Herbalife Stock: Herbalife Is Worth Adding To Your 2016 Portfolio

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Herbalife Stock: Summary

- In spite its impressive run last year, Herbalife’s stock still have some upside potential left.

- HLF is still trading more than 20% below its 52-week high.

- After Herbalife’s recent legal wins in U.S. courts, I expect this company’s multi-level marketing business to have more favorable business climate.

- Compared to its Consumer Good sector peers, Herbalife’s stock trades at a much lower P/E and P/S ratios.

- The I Know First algorithm is bullish on Herbalife in the long term.

Herbalife (HLF) won important legal victories last year but its s tock is still trading well below its 52-week high of $61.95. Herbalife’s stock posted a +39.56% YTD gain last year, which definitely helped to the -20.5% performance of Bill Ackman’s hedge fund Pershing Square last year.

Ackman has been the most aggressive short seller/attacker of Herbalife. Now that Herbalife has won legal decisions establishing itself as a legitimate multi-marketing company ((MLM)), I believe Ackman and others like him has little chance of derailing the long-term growth of Herbalife.

Yes, Herbalife remains vulnerable to negative propaganda but it remains a viable investment for people who are not sensitive to the semi-volatile, roller-coaster ride of HLF. The bottomline is, in spite of the pyramid accusations against it, Herbalife sells good quality vitamins and food supplements.

In my opinion, Herbalife’s business model is very similar to Avon (AVP) and Amway’s multi-level direct marketing strategy. It is almost impossible therefore for witch-hunting hedge fund managers like Ackman to prove in court that Herbalife operates an unlawful necessary.

With pyramiding accusations essentially inapplicable to Herbalife, I expect the short-interest over HLF to gradually fade away. As per the decades-long existence of Avon and Amway prove, the U.S. (and other foreign government) authorities allow MLM firms they comply with the law. Direct selling through a network of reseller/agents is just another legitimate method of distributing goods.

Now that Herbalife is essentially free from legal challenges, it might be worth considering investing in this direct-selling nutritional company. The stock still trades more than 20% below its 52-week high of $61.95. Without the noise from pyramiding accusations, Herbalife’s stock has a good chance of recovering back to $60++ price levels.

(Source: Google Finance)

Cheaper Than Its Peers

Compared to its peers in the Consumer Goods sector and Personal Products industry, Herbalife has much lower Price/Book and Price/Sales ratios. I opine that this is an aberration of valuation considering the solid 5-year average growths in revenue and EPS of Herbalife.

Please study the charts below from Alpha Omega Mathematica. HLF’s P/S and P/S ratios are more than 100% lower than the valuation of other Consumer Goods and Personal Products firms. This is in spite of Herbalife posting an average of more than 16% annual growth in EPS and revenue for the last five years.

(Source: Alpha Omega Mathematica)

Herbalife also touts a very liquid balance sheet. Its Price/Cash and Price/Free Cash Flow ratios are way better than its sector and industry peers. I am not the only one recommending a Buy for HLF. Three other Wall Street analysts issued bullish ratings for HLF over the last three months.

Check out this screenshot from my premium account at TipRanks. Analysts from Canaccord Equity, Barclays, and Pivotal Research have a consensus 1-year price target of $73 for HLF.

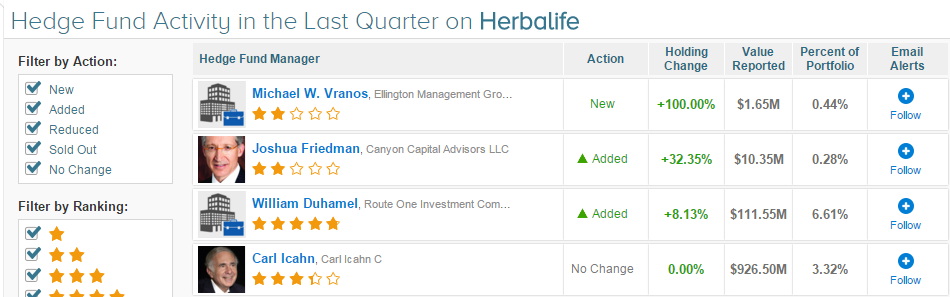

Furthermore, unlike Ackman, other hedge fund managers are going long on Herbalife. These hedge fund people did their due diligence and made their professional long-term analysts. They concluded that HLF is worth adding to their portfolios.

(Source: TipRanks)

William Dumahel of Route One Investment increased its HLF holdings by $111.55 million. Carl Icahn is also still holding on to his $926.5 million-worth of Herbalife stocks. My point is that retail investors should be as daring as hedge fund managers like Duhamel and Icahn when it comes to gambling on HLF.

Yes, Herbalife is a risky investment due to the current high short-interest. However, the fearless investor sometimes wins big when betting against serious odds.

Conclusion

Next only to Amway and Avon, Herbalife is the third-biggest direct-selling company in the world in terms of sales. If Avon andn Amway can survive and grow for several decades without any legal impediments across the globe, I also expect Herbalife to prosper for many years to come.

The fact that Herbalife now has a far bigger market cap than Avon also hints that the former’s business strategy has more fans among the investing community.

(Source: Statista)

(Source: Statista)

Avon’s stock has a terrible 1-year performance (-66%) when compared to HLF. Investors who lost their faith in Avon might instead consider taking a long position in Herbalife.

(Source: Google Finance)

My Buy recommendation for HLF is also in line with the bullish algorithmic forecasts of I Know First Research for Herbalife.I Know First Research, A FinTech Company that created a state of the art algorithm that predicts over 3,000 markets on a daily basis. To detail a bit more on the algorithm, recognizing a positive signal strength with the algorithm does not mean investors should automatically buy the stock. Dr. Roitman, who created the algorithm, created rules for entry for a stock such as Apple. Using this trading strategy, an investor should buy a stock if the last 5 signal strength’s average is positive and if the last closing price is above the 5-day moving average price. When both of these conditions are met, it is a good time to initiate a position in the stock.

The predictive algorithm of I Know First is loudly screaming that HLF’s stock price has strong chance of achieving a great return after a 1-year waiting period. The 1-month and 3-month predictions also favors the probability that HLF will shoot up in price.

If I Know First is right, Ackman’s $1 billion short position against HLF will truly hurt his Pershing Square hedge fund again this year.