AI Wealthtech: Ten Key AI Terms and Their Applications in the Wealth Management Industry

“To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insights, or inside information. What’s needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework.”

Warren Buffet in the preface to The Intelligent Investor by Benjamin Graham

The advantage of algorithmic trading using artificial intellingence is that it removes and takes out any personal biases and influences within the investment sphere. Below is a glossary of ten key AI terms that are applied and used for wealth management.

Artificial Intelligence

Artificial intelligence (AI) is a branch of computer science that aims to create intelligent machines that can think and learn for themselves. In 1950 when computers where just starting Alan Turing was asking the question “can machines think?” This question is still debated to this day but there is little doubt that Turing would be incredibly impressed with modern computing and what it has achieved in this field.

Modern AI is able to beat grand masters in chess and be used to predict financial markets. The term is still pretty loose with no real set of clear boundaries defining it but any machine that is able to think intelligently and learn is generally considered to be an Artificial Intelligent machine.

Machine Learning

Machine learning is an application of artificial intelligence (AI) that provides systems the ability to automatically learn and improve from experience without being explicitly programmed. In a sense machine learning is what lies behind the curtain of AI and what enables it to provide useful and accurate output. Machine learning enables analysis of massive quantities of data. While it generally delivers faster, more accurate results in order to identify profitable opportunities or dangerous risks, it may also require additional time and resources to train it properly.

Artificial Neural Network

Artificial Neural Networks are computing systems modelled after the structure of the neurons in a human brain. This unique assembly of ‘nodes’ allows for a different kind of computing compared to the centralised processing computers that we use in our daily lives. This system is loosely comparable to the nodes and layers in a human brain see the picture below.

The layered structure of computing that contains adaptive weights along paths between neurons enabling it to be tuned by a learning algorithm which in turn learns from observed data in order to improve the model, is one of the many techniques behind the execution of machine learning.

AI In Fintech

Many new FinTech companies are specialising in AI and using this technology in a variety of different methods. A FinTech is a contraction of financial technology and is where computer programs and other technology is used to support or enable banking or financial services. AI FinTech is where the use of this cutting-edge technology is powering revolutionary changes within the financial sector.

Algorithmic Trading

This is a type of trading that uses powerful computers to undertake complex formulas and is often synonymous with automated trading. However, it is important to point out that algorithmic trading is not exclusively automated and includes any form of algorithmic outputs that advice or predict the financial markets.

Deep Learning Algorithms

One of the way AI operate and learn is with deep learning in particular deep reinforcement learning. This method of teaching the algorithm is particularly useful and effective in the context of financial markets.

Reinforcement Learning refers to a Deep Learning area that the algorithms are trained based on reward and punishment. Reinforcement Learning is a trial and error self-learning process without a supervisor. They will receive reward signals for each of their action. Moreover, the reward and punishment will be delayed, meaning that the result of an action cannot be observed instantaneously. Instead, effects of an action will be visible many steps later.

Robo-Advisor

Robo advising is a new way to get portfolio management help without having to pay the higher percentage fees that are typically charged by traditional advisors. They tend to provide more basic wealth management services, not delving into the world of taxes and retirement or estate management as human advisors do for their clients. There are both advantages and disadvantages to this form of advising, but it is a popular tool for millennials and younger investors that are just starting to dip their toes into the financial world. Users are primarily people who feel more comfortable with the modern interface and may not have such large sums to invest.

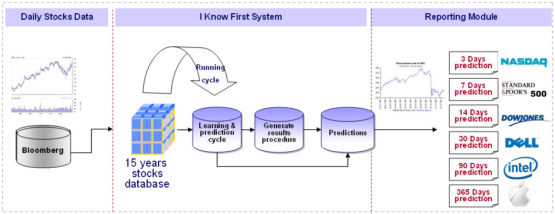

Algorithmic Prediction

This is where an algorithm in many cases one based on AI and Machine learning provides predictive analytics and information about different hypothetical scenarios such as will a specific stock go up or down. This can be particularly useful especially for the stock market where often gut instinct and lack of knowledge lead to investors going wrong.

Algorithmic Analysis

Algorithmic analysis of financial markets is not about placing individuals in boxes, it’s about placing all people into the same box and then interpreting their reactions and interactions. There is no single way to make trades in the stock market. Each investor approaches the market in a slightly different way. Some traders buy stock based on news stories, some buy stocks from companies that they admire or that have products that they like. Other traders look at fundamentals, at balance sheets, or do technical analysis. Regardless of the preferred method of trading, each individual investor has his or her own emotions affected the trades that they make.