Stock Market Forecast: China’s Stock Market Plunged Nearly 8% On Lending Curbs

Chinese equities plunged the most in six years on Monday, led by brokerage firms. The China Securities Regulatory Commission punished the three largest brokerages by assets from opening new margin trading accounts for three months, following an investigation into high-risk margin trading. Investors and analysts see these penalties against the brokerages as foreshadowing more curbs on credit-financed trading by China’s government. Brokerage firms had been the biggest beneficiaries of a bull market in China since November.

Margin financing allows investors to borrow money to buy into the stock market. China recently softened restrictions on margin trading to help open up its financial markets. That has in turn given rise to a boom in margin trading that has pushed up Chinese stocks, with the Shanghai Composite Index (SCI) reaching its highest close in over five years on Friday.

This has happened even as corporate profits have underperformed and Chinese economic data has disappointed. Outstanding margin loans were about 767 billion yuan ($123 billion), according to the Shanghai Stock Exchange, compared to just 444 billion yuan just three months earlier. Authorities want to stop the stock market’s boom over the past year from turning into a bubble that could damage the broader economy.

The Shanghai Composite surged 54 percent last year, partly because of easy credit that investors used to finance their trading. David Cui, a strategist at Bank of America Merrill Lynch, warned in a report last month that the swift rally in the Chinese stock market of late was unsupported by fundamentals, and that the stock market would be capable of falling just as quickly as it had risen when the tide turns.

In a margin trade, an investor’s loans from a broker are backed by his or her equity holdings. This could prove problematic, as the margin trading has been extremely popular with mom and pop investors. These investors aren’t experienced enough with margin trading to know what happens when the market drops.

When falling markets force investors to sell out of their margin positions, they find themselves suddenly owing much more than the money they initially invested. That inexperience could cause an overreaction that makes liquidity disappear quickly. Market selloffs can also become self-reinforcing as other investors sell because of fear they will suffer even greater losses if they do nothing. That would be bad for the market, of course. It could also be disastrous for the economy, where tight liquidity makes sudden cash squeezes dangerously easy to trigger.

The three brokerages targeted on Friday, Citic Securities, Haitong Securities and Guotai Junan Securities, had broken trading rules by rolling over expired margin loans, and Chinese authorities punished nine other brokerages for similar offenses. The China Banking Regulatory Commission also banned banks from lending to companies that borrow to invest in equities, bonds, futures and derivatives. So-called entrusted loans extended by banks increased to about 458 billion yuan in December, the most since data became available in 2012.

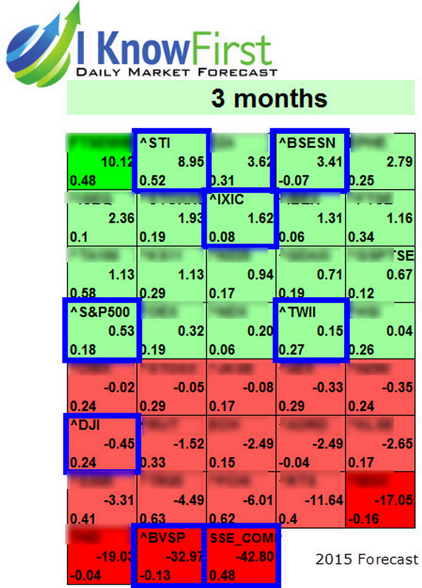

I Know First published an article on January 2nd, 2015, to Seeking Alpha titled “Global Market Forecast For 2015 Based On A Predictive Algorithm”. In the article, I Know First included a forecast from the end of 2013 to the end of 2014 for world market indices, in which all ten stocks acted in accordance with the algorithm’s prediction. It also included a forecast for the coming year, shown below.

The Shanghai Composite Index is SSE_COM in this heat map. As can be seen by reading the map, the Shanghai Composite Index had a signal strength of -42.80, the strongest signal of any of the indices. The negative signal strength indicated that the index was bearish, in this case over the next three months. This has already started to happen, and looks likely to continue as the stock experiences more pullback as the China Securities Regulatory Committee continues to curb credit-financed trading.