Top Stocks Based On Machine Learning: Up To 61.26% Return In 1 Year

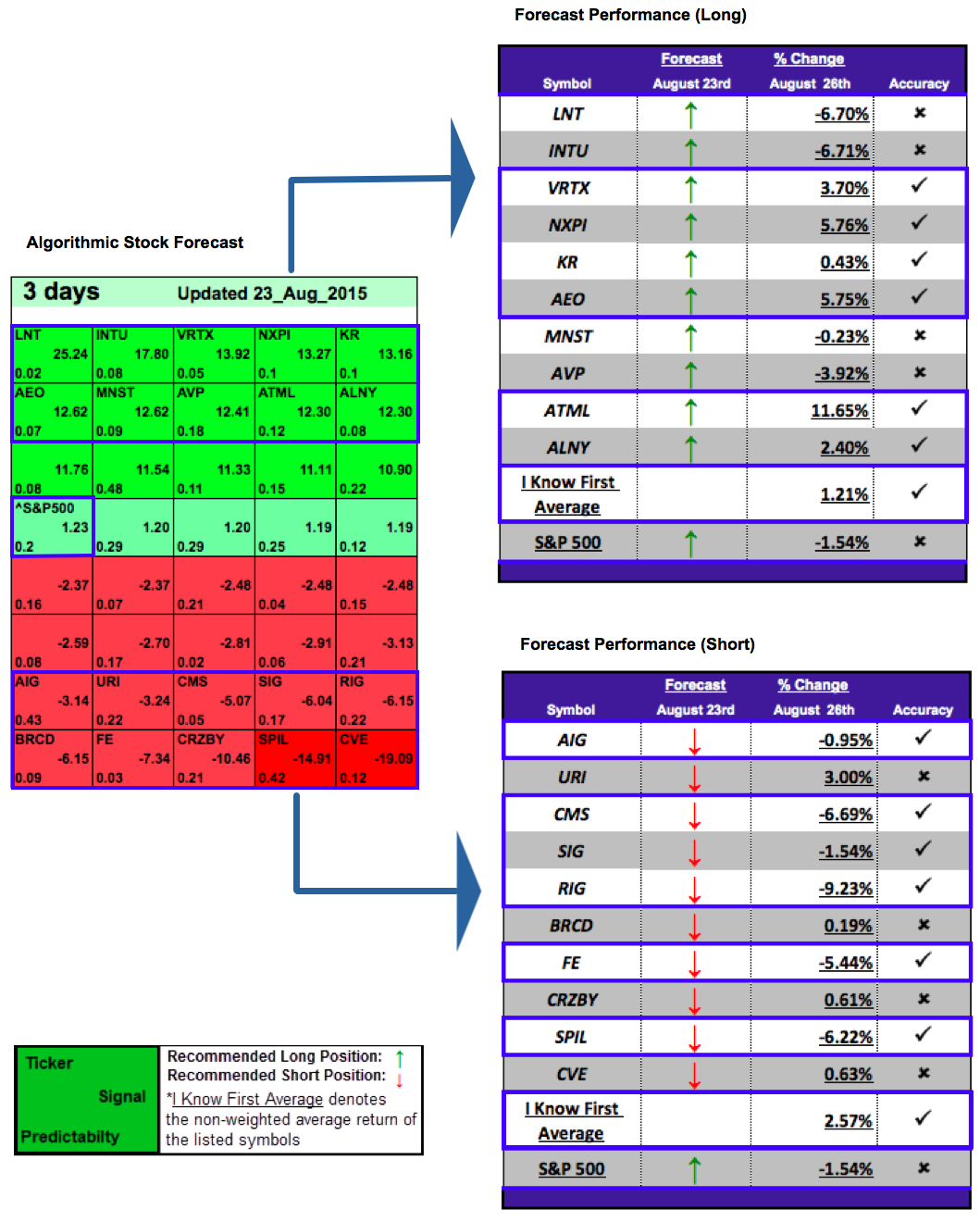

Package Name: Tech Stocks

Forecast Length: 1 year (8/26/14 – 8/26/15)

I Know First Average: 20.63% Long; 30.51% Short

Forecast Length: 1 year (8/26/14 – 8/26/15)

I Know First Average: 20.63% Long; 30.51% Short

Read The Full Forecast