I Know First Review: TechFaith Explosion-Protected

I Know First Review

TechFaith (NASDAQ: CNTF), was founded in 2002 and was listed on the Nasdaq in 2005. The Chinese company is involved in both real estate and mobile solutions in China. TechFaith has a team of engineers that develop ruggedized smart devices for both consumer and enterprise segments. In 2009, the company began investing in construction, and CNTF operates commercial real estate properties across China, where it focuses on the development of office spaces for developing economies as part of their growth and diversification strategy. Between 2011 and 2014 the company’s net revenues have been cut by a third, from around $324 million to $97 million, a trend that has sent the stock on a continual decline from a 5 year high of $28.00 a share, in April of 2011.

(Source: asiatechhub.com)

The company started 2016 at $3.65 and during the first two weeks of the year the company sank to $2.70. On January 19th, the company announced that they would target higher volume, mass market launch a new 4G smartphone, branded the M2, the rugged smartphone will feature outdoor applications such as a barometer, compass, torch light and magnifying glass. The next week, the company announced that they had won the rights to a three-year, $30 million dollar contract to build and ship a tailor-made device to unnamed analytical solutions customer. With regards to this announcement, CEO, Deyou Dong explained: “we believe our ability to provide custom solutions is an advantage in meeting the needs of enterprise customers as we pursue other potential opportunities in this market segment.” By February 2nd, the stock was back up to $3.65 a share as the company announced that they would launch an explosion-protected 4G smartphone, capable of detecting flammable gas that is tailor made for the oil and gas industries.

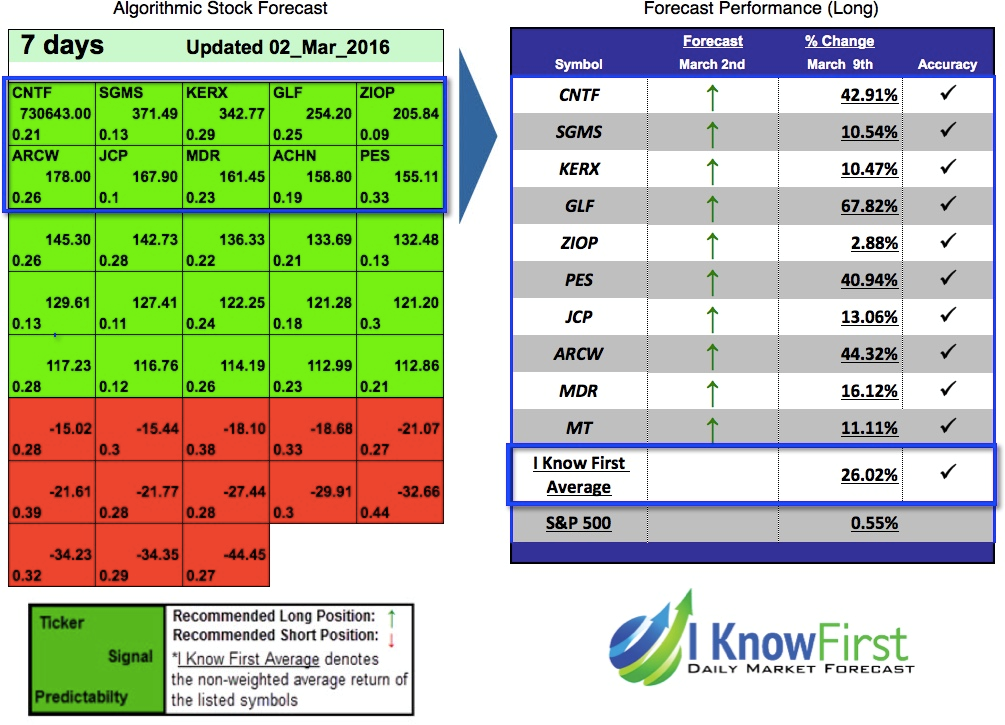

On March 2nd, CNTF was trading at $3.35, and the I Know First Algorithm had an incredibly bullish short-term signal for CNTF. The next week, on March 9th, the stock closed at $4.23, up over 40%.

On February 12th, due to regulatory pressure to keep American depository shares of foreign companies above $1, CNTF announced that they would be doing a reverse split. According to the “ratio change,” one ADS would change from fifteen ordinary shares to seventy-five ordinary shares. This would have the same effect as a one-for-five reverse ADS split, and would be effective March 1st, which is probably what sent the stock soaring this past week.

(Source: Yahoo Finance)