Adobe Stock: Adobe’s Creative Cloud Subscribers Will Continue To Grow In 2016

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Adobe Stock: Summary

- Adobe touts 6.17 million monthly paying subscribers to its suite of Creative Cloud design software products.

- Due to the affordable subscriptions fees of Adobe’s software, I still expect more amateur and professional designers to sign up for Adobe Creative Cloud subscriptions.

- Adobe now wants to compete with template-based online design software provider Canva, ReadyMag, and LucidPress.

- Canva and LucidPress’ newbie-friendly web/mobile design apps are rapidly becoming a threat to Adobe InDesign.

Long-term investors who like software firms might consider adding Adobe (ADBE) to their 2016 portfolio. Adobe remains the undisputed champion when it comes to creative/design-related software. Adobe’s Photoshop, Illustrator, After Effects, Premiere, and Dreamweaver products are industry-standard software in the enterprise and creative market.

ADBE outperformed Autodesk’s (ADSK) stock this year but I still see more upside potential for Adobe in 2016.

As per the latest quarterly earnings report of Adobe, this company now boasts 6.17 million paying customers for its Creative Cloud suite of software. The affordability of Adobe’s monthly fees for its Creative Cloud software helped the company increase its subscribers by 2.71 million this year.

(Source: Google Finance)

I again expect the affordability of its subscription-only software to help Adobe post continuous growth in individual and team subscriptions next year. Since switching to a subscription-only business model in June 2013, Adobe has rapidly increased its software subscribers. The last quarter saw Adobe adding 833,000 new paying subscribers.

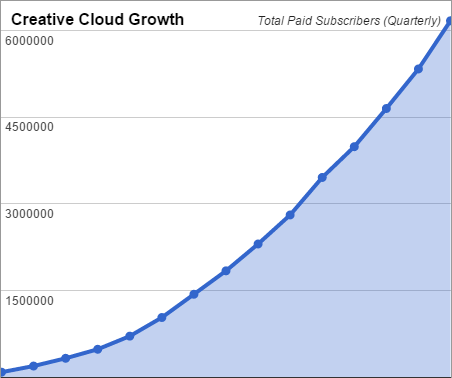

The chart below from ProDesignTools.com greatly illustrates the impressive growth momentum of Adobe’s Creative Cloud business. From less than 500,000 subscribers in 2013, Adobe could eventually hit 8-10 million subscribers within the next 12 months.

The impressive growth rate of paying customers of Adobe Creative Cloud is even more notable considering that there are now numerous free alternatives to Adobe’s software suite. The overwhelming success of Creative Cloud only confirmed that creative print/web design professionals are too accustomed to Adobe’s software to consider switching to other software.

Why It Matters

Photoshop and other Creative Cloud software remains the main source of income of Adobe. The Digital Media ARR (Annualized Recurring Revenue) division responsible for Creative Cloud sales posted $2.99 billion in FY 2015 sales – up by $1.12 billion Year-over-Year. The other division, Adobe Marketing Cloud, only generated $1.36 billion in FY 2015 revenue.

I therefore love any report that announces growth in subscribers of Adobe Creative Cloud. The subscription-based or software-as-a-service method adopted by Adobe two years ago help eliminate/greatly reduce the rampant piracy of the company’s Creative Suite CS6 product.

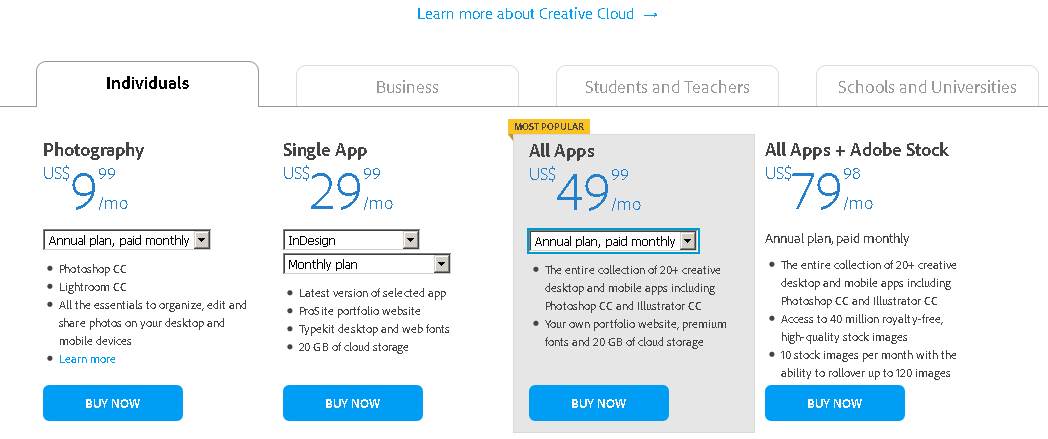

There is little reason for people to use pirated versions of Adobe software. Creative Cloud subscriptions are very affordable even for people in emerging markets. Instead of paying $800 upfront for the old Photoshop CS6 Extended, freelance or employed designers could easily afford the $9.99 monthly fee charged by Adobe for its Photoshop CC and Lightroom CC bundle.

(Source: Adobe)

Small design studios could also certainly afford the $49.99 monthly fee needed to use all of Adobe 20+++ software products. My point is that I, a freelance graphic artist in the Philippines, could charge $5-10 for just one logo design project to help quickly recover my monthly Photoshop CC subscription. I can also still get away with a $50 talent fee to customize a PSD+WordPress template from Themeforest.

Adobe’s switch to software-as-as-service therefore assures its long-term growth potential. The era of expensive boxed software selling is over. The cheap monthly subscription rates of Creative Cloud effectively helps Adobe create a growing population of loyal paying customers.

Attacking The Rivals of InDesign

InDesign CC is Adobe’s $19.99/month software for desktop publishing (DTP). Released in 1999, Adobe InDesign quickly displaced QuarkXPress as the industry-standard for print and web graphic design. QuarkXpress used to enjoy 95% market share in desktop publishing. Adobe’s release of InDesign quickly made QuarkXpress nearly obsolete in home-based and professional desktop publishing.

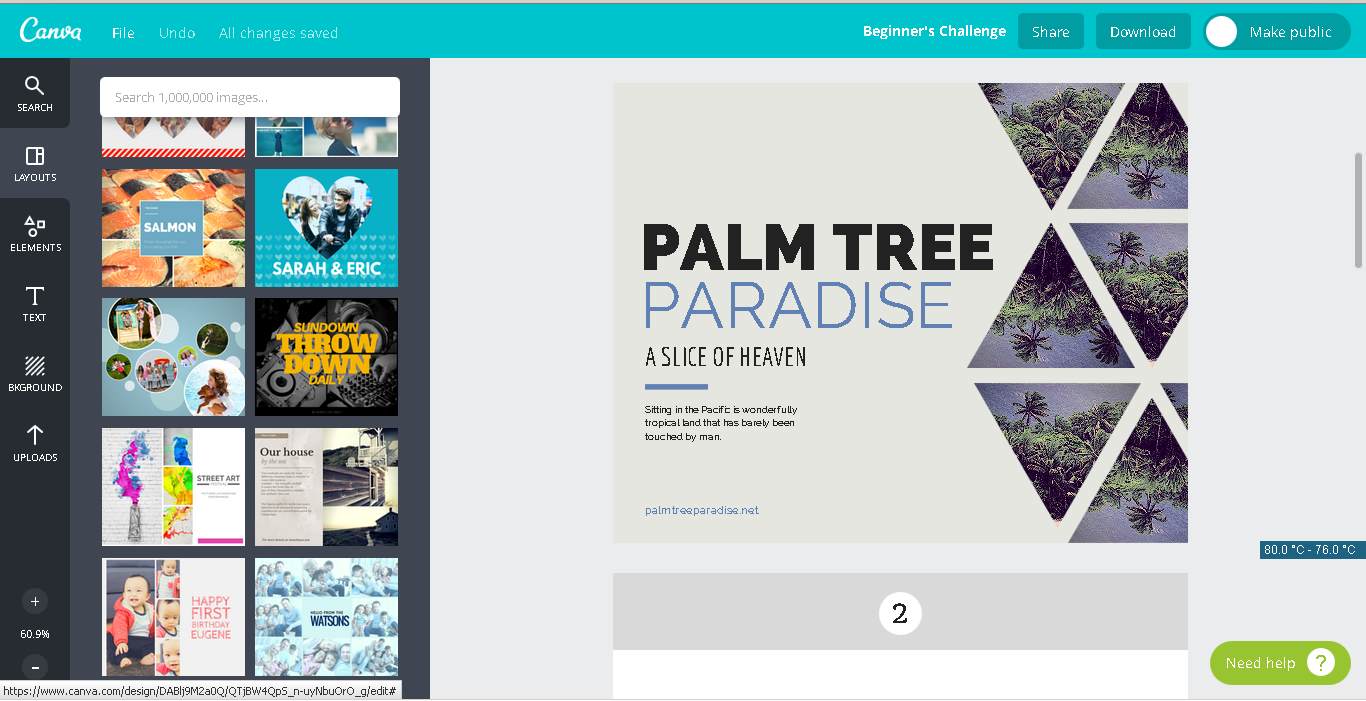

On the other hand, the pervasive success of InDesign is now under threat from online template-based graphic design software services. Start-ups like Canva and Lucidpress offer template-based web/mobile software that allows amateur and professional designers quickly create great-looking graphic designs.

Ordinary people could easily create impressive print/web graphic materials through Canva’s free service. Canva and LucidPress offer thousands of free templates designed by professional graphic artists. Canva only charges users $1 for every premium photo/image they use in their layouts.

The text/image contents of Canva can also be easily revised with drag-n-drop simplicity. It will also let users upload their own images/graphic elements so they can customize further the templates.

(Source: Canva)

Canva’s rapid growth in popularity is especially worrisome for Adobe. Launched only two years ago, Canva now touts 5 million users. Australia-based Canva also recently raised $15 million. Venture capitalists now gave Canva a valuation of $165 million.

Like InDesign, the new Canva For Work service will charge users a monthly fee of $12.95. Consequently, Adobe had cause for concern; Canva For Work quickly signed-up 35,000 paying subscribers. InDesign’s future growth prospect is certainly threatened by the news that 40% of Fortune 500 companies are now clients of Canva.

Lucidpress, which is another template-based design software service provider, touts 1 million users. LucidPress charges individuals $12.95/month for its online software. Canva and Lucidpress also have mobile apps with in-app purchases.

Fortunately, Adobe is addressing this escalating threat from Canva and Lucidpress. The management recently released the free Adobe Post iOS app. This new software is a copycat version of Canva and Lucidpress. Adobe Post is also a template-based graphic design mobile app.

The people who love Canva’s template-based and mix-n-match method of creating stunning professional-level designs will like Adobe Post. It is a very user-friendly, nearly automated, software to create professional-quality print/digital designs.

Seasoned InDesign users will also find Adobe Post as a quick-idea generator to make design mock-ups for brochures, ad posters, presentations, flyers, and web banners. My point is that there is now more reason for people to keep on paying $19.99 every month to accelerate their InDesign workflow. Rapid design prototyping could be done in Adobe Post. Designers would just tweak the said designs from Post inside InDesign.

Like other Adobe mobile apps, designs created in Post will likely integrate with the desktop version of InDesign or Illustrator CC. By coming up with the free Post iOS app, Adobe will slow down (or even kill) the growth of Canva and Lucidpress.

Some of the paying customers of Canva For Work may no longer renew their subscriptions in favor of the Adobe InDesign/Post combination.

My Takeaway

Adobe is a stock worth buying for long-term investing. Releasing Adobe Post is one way to protect InDesign.

Adobe is ruthless when it comes to quashing out rivals. Adobe easily crushed QuarkXpress. Adobe is now again trying to crush Canva and Lucidpress.

My Buy recommendation for ADBE is supported by the bullish 1-year algorithmic forecast of I Know First.

I Know First supplies financial services, mainly through stock forecasts via theirpredictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

Now that we have understood how I Know First algorithms work, we can see that in the table below, ADBE has a positive 24.56 12-month forecast from I Know First. It means market trends favor the chance that Adobe’s stock will rise in price within a one-year period.

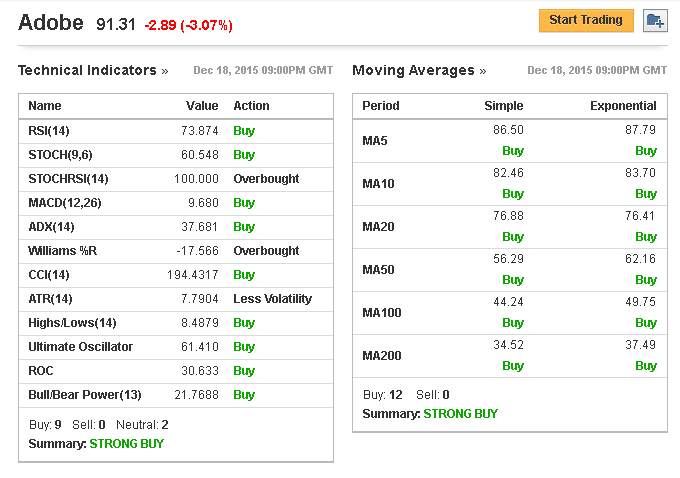

The positive algorithmic forecast of I Know First is also in line with the Strong Buy endorsement from long-term technical indicators and Moving Averages.

(Source: Investing.com)