Nvidia Stock Predictions: NVIDIA’s Growth Will Continue Surprising Investors

![]() Naman Shukla is an Analyst at I Know First. He writes and invests in the stock market. Ranked in the top 8 percentile in TipRanks.com. Featured on SeekingAlpha.com, GuruFocus.com, Valuewalk.com among others.

Naman Shukla is an Analyst at I Know First. He writes and invests in the stock market. Ranked in the top 8 percentile in TipRanks.com. Featured on SeekingAlpha.com, GuruFocus.com, Valuewalk.com among others.

Nvidia Stock Predictions

summary

- Strengthening gaming business is a plus.

- NVIDIA’s automotive business is gaining strength.

- The self-driving market is a massive opportunity for NVIDIA.

- Stock should continue moving higher on the back of strong growth.

- I Know First is currently bullish on NVDA stock

NVIDIA (NVDA) has continued to defy gravity as the stock has sustained its upward trajectory despite the rich valuation. Earlier this month, NVIDIA delivered another blowout quarter, and the company’s sustained double-digit growth really impressed Mr. Market as the stock jumped almost 10% post-earnings.

NVIDIA’s management has done a tremendous job over the last two years as the company has outperformed the market despite the slowdown in the PC industry. With NVIDIA’s PC business nearing saturation, the company is venturing into several other high-potential avenues that can maintain its growth late in the long-term.

In addition, NVIDIA is also careful about not letting its lead in the graphics card segment slip and is constantly upgrading its products to outsmart rivals like Advanced Micro Devices (AMD). Due to the company’s strength in its core business and growing presence in markets like automotive, I think NVIDIA can still move higher and is a buy.

16 nanometer FinFET technology

After a long time of about four years, graphics cards giant NVIDIA is launching a graphics processor grounded on its latest chip manufacturing technology. From the time when the company launched its Kepler architecture in 2012, it has introduced many graphics cards based on TSMC’s 28-nm chip manufacturing technology.

However, in late 2014, TSMC went started bulk manufacturing a newer 20-nm chip technology. NVIDIA avoided this technology for its discrete graphics processors in favor of TSMC’s 16-nm FinFET Plus technology. According to NVIDIA’s most recent earnings call, manufacturing yields on the company’s 16-nanometer Pascal graphics processors are worthy.

In the most recent investors’ meeting, NVIDIA detailed that it would no longer be the first one to practice new chip manufacturing technologies. As a substitute, it would hold its fire and wait for the major firms to use the latest technologies and then step onboard subsequently. NVIDIA’s management has been correct more often than not and I think they have made the right decision this time, too.

Gaming

In the most recent quarter, NVIDIA’s gaming revenue surged 17 percent on an annual basis to $687 million. This was possible mainly because NVIDIA’s GPU architecture is excellent and a lot better than its competitors. The company is putting massive amount of effort to advance its GPU architecture.

The manufacturing of NVIDIA is superb, and the company’s skill is truly unchallenged. The company has ascended its GPU building levels so much that they are currently superior than any other firm. This is one of the reasons why NVIDIA manages to outsmart its competitors and hold its leading position.

Moreover, the company has thrived in gaming region because it figured out the way to integrate its GPUs into new platforms also. The combination of superior GPUs and platforms has turned NVIDIA into a leader of the gaming industry.

Apart from this, NVIDIA is also aggressively focusing on deep learning. In just few years, deep learning is being implemented across the up-scale landscape. It is highly likely that development will grow in the imminent years.

NVIDIA is just getting started with deep learning. This deep learning segment is a new one, an improved way of performing computational tasks for a huge number of companies, and the company is perceiving grip all over the place.

Robust presence in automotive segment

According to the most recent quarterly results, the company’s automotive sales exceeded $100 million in a solo quarter for the first time. This quarter’s $113-million count was greater than $93 million recorded in the prior quarter, and jumped almost 47 percent on a year-over-year basis.

Automotive chips presently account for the least out of the company’s five-reported product classifications, but it is intensifying at a rapid pace. Also the company’s management is excited to take NVIDIA even further into this appealing market.

Furthermore, NVIDIA recently launched the second generation of its autonomous car development platform recognized as NVIDIA DRIVE PX 2. This package includes most efficiently working Tegra processors together with software and connector hardware that permits it gather and respond to the car’s surroundings.

Despite the fact that NVIDIA’s in-car information and entertainment systems accounts for the major portion of the revenue generated by the company’s automotive sales, it is an intrepid attempt to take a step beyond these systems.

As the company has introduced DRIVE PX 2 in January this year, global interest has lingered to surge amid car manufacturers, tier 1 suppliers, and others. The company is now working together with over 80 companies, via open architecture of DRIVE PX to create their own software and driving skills.

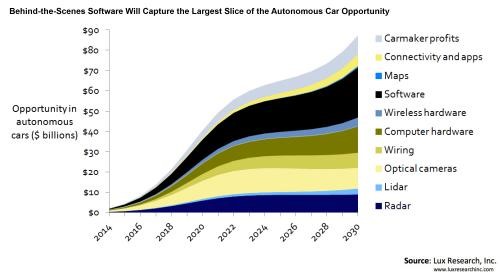

The autonomous car segment is a very attractive market and NVIDIA’s growing presence bodes well for long-term investors. As you can see from the image below, the self-driving car market is estimated to grow to $87 billion in worth by 2030.

Thus, NVIDIA has a very big opportunity and the company is taking the right steps to capitalize on this growth prospect.

Conclusion

Not only is NVIDIA’s core business strengthening every quarter, the chip maker is also expanding its wings over other fast growing markets. NVIDIA is rightly valued as a growth stock and will continue moving higher due to the ability of its management to efficiently harness growth opportunities. Thus, I think NVIDIA is a long-term buy.

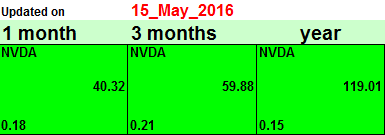

My bullish stance on NVIDIA is resonated by I Know First’s algorithmic forecasts. I Know First uses an advanced state of the art algorithm based on artificial intelligence and machine learning to foresee market performance for more than 3,000 markets including stock forecasts, world indices, commodities, interest rates, ETFs, and currencies. The algorithm generates a forecast with a signal and a predictability indicator. The signal is the number at the center of the box. The predictability is the figure at the bottom of the box. At the top, a particular asset is identified. This format is standardized across all forecasts. The middle number indicates strength and direction, not a price target or percentage gain/loss. The bottom figure, the predictability, signifies a confidence level.

As seen from the above image, I Know First’s 1-year forecast is extremely bullish on Apple. The 119.01 indicates that the algorithm is bullish on Apple in the long run, which coincides with my outlook as well.

I Know First algorithm has previously predicted the NVDA stock movement like in this forecast from the 15th of May to the 18th. With a signal of 30.38 and predictability of 0.07 it managed to bring returns of 5.81% in just 3 days.