Is Activision Stock A Good Buy (NASDAQ: ATVI): King Digital Is Activision’s Most Profitable Segment

Is Activision Stock A Good Buy?

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- Due to Activision and Blizzard’s zero adoption of Battle Royale games, King Digital emerged as the most durable and profitable segment.

- Unlike Destiny 2, Call of Duty, and Overwatch, Candy Crush Saga’s paying players are not vulnerable to the strong pull of Battle Royale games.

- I expect King Digital to remain as Activision Blizzard’s most promising subsidiary. There are tens of thousands of copycat games but Candy Crush Saga remains very profitable.

- I Know First has negative market trend scores for ATVI but I’m still endorsing this stock as a buy.

Dow Jones leaked wrong Q1 2018 numbers of Activision Blizzard (ATVI). After Activision released the real numbers, ATVI’s stock recovered the -5% drop it suffered from the wrong EPS and revenue numbers initially leaked by Dow Jones. Activision posted a record Q1 revenue of $1.965 billion, up 13.8% year-over-year. The Q1 EPS of 0.65 (up 16%) is also a new record.

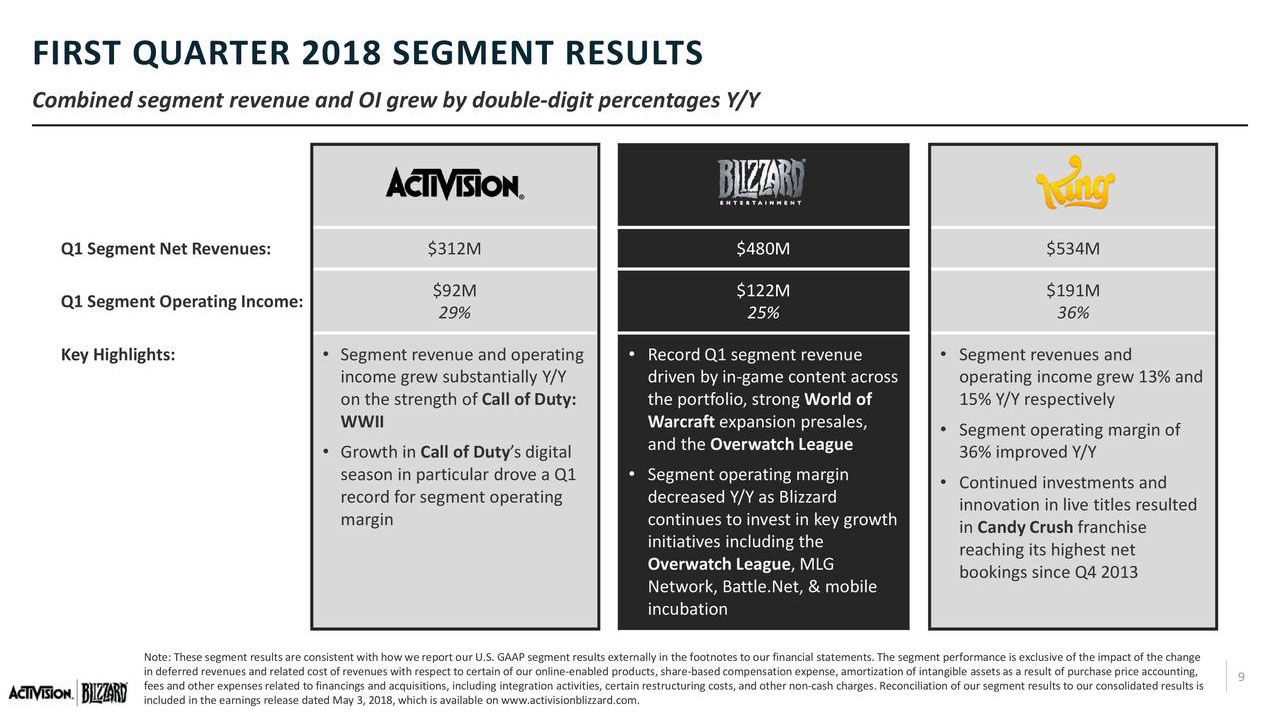

Please study the chart below to appreciate other Q1 achievements.

(Source: Activision)

(Source: Activision)

Candy Crush Saga Is The Superstar Performer of Activision Blizzard

I would like to point out now that Activision’s outstanding Q1 performance was thanks to its mobile games subsidiary, King Digital. As the chart below illustrates, King Digital is clearly the company’s most profitable and reliable segment. The free-to-play Candy Crush Saga and other mobile games of King Digital contributed the most revenue to Activision, $534 million or 27.18%.

King Digital also posted the highest amount of operating profit of $191 million. This robust revenue stream from King Digital is likely to continue well beyond 2018. They are very old games but Candy Crush Saga and Candy Crush Soda Saga continues to top the iPhone charts in America and other countries.

These two Candy Crush games are already raking in average daily sales of $1.75 million just from American iPhone gamers. Candy Crush mobile games obviously generate more monthly digital sales than any game of Blizzard Entertainment or Activision.

(Source: ThinkGaming)

Why Candy Crush Mobile Games Are Long-term Tailwinds

Unlike the PC/console games of Activision and Blizzard, the paying players of Candy Crush Saga are immune to the strong pull of Battle Royale games like Fortnite and PlayerUnknown’s Battlegrounds. It means Call of Duty: World War II, Destiny 2, and Overwatch are losing many players to Battle Royale games.

The core population of Candy Crush mobile games are not attracted to shooting or survival games. Fortnite and PlayerUnknown’s Battlegrounds do not appeal to them. These make King Digital’s huge population of Candy Crush Saga and Candy Crush Soda Saga very important to Activision Blizzard’s long-term prosperity.

I’m Still Endorsing ATVI As A Buy

Activision Blizzard’s CEO Bobby Cotick acknowledged that Battle Royale games like Fortnite “is a lot of competition right now.” Cotick also hinted that Activision considers Battle Royale as a very important mode that might get incorporated in future games. I firmly believe that the May 17 launch event of the new Call of Duty: Black Ops 4 might have a Battle Royale mode.

The entry of Activision in Battle Royale games is a good reason to go long on ATVI. Call of Duty: Black Ops 4 might not be the only game that Activision Blizzard will release with a Battle Royale mode. Should the Battle Royale mode of Call of Duty: Black Ops 4 proved a hit, Activision Blizzard will likely won’t hesitate enabling Battle Royale modes for Destiny 2 and Call of Duty: WW II.

Conclusion

The bottom line is Activision left a lot of money on the table by not competing early against Fortnite and PlayerUnknown’s Battlegrounds. Cotick was too focused on building Overwatch as an e-sports game that he failed to properly address the danger presented by Battle Royale games. Since January 2018, Overwatch is no longer among the top-grossing PC or console games in the world.

Thanks to the strong revenue stream of Candy Crush Saga, Activision balanced the decline in Overwatch’s digital sales.

The inaction of Activision Blizzard to the threat posed by Fortnite and PlayerUnKnown’s Battlegrounds is partly why I Know First has bearish market trend signals. Cotick and his team has not made any official announcement that Activision has real equalizer to popular Battle Royale games. Being not forthcoming on what Activision’s plans on addressing the threat of Battle Royale games is a big turn-off.

Nevertheless, I am still rating ATVI as a Buy because I like how King Digital is growing its business. I went long ATVI because I was previously long KING. King Digital is Activision Blizzard’s bright hope in raking in a bigger share of the $70.3 billion/year mobile games industry.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.