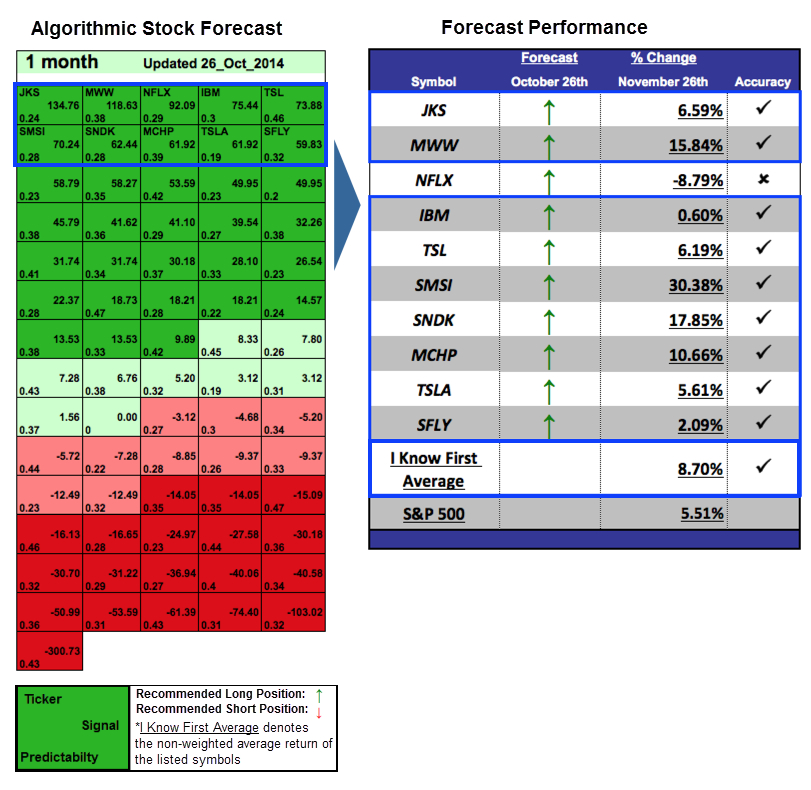

Top Tech Stocks Based On Algorithms: Up To 30.38% Gain In 1 Month

Top Tech Stocks Based On Algorithms

This Best Tech Stocks forecast is designed for investors and analysts who need predictions of the best performing stocks for the whole Technology Industry. It includes 20 stocks with bullish and bearish signals and indicates the best tech stocks to buy:- Top 10 tech stocks for the long position

- Top 10 tech stocks for the short position

Recommended Positions: Long

Forecast Length: 1 Month (10/26/2014 - 11/26/2014)

Forecast Length: 1 Month (10/26/2014 - 11/26/2014)I Know First Average: 8.70%

Get the “Top Tech Stocks” Package.

Rackspace Stock Forecast Rackspace Hosting, Inc., provides cloud computing services and managing Web-based IT systems for small and medium-sized businesses and large enterprises worldwide. Founded in 1998 by three Trinity University classmates, Rackspace is a global company headquartered in San Antonio, Texas, with more than 200,000 customers and $1.5 billion in annual revenue. Rackspace is the number one managed cloud company, with technical expertise and Fanatical Support allowing companies to tap the power of the cloud without the pain of hiring experts in dozens of complex technologies.

Rackspace Stock Forecast Rackspace Hosting, Inc., provides cloud computing services and managing Web-based IT systems for small and medium-sized businesses and large enterprises worldwide. Founded in 1998 by three Trinity University classmates, Rackspace is a global company headquartered in San Antonio, Texas, with more than 200,000 customers and $1.5 billion in annual revenue. Rackspace is the number one managed cloud company, with technical expertise and Fanatical Support allowing companies to tap the power of the cloud without the pain of hiring experts in dozens of complex technologies.