I Know First Reviews: May 19th, 2015

I Know First Reviews

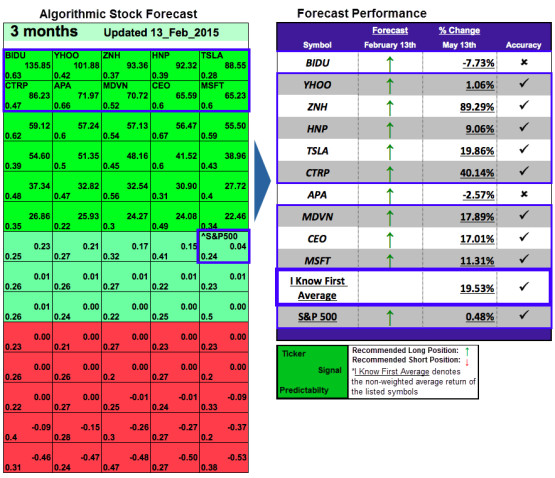

The stocks selected here are the top performing stocks from I Know First: Daily Market Forecast’s May 13th, 2015 stock forecast titled “Quantitative Investment: Up To 89.29% In 3 Months“.

This forecast is part of the “Top 10 Stocks” package, as one of I Know First’s quantitative investment solutions. The “I Know First Average” return was 19.53% over 3 months versus the S&P 500’s return of 0.48% over the same time period.

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Signal: 135.85

Predictability: 0.63

Return: -7.73%

Baidu is a Chinese web services company well known throughout China: so much so, in fact, that it is commonly regarded as significantly more popular than Google China. Founded in 2000, the company – headquartered in Beijing – offers a myriad of features to its predominantly Chinese audience: its communities and services include a question-and-answer community (Zhidao), a Wikipedia-esque publication (Baike), an image search, news, an instant messaging application, and a very popular MP3 music player.

Signal: 101.88

Predictability: 0.42

Return: 1.06%

Yahoo, incorporated in 1995, is a technology company. Yahoo provides digital contents through its different properties such as Yahoo Search, Yahoo Finance, Yahoo Answers, etc. The company had a signal strength of 101.88 and a predictability indicator of 0.42. In accordance with the algorithm’s prediction, the stock price increased 1.06%. The stock is increasing as the company is developing two messaging app and new mobile search app. This would help Yahoo to be more competitive. Also, after the acquisition of AOL by Verizon Communication, people on Wall Street are wondering if Alibaba will buy Yahoo. A potential acquisition could imply surge of the Yahoo stock.

Signal: 93.36

Predictability: 0.37

Return: 89.29%

China Southern Airlines is a airplane company. With its subsidiaries (CSN Group), China Southern company is the bigger airplane company in China. They offer international and domestic airlines. The company had a signal strength of 93.36 and a predictability indicator of 0.37. In accordance with the algorithm’s prediction, the stock price increased 89.29%. The share price were up due to the decline in crude oil. Moreover, while airline and Chinese stocks have been surging, China Southern Airlines is opening a number of new routes connecting the southern city of Guangzhou with cities in southwest Asia, Europe, and Africa.

Signal : 92.32

Predictability : 0.39

Return: 9.06%

Huaneng Power International is a Chinese company which produces and distributes electricity. The company is part of the power producer leaders in China. The company had a signal strength of 92.32 and a predictability indicator of 0.39. In accordance with the algorithm’s prediction, the stock price increased 9.06%. The Huaneng Power International company increased its net income thanks to the the decline in the domestic cost of the fuel. We notice also that the 2015 first quarterly net profit given to the shareholders has risen by 21.02% compared to the same period last year.

Signal: 88.55

Predictability: 0.28

Return: 19.86%

Tesla Motors, Inc designs, develops, manufactures and sells electric vehicles and advanced electric vehicle powertrain components. Tesla owns its sales and service network. The Company is engaged in commercially producing a federally-compliant electric vehicle, the Tesla Roadster.The company had a signal strength of 88.55 and a predictability indicator of 0.28. In accordance with the algorithm’s prediction, the stock price increased 19.86%. At the beginning of May, Tesla has made its first acquisition. Tesla firm has bought Riviera Tool LLC company. It is a tool-and-die maker from Michigan. This acquisition will help Tesla to increase its production.

Signal: 86.23

Predictability: 0.47

Return: 40.14%

Ctrip.com is a Chinese company which operates in the tourism sector. The company created a travel website in order to sell discount airplane tickets and to offer the cheapest hotel reservations. The company had a signal strength of 86.23 and a predictability indicator of 0.47. In accordance with the algorithm’s prediction, the stock price increased 40.14%. Ctrip.com reported satisfying first quarter 2015 results. In fact, the quarterly revenue increased by 46% over the year ago. Ctrip.com forecasts that the revenue will continue to grow at a rate of 45% to 50% year over year.

Signal: 71.97

Predictability: 0.66

Return: -2.57%

Apache Corporation is an independent energy company, which explores for, develops, and produces natural gas, crude oil, and natural gas liquids.

Signal: 70.72

Predictability: 0.52

Return: 17.89%

Medivation is a biopharmaceutical company incorporated in 2000. They created innovative therapies which are efficient to threat serious diseases in the United States. The company had a signal strength of 70.72 and a predictability indicator of 0.52. In accordance with the algorithm’s prediction, the stock price increased 17.89%. On May 7, Medivation announced the first quarter 2015 financial results. This stock is a good choice for a long-term investment. It unique model of treatment will have good consequences on revenues for many years to come.

Signal: 65.59

Predictability: 0.6

Return: 17.01%

CNOOC Limited is an investment holding company. The Company, along with its subsidiaries, is a producer of offshore crude oil and natural gas and an independent oil and gas exploration and production company. Its subsidiaries are engaged in exploration, development, production and sales of oil and natural gas. The company had a signal strength of 65.59 and a predictability indicator of 0.6. In accordance with the algorithm’s prediction, the stock price increased 17.01%. Despite the drop of the crude price, CNOOC company seems to be a great opportunity because the company has a return on equity of 16% compared to 13.4% for the Oil & Gas E&P sector. The earnings per share (EPS) has increased by 10.3% on average for the last 5 years.

Signal: 65.23

Predictability: 0.6

Return: 11.31%

Microsoft was founded in 1975 by Bill Gates and Paul Allen, and is now

one of the most famous tech company, mostly due to the Windows Operational System. Currently the company develops, licenses, markets, and supports software, services, and devices worldwide. The company had a signal strength of 65.23 and a predictability indicator of 0.6. In accordance with the algorithm’s prediction, the stock price increased 11.31%. After the disappointing earAdobe, Microsoft Corporation started a partnership. They combine Adobe Marketing Cloud Solutions with Microsoft Dynamics CRM in order to improve the connection between the sales, marketing and customer services data. Also new products, such as Azure and Office 365, create positivity around the stock movement.

Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article. Read More From I Know First Research:

- Electric Buses Vs. Fuel Cell Buses: Plug Power Has A Stake In The Winner (View)

- Why BlackBerry Holds Long-Term Value For Investors (View)

- Tata Motors Is An Attractive Opportunity: An Algorithmic Analysis (View)

- Applied Material’s Venture Group Invests Into UV LED, An Interesting Portfolio Expansion With Growth Potential (View)

- Can Apollo Fight Online Education Any Longer? (View)