Introducing The New Fundamental Analysis Filter To The I Know First Algorithm

Fundamental Analysis Filter

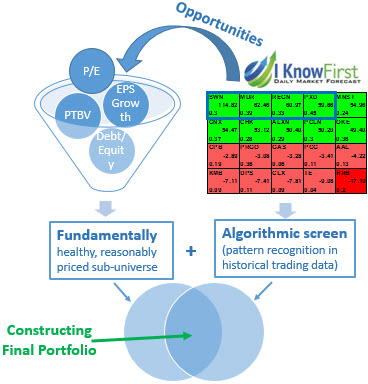

When investing in the stock market, investors often do a fundamental analysis to determine which stocks will be beneficial to add to their portfolio. Fundamental analysis, unlike technical analysis, involves looking at the specifics of the company itself. Some of the most common fundamentals that analysts look at include the company’s cash flow, profit retention, and gross margins. By looking at a company’s fundamentals, investors can determine the overall “health” of the company and decide whether they expect the stock price to go up in the future, stay relatively flat or decline.

Studying the fundamentals of a company can tell investors if the company’s revenue is on an upward trend if the company will be able to pay off its outstanding debts, and if the company is in a good position relative to its competitors. This kind of analysis involves data on both the company and its industry, and the data is pulled from balance sheets, income statements, and earnings reports among other financial statements.

Our fundamental package includes algorithmic forecasts for stocks based on a number of fundamental criteria. The package includes forecasts for stocks with high and low of each of the four basic valuation indicators:

- P/E (price to earnings ratio)

- PEG (price/earnings to growth ratio)

- price-to-book ratio

- price-to-sales ratio

Institutional investors can customize their forecasts to be screened for the valuation indicators that are most relevant to their personal trading strategy. Our algorithms help find best opportunities for both long and short positions in stocks within each fundamental screen.