Coeur Mining Stock Prediction: Outlook Remains Positive Despite Recent Commodity Price Turbulence

Dario Biasini is a Financial Analyst Intern at I Know First.

Coeur Mining Stock Prediction

May 25th, 2016

Summary

Long-Term Commodity Price Expectations Remain Positive

Long-Term Commodity Price Expectations Remain Positive- Improved Marginality Should Continue to Drive Profits

- BMO Capital Upgrades Coeur Mining Inc to Outperform

- I Know First Algorithm maintains its strong Buy recommendation for CDE

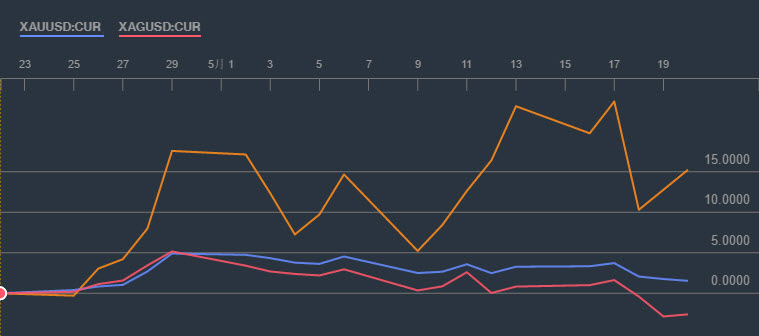

(Source: Bloomberg)

Long-Term Commodity Price Expectations Remain Positive

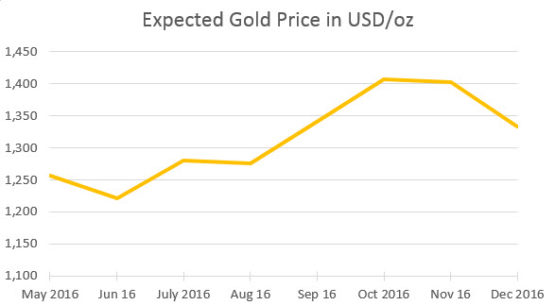

Long term expectations for Silver and Gold prices remain positive despite recent turmoil. The price of Gold is expected to reach 1404 USD/oz in November (roughly +12% from the current price level) as continued uncertainty in equity markets and low interest rates herd investors to the precious metal. This will imply further gains for CDE which derives roughly 67% of its revenue from Gold mining and whose stock price has surged 220% YTD on a Gold price increase of 18% YTD. Moreover Coeur CEO Mitch Krebs expects more upside for Silver as industrial demand grows and the Gold to Silver Ratio decreases from around 75 to 60, returning in line with historical trends (Source: Yahoo Finance). The further increases in the value of the two metals are thus expected to lead to continuing gains for CDE’s stock price.

(Source: longforecast.com)

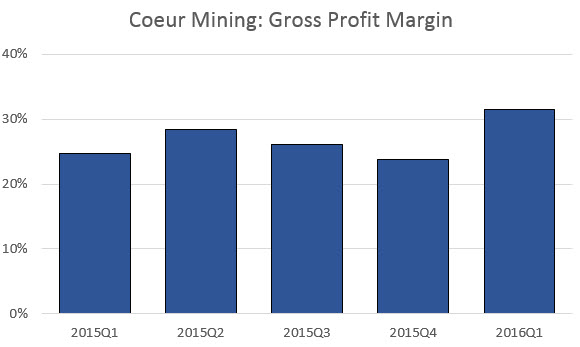

Improved Marginality Should Continue to Drive Profits

Prolonged gold and silver price pressure starting in mid-2013 forced CDE to write-down 1.021 billion USD in 2014 and has compelled the entire mining sector to deleverage and improve efficiency. Coeur has since 2013 managed to lower its Long-Term Debt from 1,011 million to 790 million USD (-21%) while its Gross Profit Margin has increased from 24% in 2015Q1 to 31% in 2016Q1 through the reduction of operating and non-operating costs (Source: Morningstar). These efficiency improvements are expected to increase marginality and to thus further support the growth of the stock price.

(Source: Coeur Mining Inc.)

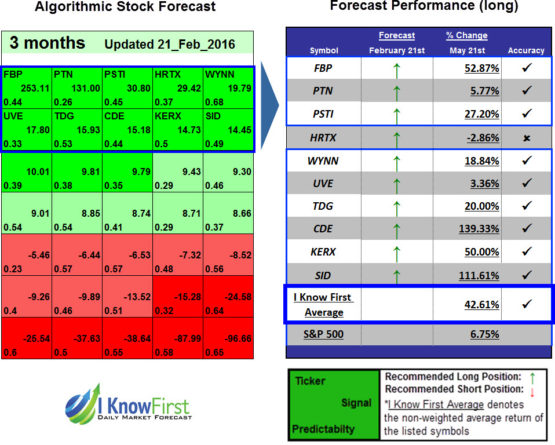

The I Know First Algorithm maintains its strong Buy recommendation for CDE for the 1 month, 3 months, and one-year time horizons. The one-year 1347.6 score indicates a strong bullish signal with .49 predictability.

I Know First Algorithm has previously predicted CDE’s stock movement like in this prediction of a 3 month period from February 21, 2016 until May 21, 2016. The CDE signal was 15.18 with a predictability of 0.44 which managed to bring returns of 139.33% in only 3 months.

Long-Term Commodity Price Expectations Remain Positive

Long-Term Commodity Price Expectations Remain Positive