engine on it to assist the bank’s employees. The program has already been tested in partnership with Thailand’s fifth-largest bank, focusing primarily on countering fraud and money laundering.

Europe: New Tech In Old World

In Europe, the UK is currently the center of gravity for all things AI, while Germany and France play catch-up. Ironically, the same report also points out that as much as 40% of European startups claiming to deliver AI-based services actually have nothing to do with AI. This is to remind us that while the AI genuinely has a lot to offer to the financial sector, there are some free-riders on this hype train.

Nevertheless, the appetite for AI is real in the Old World as well, and there are multiple cases for us to go over. UniCredit and ING Ventures have recently invested in an Italian startup called Axyon AI, which has trained a deep learning AI aimed at helping asset managers with running portfolios through insights based on predictive AI.

Santander InnoVentures, an investment arm of Banco Santander SA, has recently invested into two AI companies. One of them, Personetics Technologies, offers front office AI-driven capacities, including conversational algorithms, finance management assistance and personalized investment insights. The other, Gridspace, goes in-depth on natural language processing, which is all about training machines to understand human languages.

French BNP Paribas spearheaded the investment into a US-based startup called Digital Reasoning, which was able to raise $30 mln. The company also deals with natural language processing to gather insights from human conversations and pick up signals that may point at the possibility of fraud. While AI is routinely used to flag suspicious transactions, this represents an innovative approach to the task, as the idea is normally to look at the transactions record rather than conversations.

I Know First: AI Revolution In Finance – For All

If you feel that it is time to roll with the flow and join the global tide of AI-enabled high-tech, look no further than I Know First, an Israeli company that seeks to make the AI revolution in finance accessible to everybody.

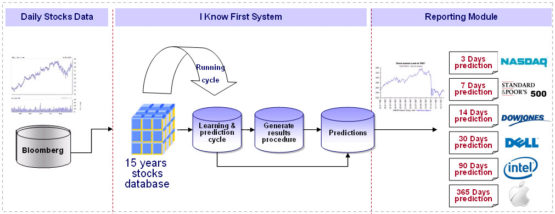

I Know First has developed a deep learning AI that delivers daily forecasts for over 10,500 financial instruments, including stocks, ETFs and currencies. Trained on a historic dataset covering 15 years of trading, it approaches the market as such from a holistic standpoint, looking for signals in the fresh trading data and using those to model the trends and seasonal patterns. In doing so, it looks at the direction which financial instruments across multiple investment universes are most likely to take and measure the expected intensity of these price swings.

The forecasts are delivered as a heatmap with two numeric indicators: signal and predictability. Signal shows how a given asset is expected to perform against others on the list. Predictability is an indication of how much of a good job the algorithm has done in its prior predictions for the asset. It ranges from -1 to 1 and is defined as the Pearson correlation rate between earlier forecasts and actual price movements.

The system is thus of value for both institutional and retail investors, who can easily identify top investment opportunities by picking out the stocks with the highest values for both indicators. The predictability indicator also helps in assessing the risks of an investment portfolio.

The algorithm can adapt to periods of market volatility, because its design incorporates elements of genetic coding. To put it simply, it keeps track of its own performance and updates its predictive models as soon as they start to lose their grasp. This also ensures that the prediction accuracy goes up with every prediction delivered.

The AI also draws on chaos theory to account for market volatility. It delivers its forecasts for time horizons ranging from 3 to 365 days, covering short, medium and long-term perspectives, which helps the traders to identify opportunities both for a quick profit from short trading and find the stocks that would generate most value over time.