Valeant Pharmaceuticals Stock Prediction: The Road to Recovery

Samantha Fischler is a Financial Analyst at I Know First. She is currently a candidate for her bachelor’s degree in Accounting with a Concentration in Finance at Binghamton University.

Samantha Fischler is a Financial Analyst at I Know First. She is currently a candidate for her bachelor’s degree in Accounting with a Concentration in Finance at Binghamton University.

Valeant Pharmaceuticals Stock Prediction: The Road to Recovery

Summary

- Valeant Pharmaceuticals makes major changes to its leadership

- Since October 2015, Valeant has been under investigation due to its connection to Philidor

- Valeant is currently being sued by T. Rowe Price Group who allege that Valeant engaged in fraudulent activities that cost investor billions of dollars

- The company reported losses in Q2 2016

- Valeant is relaunching temporarily discontinued drugs and releasing new drugs

- I Know First is currently bullish on VRX

Some Background and Leadership Switches

Valeant Pharmaceuticals is a multinational pharmaceutical company headquartered in Laval, Quebec, Canada. The company predominately develops generic and over-the-counter drugs to treat different dermatological, gastrointestinal, and neurological issues, among a host of other health issues.

Valeant Pharmaceuticals is looking to make some big changes to its leadership. As of May 2, 2016, Joseph C. Papa took over as chairman and CEO of the pharmaceutical giant. The company announced last week that they will be replacing Chief Financial Officer Robert Rosiello, who will remain with Valeant Pharmaceuticals as head of corporate development and strategy. Paul Herendeen will be filling the role of CFO. Major challenges lie ahead for Paul Herendeen as he comes into the CFO position at a time when Valeant Pharamceutical’s economic practices are being questioned as will be explained in more depth later in the article. Herendeen has vast experience, working for over 30 years in positions of financial leadership, included in which is his time as CFO of Warner Chilcott, MedPointe, and Zoetis. The company also named Christina Ackermann as the new general counsel earlier and EVP in August in addition to the expansion of its executive committee and giving some senior executives larger roles within the company.

Investigation and Lawsuit

Valeant Pharmaceuticals is in the spotlight a lot lately, being investigated by the US Attorney’s office in the Southern District of New York and the SEC in connection to defunct drug company Philidor, which deceived insurance companies who in turn paid for Valeant’s expensive medications, rather than turning to cheaper alternatives. The company put forth a press release on August 10th regarding the investigation stating that “Valeant takes these matters seriously and intends to uphold the highest standards of ethical conduct as we move forward with our mission to improve people’s lives with our healthcare products.”

Valeant Pharmaceuticals is being sued by hedge fund T. Rowe Price Group. T. Rowe Price group alleges that Valeant engaged in fraudulent activities, resulting from which T. Rowe and other Valeant investors lost billions of dollars. T. Rowe was one of Valeant’s largest investors. According to T. Rowe, Valeant used deceptive pricing and improper accounting practices to inflate the revenue from its drugs and safeguard the company against competition. The lawsuit alleges that Valeant, a company that uses an expansion-through-acquisitions business model, led investors believe that its growth was due to strategic marketing and strong sales of its quality products. However, T. Rowe claims that Valeant “hid from investors the company’s clandestine network of controlled pharmacies and other deceptive practices that were true drivers of Valeant’s purported growth and which exposed the company to massive risks.”

Looking on Up with Q2 Earnings

During the second quarter (ended June 30, 2016) earnings call on August 9, Chairman and CEO Joseph C. Papa acknowledged that while the company showed strong performance during Q2, it still has ways to go in terms of regaining the trust of both investors and prescribers alike. He said “We continue to make progress towards stabilizing the organization…We are also announcing a new strategic direction for Valeant today, which, at its heart has a mission to improve patients’ lives, and will involve reorganizing our company and reporting segments. I am continuously encouraged by the commitment of our employees who work hard daily, rebuilding our relationships with prescribers, patients and payers, and regaining the trust of our debt holders and shareholders. Although it will take time to implement and execute our turnaround plan, I am confident that we will show progress in the coming quarters.”

Valeant’s total revenues decreased significantly year over year, declining 11%. Revenues were down to $2.42 billion as opposed to the $2.73 billion that the company brought in during the second quarter of 2015. Valeant primary attributes this decline to lower product sales revenue from existing businesses and the negative toll that Brexit has taken on currencies worldwide. The negative effects of the company’s lower product sales and the negative effects on currencies have been partially reversed by the product sales revenue brought in by companies that Valeant Pharmaceuticals acquired in 2015. Overall, the company experienced a huge net loss of $302 million this past quarter as opposed to the net loss of $53 million that the company faced in the second quarter of 2015. Valeant Pharmaceuticals also reported a GAAP loss per share of $0.88 compared to Q2 2015’s loss of $0.15. The adjusted EPS was $1.40 compared to last year’s Q2 gain of $2.14.

Valeant Pharmaceuticals is predicting that for the year 2016 total revenue will fall between $9.9 and $10.1 billion. The company also expects adjusted (non-GAAP) earnings per share to be in the range of $6.60-7.00.

Latest Developments from Valeant

Valeant Pharmaceuticals has made numerous announcements over the past few months regarding breakthroughs that it is making with new medications, relaunching others, and closing deals to develop others.

Valeant Pharmaceuticals will be relaunching its generic Ofloxacin Otic solution. This medication is used to treat bacterial ear infections. The product was temporarily discontinued in early 2015 due to an issue with a supplier of a key ingredient.

On August 8, Valeant also secured a deal with European pharmaceutical company Norgine that allows Valeant Pharmaceuticals to develop NER1006 Powder for Oral Solution in the U.S. and Canada. NER1006 Powder is used to prepare and cleanse the body before a colonoscopy.

Valeant Pharmaceuticals and Progenics Pharmaceuticals recently announced that the FDA approved RELISTOR, a medication used to treat OIC in adults who do not experience chronic non-cancer pain. Valeant expects to start selling RELISTOR commercially in Q3 2016.

Conclusion

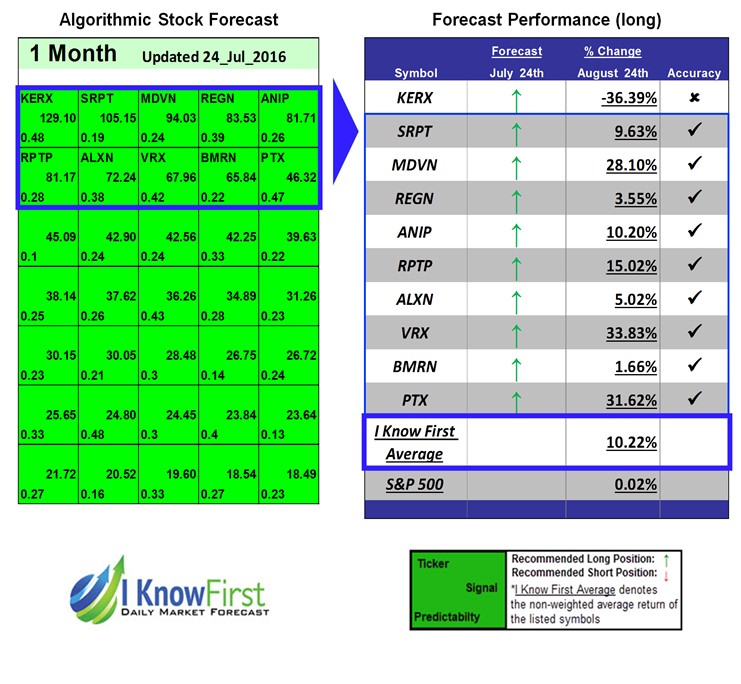

In a prediction dated July 24, 2016, the I Know First algorithm forecast that VRX would show strong growth within the 1-month period. VRX indeed had an impressive return, returning 33.83% in this short span of time.

Going forward, Valeant Pharmaceuticals will recover from the bad press that it has been receiving due to the US Attorney and SEC’s investigations and the T. Rowe lawsuit. With the shakeup of its leadership bringing in a new team of innovative and experienced professionals, Valeant will likely return to the prestige that it once held, despite its recent challenges. Additionally, Valeant will bring in more revenue in Q3 due to an increase in the number of drugs that it provides. Valeant also received the go-ahead from its lenders to lower its earnings-to-interest-payment ratio to help the company deal with its current rocky economic state.

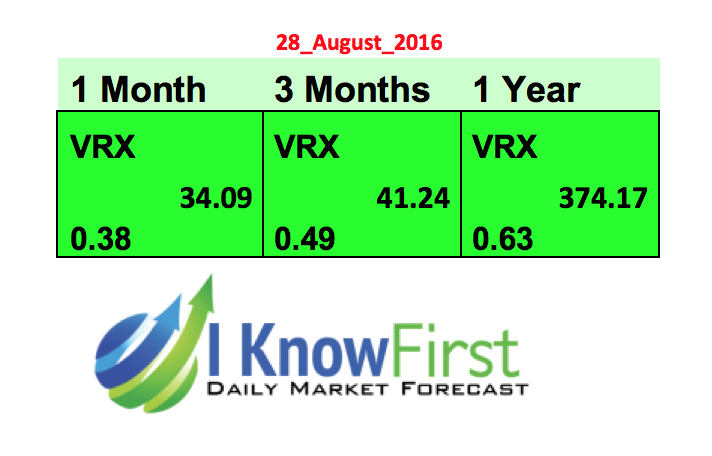

As can be seen in the forecast below, I Know First is currently bullish on VRX for the 1 month, 3 months, and 1 year periods. I Know First’s algorithm forecasts how stocks are going to perform for 3 days, 1 month, 3 months, and a year. In the case of Valeant Pharmaceuticals (VRX), the middle row represents the signal strength and the bottom number represents the predictability indicator, the historical correlation which is heavily weighted on the algorithm’s recent predictions. To learn more about how I Know First’s algorithm operates, click here.