AI In Finance Industry: The Future Is Today

This article was written by the I Know First Research Team.

This article was written by the I Know First Research Team.The traditional finance sector as we know it is going through a process of change. As new technologies disrupt the conventions and dogmas, whole industries are transformed, keeping pace with the rapidly-changing world. Finance is no exception to this rule, and, as a sphere that lives and breathes quantitative data (lots and lots of quantitative data!), it has been particularly sensitive to the rise of the artificial intelligence, a technology driven by the computers’ newfound ability to crunch massive troves of data. And while it may or may not be too early to speak of the financial industry as we are about to know it, it is already clear that AI in finance is very much a part of it.

But before we delve into all the exciting ways that AI is reshaping the financial sector in, it may be worth saying a few words about the technology itself, especially given all the buzz and hype around it.

The AI of today is, essentially, a complex mathematical model trained on a dataset and capable of processing certain inputs to produce a certain output. Training means going through the aforementioned dataset to establish the patterns and correlations within to create models that will be later used as the foundation for processing the inputs and deriving the output. Inputs can range from data that is presented in a manner specifically tailored to the needs of this particular AI (structured data) or all sorts of data jammed into the AI in one huge flow, with the algorithm left to work through it itself. The latter is known as unstructured data, and it can vary from the latest market indexes to pictures and tweets, depending on what exactly the AI can at all digest.

Now, as far as the output is concerned, today’s AIs fundamentally deal with two tasks: prediction and classification. In the former case, we are talking about trying to predict something (normally, a numeric value), be it a price of a house or a sports team’s total points at the end of the season, based on the data that we already have. In the latter scenario, the AI is trying to allocate an object to a certain category based on its known properties. An AI that is well versed in telling cats from anything that is not a cat, for example, would be happy to go through all the pictures on your phone and find all those that have cats in it.

Now, these two basic tasks may not sound like too much, but the opportunities they are opening for scores and scores of ambitious FinTech initiatives are indeed almost limitless.

AI in Finance Fraud Prevention: Watchful Machines

As we noted in the previous section, AIs are very good at munching through data, and matching new data with the patterns established in the larger dataset. This, among other things, is quite useful when you have a person’s whole credit history at hand and want to see if the new transaction fits into it or not.

That is the idea behind the AIs making sure that no malicious actors get a hold of your credit card details. And that is quite a welcome development, because credit card fraud is getting more and more sophisticated. What used to be a pretty straightforward theft of a card can now take on a whole multitude of shapes and forms. Phishing emails aimed at goading you into putting your credentials into a window on a website that looks just like your bank’s? Check. Calling up your bank to get your details through social engineering? Check. Setting up a free, unprotected Wi-Fi hotspot that will keep an eye on those who use it to make any purchases? Check. Placing a skimmer on your local ATM (or at the gas pump, for the good measure) to collect the credentials of those using them? Check! Given how prevalent this type of crime is these days, it is easy to see why high-tech solutions are a must in this sphere.

And as far as smart solutions go, AI and credit card fraud prevention are a match made in heaven. For a machine, it takes a millisecond to flag a transaction in Beijing recorded five minutes after the credit card’s actual owner got their morning coffee in a New York Starbucks. This, you could argue, would be easy enough for a human to pick up as well, but a machine does it quicker. Furthermore, the machine can pick up on some more complicated cases, irregularities that would not be as obvious to the human eye.

Furthermore, it is one of the areas where the interplay between the man and the machine can be especially important: if the AI falsely flags a transaction, the human operator can correct that mistake, making it a learning experience for the machine and thus raising the accuracy of its classifications.

This technology is being utilized by a whole variety of companies. These include, among others, Riskified, a well-known fraud prevention company that boasts not only a highly-accurate AI-based anti-fraud service but also covers up for the expenses suffered by its customers if its system fails to red flag a fraudulent transaction. Services like Feedzai and Kount are also there to take on a broad variety of fraud types.

AI In Credit Risk: To Loan Or Not To Loan?

We have discussed how anti-credit card fraud companies use people’s transaction history in order to classify the new transactions as fraudulent or not. Roughly the same logic is behind the way that banks utilize AI in order to figure out if the applicant is in the financial shape that’s good enough for a loan, or a default can be expected.

To properly assess this and make a judgement, you have to assess the applicant’s financial record, see if there have been defaults on prior loans, take a look at the person’s current income and liabilities, go over a bunch of other factors, plug all that into one big formula established through rigorous study of hundreds of cases and calculate the probability of a default.

Similarly, with a business, things get equally, if not more, complicated. Once again, ideally, you have to consider the applicant’s credit history, go through their financial statements, take a look at the market they are operating on and use all that to come up with a reasonable assessment of how likely the company is to default.

Sounds a bit difficult, doesn’t it? For a machine, it does not. An AI trained on the aforementioned historical dataset of defaults and loans that were paid in due time would do just that in no time. Furthermore, the bank can configure it in line with its preferences, setting up the cut-off line for default probability in a conservative or aggressive manner.

This approach has been picked up by such giants as JPMorgan Chase with its smart COiN platform, Wells Fargo and Bank of America. There are also multiple companies offering third-party AI-driven credit risk management platforms, such as LenddoEFL and Zest Finance.

AI In Wealth Management: Robots For Riches

Here is yet another example of classification. Imagine you are a wealth manager trying to figure out the optimal allocation strategy for your customer, who wants to retire in 15 years with some $300,000 in savings. Once again, you would consider a bunch of variables, such as the volume of the client’s funds available for allocation, risk tolerance, time horizon, etc. This, once again, suggests that here we are dealing with an area where AIs could shine.

The task at hand is to a degree reminiscent of the previous one, but this time, what we establish is not the probability of a default (in other words, if the customer belongs to the “will default” or “won’t default” type). We can go about this in a variety of ways: for example, we could try to classify the investor as belonging to one in a large multitude of groups and tailor the strategy prevalent across this group to the needs of this concrete customer. Alternatively, you could predict the optimal ratio of assets allocated across financial instruments with different risk and return levels according to the client’s profile. Both tasks, as you can see, ultimately fall into those that machine learning is best at.

This is why AI-based decision enhancement tools are becoming more and more popular among wealth management professionals. These include, among others, Squirro and Qara.ai. Giants are also in this game: Morgan Stanley, for example, has been looking into ways to bring AI at the service of its human asset managers.

AI In Stock Market Prediction: A Peek Into Future

Beating the market again and again is, quite understandably, the ultimate dream of any investor. Various strategies have been employed to reach this goal – some believe in fundamentals analysis, others rely on value investment and all sorts of other strategies. In the late 20th century, as computers began to pack more and more of a punch, they were increasingly employed to build complex models aiming to predict market dynamics. But it wasn’t until the dawn of AI that their use for the purpose would truly flourish.

Today, AI is the driving power behind the rise of a new brand of quantitative trading. Here, the idea is to collect a broad range of market data, or any other relevant data, and run it through a super-advanced AI that would use it to try and predict what happens next on the market. One of the approaches, for example, is for the AI to assume that each stock has a certain value, and its actual price is fluctuating around this value, shooting upwards and downwards. This value can be calculated through a careful study of the historical data, with a constant flow of new data coming in to make sure that the algorithm is keeping pace with the world.

It also wouldn’t take a stretch of imagination to assume that fluctuations of different stocks can impact each other, which calls for a holistic approach to the markets. This interplay between financial instruments can be modelled, once again, through a rigorous study of historical data, something AIs are traditionally good with. Needless to say, these models and formulas have to be constantly reconfigured in order to reflect the reality at hand, which is there reinforcement learning comes into play. This approach allows the AI learn from its previous successes and failures, raising the accuracy of its predictions with every new iteration.

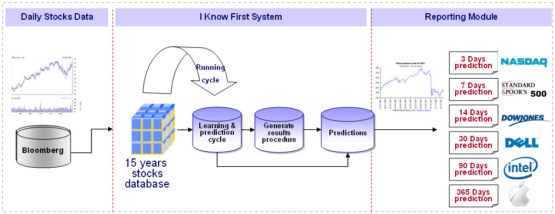

All this fully applies to the proprietary algorithm trained and developed by I Know First, an Israel-based company producing daily stock market forecasts. Its AI has been designed with elements of deep learning and genetic programming incorporated in its code. It draws on chaos theory to model the markets as complex dynamic systems where one small event can lead to a major fallout in order to be better equipped to deal with the sudden changes of tides. Trained on a dataset outlining 15 years of trading, it goes through new market data every day to update its predictions. It is also aware of its past hits and misses, keeping tabs on its models to make sure that they are both attuned to the market as it is right now and that there is no overfitting going on – in other words, that its models are not too tailored to fit a specific dataset.

The AI is capable of forecasting the price dynamics for over 10,000 assets, including stocks, ETFs, currencies and commodities. The predictions it delivers vary in their time horizons from 3 to 365 days, which allows the investors and traders to pick the best stocks for short and long positions. The forecasts are presented as an easy to read heatmap with numeric indication of signal and predictability. The signal indicator shows how the asset is predicted to behave compared against the other assets on the forecast. High positive numbers suggest that the stock is about to surge, while negatives say that a nosedive may be about to happen. The predictability indicator shows how accurately the algorithm has been able to predict the stock’s movements in its previous forecasts.