Netflix Stock Prediction: Algorithmic Analysis

Netflix Stock Prediction

I Know First wrote a bullish article on Netflix on January 9th citing the promising original content and international expansion, and the stock price has climbed over 40% since that time. We supply financial services, mainly through stock forecasts via our predictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The algorithm has more data to forecast within the long term and, naturally, outputs a more accurate predication in that time frame. Having said that, intraday traders, along with short-term players, will also benefit by taking the algorithmic perspective into consideration.

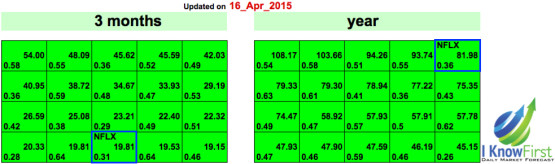

The self-learning algorithm uses artificial inelegance, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

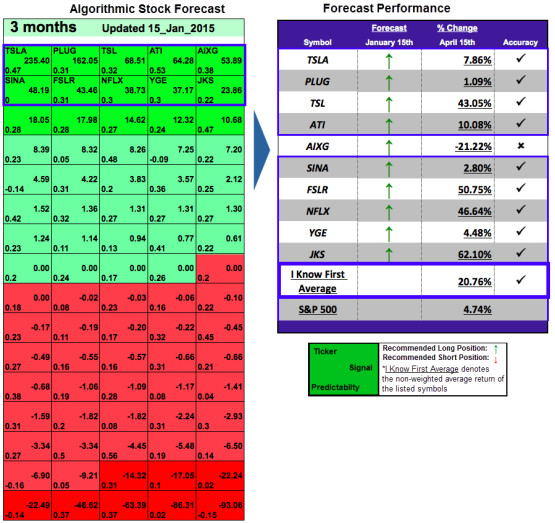

I Know First was correctly able to predict the rise of Netflix’s stock price since the last earnings report. In this forecast from January 15th, 2015, Netflix was included as one of the top 10 tech stocks to buy in the three month time horizon. The company had a signal strength of 38.73 and a predictability indicator of 0.3. In accordance with the algorithm’s prediction, the stock price increased 46.64% since that time.

Having explained how I Know First’s algorithm works and demonstrated its success in predicting the stock’s behavior in the past, it is worthwhile to see if the algorithm agrees with the bullish fundamental analysis of the company. The figure below includes the three-month and one-year forecasts for Netflix from April 16th, 2015. In both forecasts, the company has a strong positive signal, indicating the algorithm is bullish for the stock.

The algorithmic analysis is in agreement with the bullish fundamental outlook of the company, which can be read here. While profitability was underwhelming and will most likely continue to be for at least the rest of the year, it is well worth it as the company is positioned to be a leader in the new television model. When streaming takes over traditional cable services as the preferred television model for consumers, Netflix’s original content and presence internationally will give it a leg up on the competition, driving subscription growth and strong profitability.