AAPL Stock Forecast for 2022: The Road to $4 Trillion Capitalization

![]() This AAPL Stock Forecast for 2022 article was written by Opher Joseph – Financial Analyst, I Know First.

This AAPL Stock Forecast for 2022 article was written by Opher Joseph – Financial Analyst, I Know First.

Summary

- Apple needs to close above $182.86 to reach a $3 trillion market value.

- The company surely has a formidable line-up to ensure future growth and sustainable business expansion.

- Regulatory troubles cause a bumpy ride towards its expansion plans.

Overview

Apple Inc. designs, manufactures and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. It also sells various related services. In addition, the company offers iPhone, a line of smartphones; Mac, a line of personal computers; iPad, a line of multi-purpose tablets; Air Pods Max, an over-ear wireless headphone; and wearables, home, and accessories comprising Air Pods, Apple TV, Apple Watch, Beats products, Home-Pod, and iPod touch. The company sells its products through its retail and online stores, and direct sales force; and third-party cellular network carriers, wholesalers, retailers, and resellers. Its services include Advertising, AppleCare, Cloud Services, Digital Content, and Payment Services. Its customers are primarily in the consumer, small and mid-sized business, education, enterprise, and government markets. Apple Inc. was incorporated in 1977 and is headquartered in Cupertino, California.

(source: wikimedia.org)

Apple stock is just below a milestone market capitalization of $3 trillion. Apple needs to close above $182.86 to reach a $3 trillion market value. The company is already on its roadmap to reach $ 4 trillion with its exciting business avenues. Even a minor success in 2022 would mean the company moving at all-time high valuation levels through expansion in its current business. This, however, may come with its own set of challenges and regulatory downturns followed by minor corrections along the way. Apple updated its investor relations page to announce that earnings for the first fiscal quarter of 2022 (fourth calendar quarter) will be shared on Thursday, January 27. The first-quarter earnings call will give us insight into sales of the iPhone 13 models, AirPods 3, M1 Pro and Max MacBooks, and other devices during the holiday quarter that ended in December. Apple CEO Tim Cook last quarter said that supply constraints caused by chip shortages had cost Apple $6 billion, and the chip shortages and supply issues are also expected to impact Apple’s first-quarter earnings results. The production estimates predicted by analyst Yasuo Nakane of Mizuho Securities were lowered by 4% to 90 million units from 95 million. For the first quarter, Nakane now expects Apple to make 66 million iPhones, up 20% from the same period a year earlier. For full-year 2022, Nakane is forecasting production of 259 million iPhones, up 9% over the firm’s 2021 estimate of 237 million units (source: iPhone Production Seen Rebounding In Q1 |(investors.com)).

The Apple Inc. Growth Story

Apple’s return is impressive in each of its filings. With its super ambitious future projects, we know Apple just won’t do things to follow a trend but comes up with quality products. With the company already venturing into the autonomous car industry, Virtual Reality & Artificial Intelligence Metaverse, the company surely has a formidable line-up to ensure future growth and sustainable business expansion. Although it is a late entrant into the online streaming platform with Apple TV, this is another segment that has the potential to grow, and Apple endeavors to keep providing quality content instead of following its competitors and expanding its library base, thus prioritizing quality over quantity. AAPL’s revenue significantly increased by 33.26% in 2021. All AAPL’s products show amazing growth in 2021. Especially, we should notice that the iPhone takes a significant fraction in return with annual growth of 39.33%.

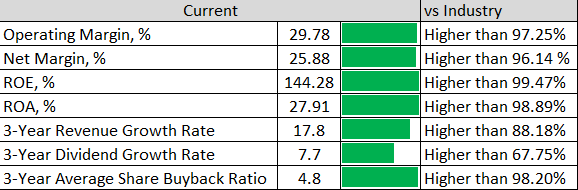

According to GuruFocus, AAPL is one of the most profitable companies in the Hardware industry. AAPL’s ROE of 144.28% is better than 99.47% of companies in the industry. The Net Margin of 25.8% is higher than 96.14% of companies in the industry. This can exhibit the company’s excellent profit generation ability.

(Figure 3 – AAPL vs Hardware Industry in TTM)

Apple has been rumored to buy the company Peloton for long enough now. Peloton Interactive, Inc. is an American exercise equipment and media company based in New York City. Peloton’s main products are internet-connected stationary bicycles and treadmills that enable monthly subscribers to remotely participate in classes via streaming media. The essential characteristics of both companies seem similar and are opined to be a good fit for each other. Historically, Apple’s acquisition strategy has been to acquire small companies that can be easily integrated into existing projects. Speaking to shareholders at Apple’s AGM in February 2021, Chief Executive Officer Tim Cook also emphasized that Apple uses M&A as a vehicle to acquire technology and talent. At that same meeting, Mr. Cook revealed that Apple had acquired “about 100 companies over the last six years”. Apple’s foray into the virtual reality world has also been one of the most anticipated ones and eagerly awaited. Talks of the first Apple VR headset are always around the corner while Apple has started to develop on the second generation of its VR headset.

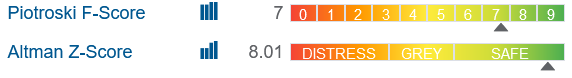

Apple Inc. has formidable operating margins compared to its peers in the hardware industry with promising growth track records to deliver on its future prospects. It scores a rating of 7 in the Piotroski F-Score indicating a healthy financial situation. Apple has continued to be a high-liquidity cash-rich company. While it has a safe rating in Altman Z-Score indicating it to be in the safe zone.

Promising growth not without its own legal battles

Apple, again and again, finds itself facing lawsuits with regulatory authorities regarding competition rules and monopoly markets. Currently, it is facing legal proceedings against its anti-competition practices and tight control on its application eco-system in several regions across European Union and Asia including India. This comes after their class-action lawsuit settlement in the US with software developers, again in relation to practices in App Store policies. Apple Inc. had several legal battles with several small as well as larger entities like Epic Games Inc., Match Group Inc., and Facebook Inc. (now Meta). The company has repeated trouble continuing its 30% in-app fee on app distribution of paid digital content and this could hurt its revenue from its app eco-system depending on the outcomes of the above proceedings in the coming periods.

Conclusion

Apple Inc. has been among the top picks as a must-have stock in the portfolio of every investor for a long time stock. It is amongst the big five companies to be traded on NASDAQ namely Facebook Inc. (now Meta), Amazon, Apple, Microsoft, and Google also known to be FAAMG. There is no doubt that the stock price would continue its upward trend and achieve higher levels in the coming periods, regardless of the fact that it faces some regulatory challenges ahead.

Given the formidable outlook on this stock, AAPL is a recommended buy with an upside target of $200 and beyond.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the AAPL stock forecast. The dark green for all forecasts is a strong bullish signal.

Past Success With AAPL Stock Forecast

I Know First has been bullish on the AAPL stock forecast in the past. I Know First analyst published a premium article on July 28th, 2021 about the great AAPL’s stock potential in the coming year. Despite that the prediction one year horizon is not over yet, we can notice a significant current return of some 15.57% that an investor could have If he bought AAPL’s stock according to the analyst’s advice.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast