Quick Win by the Algorithm: ^VIX and Gold

Devin Gellis is a Junior Financial Analyst at I Know First.

Devin Gellis is a Junior Financial Analyst at I Know First.

Quick Win by the Algorithm:

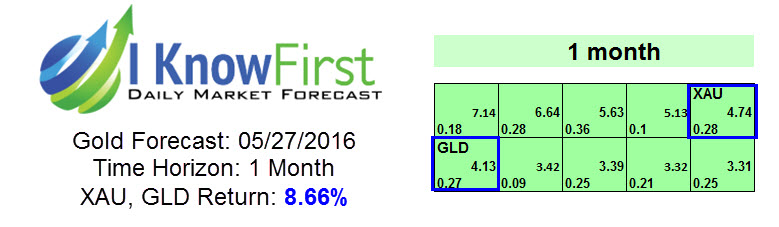

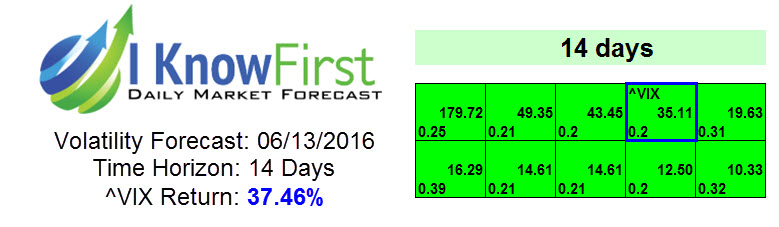

On May 27th, 2016, the I Know First algorithm gave a bullish signal of 4.74 with a predictability indicator of 0.28 for XAU, while at the same time presenting GLD with a signal of 4.13 and a predictability indicator of 0.27. In the following month, XAU and GLD both rose 8.66%. Also, on June 13th, the I Know First algorithm yielded a 35.11 bullish signal and a predictability index of 0.2 for ^VIX. Fourteen days later, ^VIX increased 37.46%.

Physical Gold (XAU) is a distinct valuable sought after metal. Gold is an element with the atomic number 79, It is used for jewelry, electronics, and a variety of other purposes. Throughout history, gold has been used as a form of currency in many cultures, but this is no longer the circumstance. Making investments in gold are often used as a hedging method against inflation because, for the most part, keeps its value over time.

Gold ETFs (GLD) are exchanged traded funds where the common asset is gold. As a result, the value of gold ETF is contingent upon the price of gold. The concept of gold ETFs were first introduced by Benchmark Asset Management Company, in India.

The Chicago Board Options Exchange (CBOE), or VIX shows the market’s prediction of 30-day volatility. It is devised using the suggested volatilities of a wide range of the S&P 500 index options.

An article published on The Wall Street Journal on June 27th stated that the two largest gold funds, SPDR Gold Trust and iShares Gold Trust, currently possess more physical gold together than all but seven other countries. SPDR Gold Trust is up 5.5% and have seen $1.1 billion worth of inflows over the last week. Following Great Britain’s vote to leave the European Union, the third-biggest U.S gold ETF, ETFS Physical Gold Shares, stated on Monday that their assets have passed over 1 billion. With $39.5 billion in assets, GLD is the biggest but definitely not the only gold fund rising in notoriety.

Gold prices have seen substantial gains of 25% year to date as investors seek safety against slow moving global growth and diminishing interest rates. Fear over the Brexit vote has caused a sudden surge of demand for physical bars and coins. Gold prices have risen up to $1,328 per ounce on Monday, making a 23% increase since January, compared to a 2.1% decline for the S&P 500. With the uncertain future following Brexit, analysts don’t expect gold to decrease anytime soon.

The Chicago Board Options Exchange (CBOE) Volatility Index increased 1.91 points or 7.4% to close at 23.85, the highest since the middle of February. As a result of the Brexit vote, the index spiked close to 50%. The strong performance comes as cyclic stock swings are coming back to markets after close to zero interest rates helped inhibit of suppression of volatility.