Softbank Stock: Supercell’s Estimated Monthly Sales Is More Than $259 Million

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Softbank Stock

- SoftBank’s 73.2% stake in mobile game developer Supercell is a runaway success.

- SoftBank should focus more on acquiring successful game developers/studios.

- Tablet and smartphone gaming could generate $35 billion in global sales this year.

- I Know First is currently bullish on SoftBank’s stock movement.

SoftBank’s (SFTBY) decision to increase its stake in Supercell was a smart move. The business of selling virtual items/currencies to mobile users is a gold mine for SoftBank. Supercell is still the top-grossing games developer in the mobile sector. SoftBank stands to benefit the most out of the estimated $35 billion annual revenue from tablet and smartphone games.

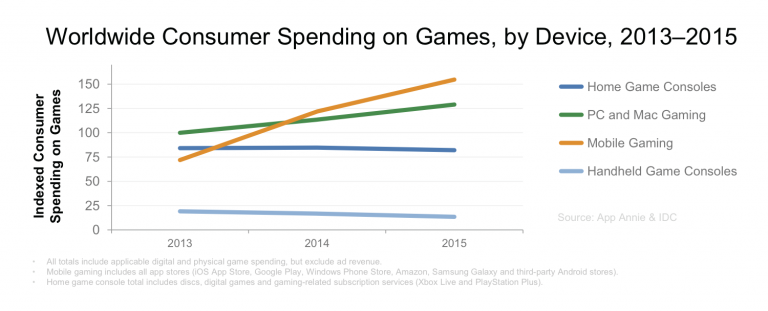

(Source: App Annie & IDC)

Deloitte’s 2016 estimate of $35 billion for tablet/smartphone gaming revenue is 20% higher than last year’s numbers. This double digit growth rate has been happening since 2013. I expect mobile gaming to continue its robust growth rate. Tablets and smartphones have declining average selling prices in spite of them having more powerful processors and GPUs.

(Source: Supercell Site)

According to the March 2016 estimates of SensorTower, Supercell’s global net sales (30% cut of app store owners was already deducted) was $259 million. This estimate is just from two mobile games, Clash of Clans and Clash Royale. The latest game, Clash Royale, only had its global launch last March 2.

Their estimated net sales for March was already $144 million ($91 million from iOS devices and $53 million from Android users).

(Image Source: Supercell/Motek Moyen)

ThinkGaming also has impressive numbers for Clash of Clans and Clash Royale. The estimated average daily sales of Clash Royale is $1.53 million. This number is just from iPhone-using Americans.

Giants Will Rule Mobile Gaming

I agree with Deloitte’s assessment that size matters now when it comes to the mobile games industry. Only the biggest developers like Supercell (who can afford $500++ million annual advertising budgets) can flourish and grow. Smaller players like Glu Mobile (GLUU) are going to find it more difficult to compete against Supercell.

Mobile gamers are prone to herd mentality. Most people will likely favor those games that are also being played by their friends and relatives. Of course, the developer who spends the most on promoting its games gets the most amount of active players.

On hindsight, SoftBank’s initial investment of $1.5 billion in 2013 help fund Supercell’s aggressive advertising campaigns in 2014 and 2015. With that huge cash infusion from SoftBank, Supercell was able to super-popularize its Clash of Clans. The strategy worked.

The 8-figure annual marketing budget helped Supercell grossed $2.236 billion last year. Their 2015 net profit was $964 million. From this amount, Supercell paid out a dividend of $669 million. SoftBank’s share should be around $489.71 million.

Why Clash Royale Is So Successful

Supercell did right using the same familiar heroes and spells from Clash of Clans inside Clash Royale. People accustomed to the roles/purposes of the different types of units (in Clash of Clans) easily transitioned to Clash Royale. The 1-versus-1 combat design of Clash Royale also prevents it from directly competing with the group-based fun of Clash of Clans.

Clash Royale is now the number one top-grossing game. It is, even more, Pay-to-Win than Clash of Clans. The 4-chests-only limit and the long waiting time (3 hours for silver Chests, 8 hours for gold Chests) to unlock Chests encourages players to repeatedly spend money.

(Image Source: Supercell)

Getting those purple Epic Heroes like The Prince, Witch, Skeleton Giant, is easier done by spending $19.99. Of course, spending another $19.99 could produce another copy of the Witch and make her level 2. The gambling-feel of unpredictable hero/spell drops from premium and free Chests encourages more people to keep on playing (and spending money) Clash Royale.

The random drop sequence of the 8-deck cards during fights also adds to the gambling-vibe of this game. The short 3-4 minutes combat time is akin to a quick round of all-in-betting-only heads-up Poker.

Conclusion

Instead of wasting more money on shaky investments like Sprint (S), I want SoftBank to focus more on expanding its mobile games empire. Taking full ownership of Supercell will be a good move. Buying another successful games developer is even better.

Investors who like the business of selling virtual goods should consider adding SoftBank to their long-term portfolio. I expect Supercell to make around $3 billion in revenue this year. About 43% of which will be profit. And just like the 3-year old Clash of Clans game, Clash Royale is also a long-term cash cow for Supercell.

This new game is truly unique with its great blend of the Card Battle and MOBA genres of Hearthstone: Heroes of Warcraft and Vainglory.

My bullish outlook for SoftBank is also reinforced by the positive signals of the I Know First Algorithm. SoftBank’s stock has an outstanding +250.49 algorithmic forecast for the next 12 months. Adding this stock to your portfolio now could net you substantial return next year.

I Know First manages a great range of stocks and other financial instruments and predicts their movement in the market. Previously has predicted the movement for a range of Tech Stocks including SFTBY. A great example of this is the Tech Forecast that we can see below had a fantastic year with 37.69% for the long position and 19.70% for the short position during the period from January 9th 2015 to 2016. Compared to the S&P500 return of -6.79% the I Know First forecast outperformed this negative S&P500 return for the same year period. The top stock from the package was NFLX returning an amazing 133.13%.