Yingli Solar Stock Forecast: An Algorithmic Analysis

Yingli Solar Stock Forecast

- Yingli Solar’s stock price has fallen over 50% since the end of June, partly because of falling oil prices.

- Oil prices and solar stocks should have no correlation, meaning the stock is undervalued.

- Solar energy companies like Yingli Solar will have plenty of room for growth as demand in China grows to meet renewable energy targets.

- I Know First’s algorithm is very bullish for Yingli Solar in the one-month and three-month time horizons.

Yingli Green Energy Holding Company Limited (YGE), also known as Yingli Solar, released its most recent earnings report last week, which underperformed compared to analysts’ expectations. While the company’s performance was underwhelming, the resulting fall in the stock price makes now a good time to invest in this company, which has a strong legacy in the solar industry. When looking at this particular stock, it becomes quickly apparent that the stock is greatly undervalued and is set to increase rapidly over the next few months.

Solar Stocks Suffer As Oil Prices Fall

Chinese solar stocks such as Yingli Solar have declined as oil prices have halved since June of 2014, as investors believe that these things are related. These investors are incorrect, however, and stock prices should correct themselves in the future. Diesel and other petroleum-based fuels account for only 5% of global power generation today, and that figure is still dropping further. It is already even lower in the US, where it accounts for only 1% of generation.

The actual impact from oil prices on solar should be zero. But lower oil prices have continued to have a large impact on renewable energy stocks, such as Yingli Solar. These two facts put together mean that a stock like Yingli Solar is undervalued at this time, as its growth potential and future outlook are still as strong as ever. Add to this that oil prices are starting to slowly rally, which could have a positive impact on the solar company even though it shouldn’t, and the stock is currently valued lower than it should be based off of this factor.

China Is Focused On Solar Growth

China recently set a higher-than-expected target for solar power installations in 2015, as the company aims to boost renewable energy in the pollution-riddled country. The solar market is general is growing around the world, but China is taking it to another level by targeting 17.8 GW of solar installations in 2015, which is 19% higher than the proposed 15 GW goal that was expected. To put this huge growth in perspective, China could approach the 18.3 GW of solar ever installed in the US next year alone. The country has also set an ambitious solar energy generation target of 70 GW by 2017.

Yingli Solar will be one of the main companies to benefit from this, not only from panel sales but also from building projects. The company recently announced that it was building a 50 MW solar power plant in Huangshi City, Hubei Province, China. The country is pushing for more projects like these from solar and other renewable energy companies as it addresses its increasing energy demands. Having relied on coal in the past, the country has become extremely polluted, and the Chinese government is now determined to curb carbon pollution and encourage alternate resources for power generation.

Analysts Projections

Market analysts are similarly bullish about Yingli Solar looking ahead to the future. The consensus estimate of analysts for this stock is $3.37, well above the stock’s current price of $2.42 as of the time of this writing. This represents a price premium of over 28%, further evidence that this stock is undervalued at this time.

Algorithmic Analysis

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The algorithm has more data to forecast within the long term and, naturally, outputs a more accurate predication in that time frame. Having said that, intraday traders, along with short-term players, will also benefit by taking the algorithmic perspective into consideration.

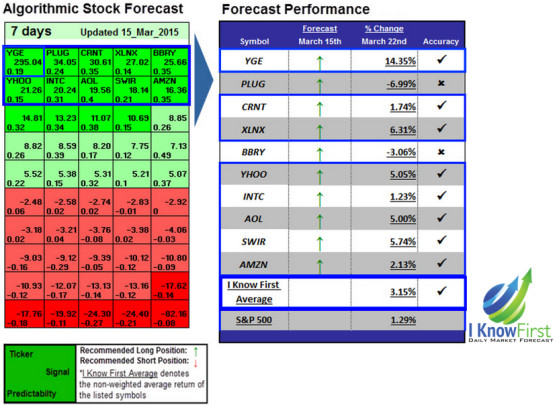

The I Know First algorithm was able to correctly predict the behavior of Yingli Solar’s stock price for the last week. Figure 2 is an I Know First algorithm prediction made on March 15th, 2015. The self-learning algorithm uses artificial inelegance, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

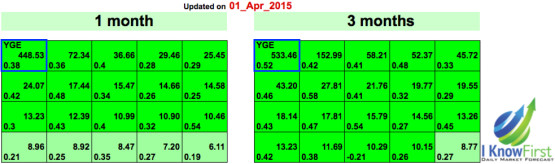

Having explained how I Know First’s algorithm works, it is worthwhile to see if the algorithm agrees with the bullish fundamental analysis of the company. Figure 3 includes the three-month and one-year forecasts for Yingli Solar from April 1st, 2015. In both forecasts, the company has an incredibly strong positive signal, indicating the algorithm is bullish for the stock.

This forecast is in agreement with the fundamental analysis of how undervalued Yingli Solar is at this point in time. These signals are exceptionally strong and are the top picks for both time horizons, meaning the algorithm believes that the stock price will move much higher in the future. This makes sense, as it is currently vastly undervalued due to lower oil prices and will have plenty of opportunities to increase sales in the future as China looks to install more and more solar power in the next few years. Investors should be ready to jump on this stock when the opportunity presents itself.