Tesla Stock Predictions: New Developments Further Power Bullish Tesla Case (TSLA)

Tesla Stock Predictions

Tesla Motors, Inc. (TSLA) has maintained its projection for 55,000 vehicle sales during the current fiscal year. With 10,045 Model S sedans delivered during the first quarter and forecasted deliveries for 10,000 to 11,000 vehicles for the second quarter, it is obvious that the company will have to have increased sales during the second half of the year. The release of the Model X crossover SUV and the subsequent ramping up of production will make this possible. Recent developments both domestically and abroad will help Tesla meet its goal. Along with the amazing orders for stationary batteries, the forecast for the company is bullish looking ahead, even though profits will remain low for the rest of 2015.

Success Predicting Tesla’s Stock In The Past

I Know First has posted many articles on Tesla so far in 2015. The first article was actually from December 31st, 2014, and contained a bullish forecast for 2015. Since that article was posted, the stock price has increased 11.84%. Another article was published in February after the stock price had fallen 8.78% since the beginning of the year. I Know First kept a bullish forecast on the stock, and it has increased 22.61% since the publishing of that article.

Three other articles were published surrounding the announcement of the stationary battery business and the first quarter earnings report. The first was published before the meeting where CEO Elon Musk announced the stationary battery, and contained a strong bullish forecast. The other two were about the earnings report, one of what to expect before the report was released and one about what the report meant for the stock. Since those articles, the stock price has increased 10.04% in less than two weeks.

Optimistic Prediction For Second Half Sales

Tesla and Musk recently won another battle in the US to be able to sell directly to customers, this time in the state of Maryland. The company has been fighting to be able to sell its vehicles in retail stores instead of working through dealers. The new deal in Maryland permits companies that make electric cars to operate as auto dealers, with as many as four locations allowed. This deal is basically written directly for Tesla, as it is only for vehicles that don’t burn fossil fuels.

This is only the company’s latest effort, with New Jersey signing a similar bill into law two months ago and the state of Connecticut currently working on allowing direct sales in its jurisdiction. Last week, Georgia also passed a bill lifting restriction on how many vehicles can be sold per year and allowing Tesla to expand the amount of dealerships it has from three to five.

Michigan, Texas, West Virginia, and Arizona are the other states that Tesla is currently still trying to get permission for direct sales in besides Connecticut. The Federal Trade Commission recently published a post with its most clear-cut support for direct sales yet, showing that the federal sentiment is in favor of companies like Tesla. This momentum should lead to the rest of the states allowing Tesla to operate there, opening up more markets to sales during the second half of the year.

Progress is also being made in China, where Tesla is working to comply with the country’s charging standards. China has long been seen as a potentially huge market for Tesla, both because of the amount of automobiles purchased in the country and the need to decrease pollution there. However, sales have been pretty dismal so far, with only 2,500 vehicles having been registered in the country since sales started there in April 2014. Many reasons have contributed to lagging sales in this potentially huge market, but one main concern among Chinese consumers about the lack of charging stations.

By working with the Chinese government to comply with national charging standards, the company will modify both its cars and its charging stations. Tesla has invested heavily in installing supercharging stations in China and internationally, but the technology isn’t compatible with other electric cars. The Chinese government is emphasizing the need for more electric cars, wanting more than 500,000 electric vehicles on the road by the end of the year. By meeting standards, electric vehicles in general will become more popular, helping Tesla in the process.

Figure 1. Source: Triplepundit.com.

Both of these developments will be huge for sales of the new Model X, which is set to be released during the second half of the year. Musk recently said that the first models should be shipped toward the end of the third quarter, as the date was slightly pushed back to make sure that the vehicle has no issues, such as the problem that some Model S vehicles have had with the door handles.

More importantly, the Model X will ramp up production much quicker than the previous model, going from a relatively small number of vehicles being delivered to around 1,000 vehicles a week very quickly. This will be key to meeting the estimated deliveries for the current fiscal year, set at 55,000 vehicles. Meeting this number will be key for the stock’s growth price, because it will show that Tesla has a sustainable model going forward. The new developments in states like New Jersey and in China, both of which have large numbers of luxury car sales, are key to driving demand for the product this year.

Importance Of The Gigafactory

With vehicle deliveries expected to grow quickly during the second half of the year and moving forward, it is important to keep in mind the tremendous demand for the storage battery since the new product offering was announced May 6th. The new product has already generated $800 million in potential revenue through reservations so far. Conservative analysts point out that these reservations are not backed by deposits like similar reservations for vehicles are.

However, roughly $625 million of that potential revenue is estimated to have come from businesses and utilities that are more likely to carry through with the transaction than independent home users. This is a good sign for the company, but being able to meet this demand will be a significant challenge. Luckily, the Gigafactory that Tesla has been building in Nevada should become operational early next year and will immediately boost the company’s production capabilities.

Musk has also been betting on the Tesla battery packs demand increasing in the future, with the Gigafactory being built as a product, so that it could easily be replicated. Building more factories like the Gigafactory is part of the company’s plan to meet demand in the future. This could be especially key when the Tesla Model 3 is released in 2017. Set to be debuted next March, this vehicle will be much more affordable. Having already figured out how to ramp up production with experience from the Model S and Model X releases, having enough battery production will be key.

Algorithmic Analysis

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The algorithm has more data to forecast within the long term and, naturally, outputs a more accurate predication in that time frame. Having said that, intraday traders, along with short-term players, will also benefit by taking the algorithmic perspective into consideration.

The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

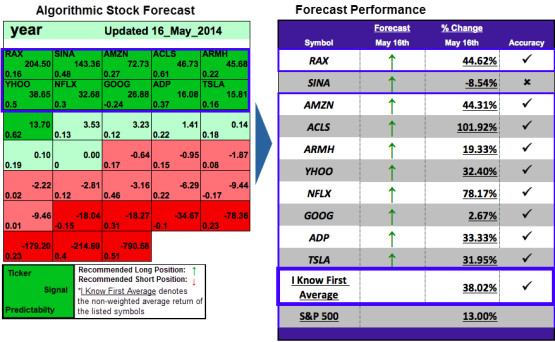

I Know First was correctly able to predict the rise of Tesla’s stock price over the past year. In this forecast from May 16th, 2015, Tesla was included as one of the top 10 stocks to buy in the one-year time horizon. The company had a signal strength of 15.81 and a predictability indicator of 0.16. In accordance with the algorithm’s prediction, the stock price increased 31.95% since that time.

Figure 2. 1-Year Algorithmic Performance For Tesla.

Having explained how I Know First’s algorithm works and demonstrated its success in predicting the stock’s behavior in the past, it is worthwhile to see if the algorithm agrees with the bullish fundamental analysis of the company.

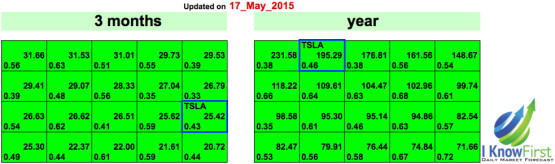

Figure 3. Long-Term Algorithmic Forecast For Tesla.

The figure above includes the three-month and one-year forecasts for Tesla from May 17th, 2015. Tesla has strong bullish forecasts in both time horizons, but especially for the one-year forecast. This makes sense, as the company should start becoming cash flow positive by that time due to sales of the Model X, new stationary batteries, and the completion of the Gigafactory. At that time, the stock price will soar, with the possibility of the stock trading near $400 not that hard to imagine.