I Know First Review: November 16th

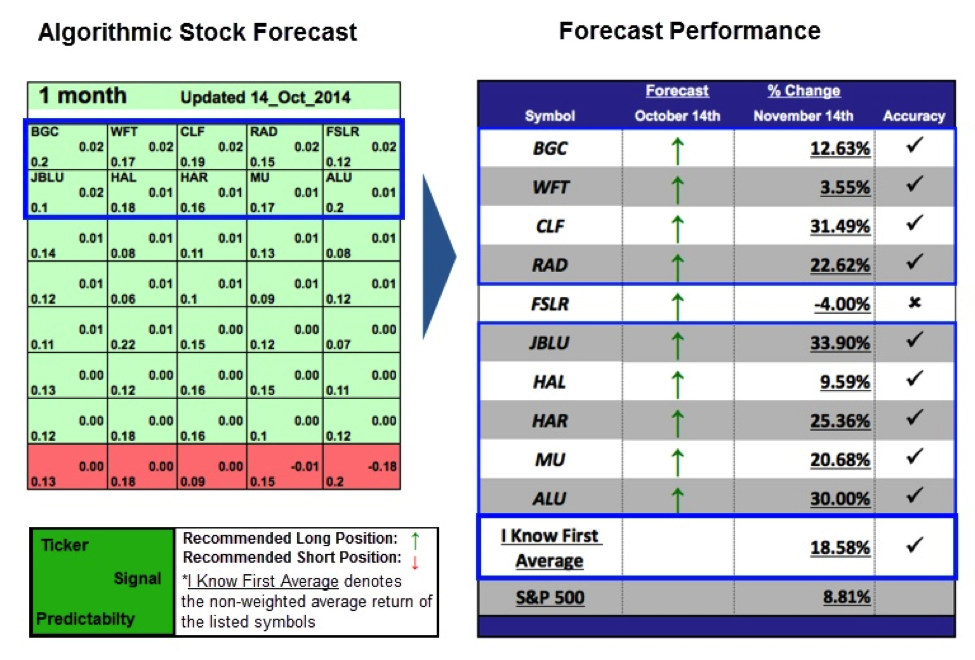

The stocks selected here are the top performing aggressive stocks from I Know First: Daily Market Forecast’s November 14th 2014 Stock Forecast titled Algorithmic Trading Strategies: Top Aggressive Stocks. This forecast is part of the Aggressive Stocks Package. The “I Know First Average” return was 18.58% versus the S&P 500’s return of 8.81% over the same time period.

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Signal (1 Month): 0.02

Predictability (1 Month): 0.2

Return: 12.63%

General Cable Corp. designs, develops, manufactures, markets, and distributes copper, aluminum, and fiber optic wire and cable products for the energy, industrial, construction, specialty, and communications markets worldwide. The company sells its products directly to utilities, independent distributors, retailers, contractors, and original equipment manufacturers. General Cable Corporation was founded in 1992 and is headquartered in Highland Heights, Kentucky. The company had a signal of 0.02 and a predictability of 0.2. In accordance with the algorithm prediction, the stock returned 12.63% in a one-month time horizon. During this time span, many financial analysts downgraded BGC from a hold to a sell due to disappointing third quarter results and lower than expected fourth quarter estimates. However, the algorithm correctly predicted that the stock was undervalued, pointing out the possibility to make a 12.63% return on the stock.

Signal (1 Month): 0.02

Predictability (1 Month): 0.17

Return: 3.55%

Weatherford International Ltd. provides equipment and services used in the drilling, evaluation, completion, production, and intervention of oil and natural gas wells worldwide. It provides services such as inspecting, cleaning, drying, testing, improving production, running, or establishing integrity from the wellhead out, including integrated management services. The company was founded in 1972 and is headquartered in Geneva, Switzerland. The company had a signal of 0.02 and a predictability of 0.17. In accordance with the algorithm prediction, the stock returned 3.55% in a one-month time horizon. While many companies involved with crude oil have struggled mightily in the last month, Weatherford stock actually gained 3.55%. In the third quarter, the company’s profits rose dramatically amid a round of cost-cutting and asset sales to pay down debt and to focus on their core business.

Signal (1 Month): 0.02

Predictability (1 Month): 0.19

Return: 31.49%

Cliffs Natural Resources Inc., a mining and natural resources company, produces iron ore and metallurgical coal. The company, formerly known as Cleveland-Cliffs Inc., was founded in 1847 and is headquartered in Cleveland, Ohio. The company had a signal of 0.02 and a predictability of 0.19. In accordance with the algorithm prediction, the stock returned 31.49% in a one-month time horizon. Higher revenues than expected in the U.S. iron ore division and large cost reductions in the North American coal operations drove the earnings of the stock. Also helping the stock was the possibility of an exit from the troubled Eastern Canadian assets with lower than expected losses.

Signal (1 Month): 0.02

Predictability (1 Month): 0.15

Return: 22.62%

Rite Aid Corporation, through its subsidiaries, operates a chain of retail drugstores in the United States. The company sells prescription drugs and a range of other merchandise. Rite Aid Corporation was founded in 1927 and is headquartered in Camp Hill, Pennsylvania. The company had a signal of 0.02 and a predictability of 0.15. In accordance with the algorithm prediction, the stock returned 22.62% in a one-month time horizon. The retail drugstore chain announced an agreement with HealthSpot Inc., a healthcare technology company specializing in the integration of telehealth and primary care. HealthSpot stations will offer customers convenient access to high-quality, medical care from board certified medical providers using high-definition videoconferencing and interactive medical devices, according to the company.

Signal (1 Month): 0.02

Predictability (1 Month): 0.12

Return: -4.00%

First Solar, Inc. provides solar energy solutions worldwide. The company operates through two segments, Components and Systems. The company was formerly known as First Solar Holdings, Inc. and changed its name to First Solar, Inc. in 2006. First Solar, Inc. was founded in 1999 and is headquartered in Tempe, Arizona.

Signal (1 Month): 0.02

Predictability (1 Month): 0.1

Return: 33.90%

JetBlue Airways Corporation, a passenger carrier company, provides air transportation services in the United States, the Caribbean, and Latin America. JetBlue Airways Corporation was founded in 1998 and is based in Long Island City, New York. The company had a signal of 0.02 and a predictability of 0.1. In accordance with the algorithm prediction, the stock returned 33.90% in a one-month time horizon. Plummeting oil prices and the Thanksgiving season have helped the airline market. These factors along with their solid stock price performance, growth in earnings per share, increase in net income, revenue growth and largely solid financial position with reasonable debt levels by most measures helped JetBlue earn a healthy gain.

Signal (1 Month): 0.01

Predictability (1 Month): 0.18

Return: 9.59%

Halliburton Company provides a range of services and products for the exploration, development, and production of oil and natural gas to oil and gas companies worldwide. The company operates in two segments, Completion and Production, and Drilling and Evaluation. The company was founded in 1919 and is based in Houston, Texas. The company had a signal of 0.01 and a predictability of 0.18. In accordance with the algorithm prediction, the stock returned 9.59% in a one-month time horizon. Talks of a merger with Baker Hughes, Inc. have helped the stock’s performance. This merger would give Halliburton more international exposure and make it the largest oil-services company.

Signal (1 Month): 0.01

Predictability (1 Month): 0.16

Return: 25.36%

Harman International Industries, Inc. develops, manufactures, and markets audio products, lighting solutions, and electronic systems, as well as digitally integrated audio and infotainment systems for the automotive industry worldwide. The company was founded in 1980 and is headquartered in Stamford, Connecticut. The company had a signal of 0.01 and a predictability of 0.16. In accordance with the algorithm prediction, the stock returned 25.36% in a one-month time horizon. Their most recent ratings report showed higher revenue growth than the industry average, which has helped boost the earnings per share. This was partly because high U.S. auto sales drove up the demand for car audio products.

Signal (1 Month): 0.01

Predictability (1 Month): 0.17

Return: 20.68%

Micron Technology, Inc., together with its subsidiaries, provides semiconductor solutions worldwide. It operates in four segments: Compute and Networking Business Unit, Mobile Business Unit, Storage Business Unit, and Embedded Business Unit. The company was founded in 1978 and is headquartered in Boise, Idaho. The company had a signal of 0.01 and a predictability of 0.17. In accordance with the algorithm prediction, the stock returned 20.68% in a one-month time horizon. The company announced a $1 billion USD share repurchase program, which improved the stock’s performance. The company has also shown a strong Return On Equity, a signal of significant strength within the company.

Signal (1 Month): 0.01

Predictability (1 Month): 0.2

Return: 30.00%

Alcatel-Lucent provides Internet protocol (IP) and cloud networking, and ultra-broadband fixed and wireless access to service providers and their customers, enterprises, and institutions worldwide. The company serves transportation, energy, and public sector customers. Alcatel-Lucent was founded in 1898 and is headquartered in Paris, France. The company had a signal of 0.01 and a predictability of 0.2. In accordance with the algorithm prediction, the stock returned 30.00% in a one-month time horizon. The stock was able to rebound after a bearish period after reporting their third quarter results. The French telecom company reported a gross margin of 34% for the quarter, up 2.1% year over year, due to better profitability in several business lines.

Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article. Read More From I Know First Research:

- IBM Fundamental And Algorithmic Analysis: Will Big Blue Bring Big-Time Blues?

- Google Can Grow Forever, But Is It The Best Investment Right Now?

- BlackBerry Is A Risky Fruit: Making 232% In A Year Using Fundamental And Algorithmic Trading

- Coca Cola – Undervalued: Stock Valuation Using A 10-Year Cash Flow Projection And Algorithmic Analysis

- Tesla Motors – Summative And Algorithmic Evaluation