Tesla Stock Forecast: Algorithmic Prediction Is Bullish On Tesla

Several years ago, fundamental analysis was the only way to go. However, at present, we can gain an algorithmic perspective on investment, as well. While algorithmic analysis should not be regarded as conclusive, it is a decidedly useful tool for most investors.

I Know First recognizes this, and has thus devoted time to developing an advanced self-learning algorithm based on artificial intelligence, machine learning, and artificial neural networks: one capable of predicting the flow of money in almost 2000 markets from 3-days to a year. This algorithm provides traders with a trend they can use to identify when to enter and exit the market; though it may be used for intra-day trading, the predictability of this trend becomes stronger in 1-month, 3-month, and 1-year forecasts; as such, it can – when coupled with traditional analysis and careful reasoning – effectively be used to analyze the value of such stocks as TSLA. While I Know First’s algorithm should not be regarded as a stand-alone testament to TSLA’s value, the algorithm has seen an unusually high degree of accuracy, and as such is, at least, a useful complement to independent analysis.

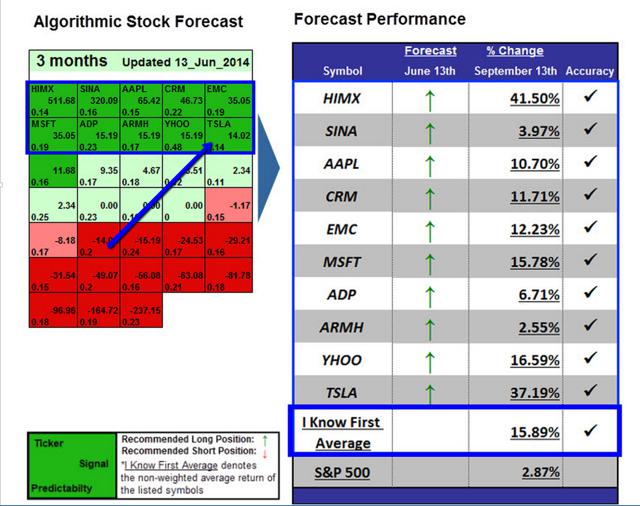

While many investors may question the validity of such an algorithm, particularly as compared to analyst recommendations, I Know First has successfully predicted the performance of many stocks – TSLA included. On June 13th, 2014, for example, I Know First recommended a strong bullish position for TSLA for a period of three months, from June 13th to September 13th, 2014. Comparing this forecast to TSLA’s actual progress (Figure 3), we see that the two aligned: the stock return was +37.19%. Specifically, since our updated May 9th prediction, featured here, TSLA has gone up by 42%; since our updated strongly bullish June 9th prediction, TSLA has gone up by 27%.

(click to enlarge)

Figure 4. I Know First successfully predicted TSLA’s strong bullish trend for three months in June 2014. I Know First’s June 13th forecast is shown on the left, with TSLA boxed in blue for clarity; TSLA’s actual performance is shown on the right.

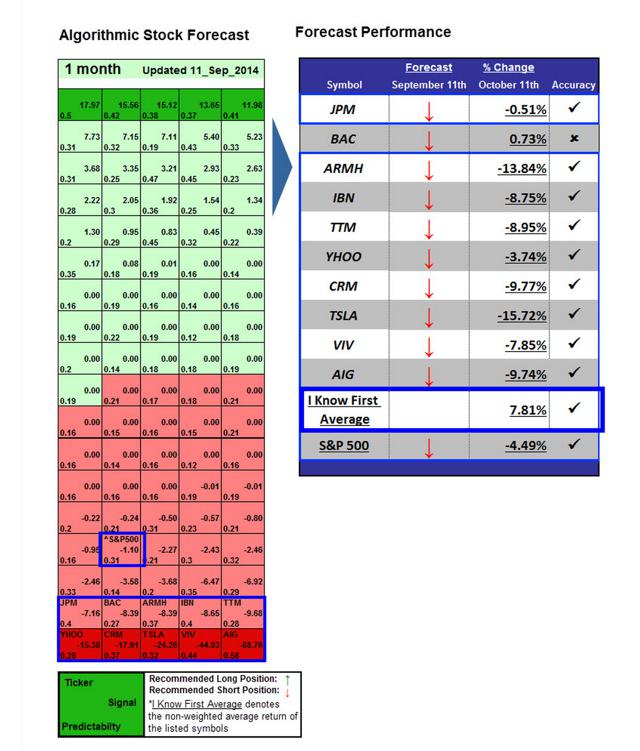

Last month, the one month forecast for TSLA was negative:

(click to enlarge)

Figure 5. I Know First’s September 11th forecast is shown on the left, with TSLA boxed in blue for clarity; TSLA’s actual performance is shown on the right.

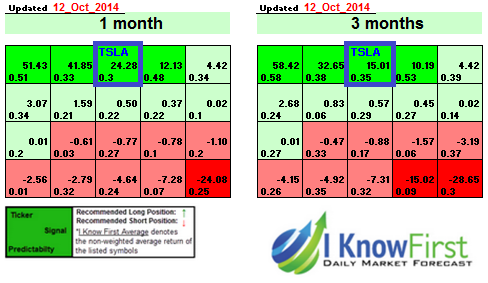

The most updated forecast generated by the I Know First algorithm, updated on October 12th, is shown below (Figures 6). Bright green signifies a highly bullish signal; light green also indicates that the forecast is bullish, but not as strongly so. Bright red, in turn, signifies a bearish forecast; correspondingly, light red indicates a bearish forecast as well, but not as negative a forecast. Each compartment contains two numbers: the strength of the signal itself (represented by the number in the middle of each box, to the right), and itspredictability (found in the bottom left corner, this is the approximate level of confidence the algorithm has in the forecast). Taking all this into consideration, the ticker symbol for Tesla Motors – “TSLA” – may be seen as bullish in the 1-month and 3-month time frames.

Tesla stock forecast

Figure 6. I Know First’s most recent 1-month and 3-month forecasts for Tesla Motors. TSLA is boxed in blue, and shown to be bullish.

This bullish forecast for the short term coincides well with recent developments in TSLA’s automated driving plans, lower-budget models, and international outreach. Given analysts’ mean positive recommendations and TSLA’s plans, it may be wise to consider keeping TSLA in one’s portfolio until further change.