Why I Am Bullish On Netflix Over The Long Term

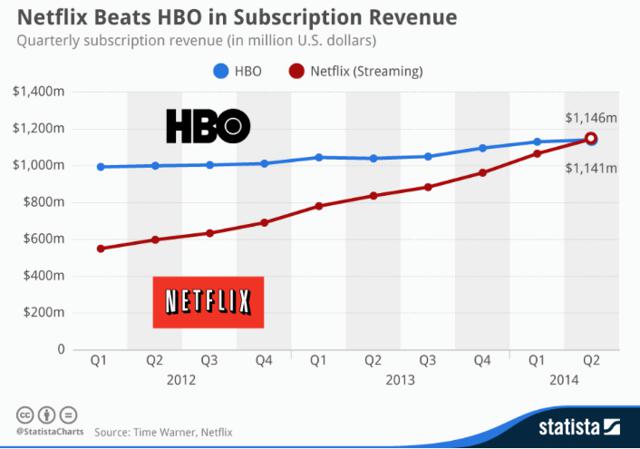

While bears have continued to criticize the high valuations of Netflix (NASDAQ:NFLX), shares have continued to climb 892% over the past five years and 21.25% YTD. Over the past year, the company has added 11.2 million new subscribers to its 50.7 million subscribers worldwide. The company has delivered strong results consecutively due to its ability to add new subscribers, as well as keep current subscribers regaled with its massive movie and television show archive, plus its highly successful original programming. As such, revenues rose 25% year-over-year in the second quarter of its fiscal 2014, and profits increased to $71 million. To help give some comparative insight, CEO Reed Hastings wrote an interesting statistic on Facebook (NASDAQ:FB); “last quarter we passed HBO in subscriber revenue ($1.146 billion vs. $1.141 billion). They still kick

our ass in profits and Emmy’s, but we are making progress. HBO rocks, and we are honored to be in the same league.” Figure 1 shows Netflix catch up and surpass HBO’s quarterly subscription revenue over the past few years. (click to enlarge) While Netflix has surpassed the 50 million worldwide subscribers benchmark, it is still well below HBO’s estimated 120 million worldwide subscribers. At least in the United States market, Netflix has more subscribers than HBO. However, HBO has shown that it can leverage its premium position for higher margins, but the tides could change as Netflix gears up its in-house series productions. Currently, Netflix has lowered its expected profit for the next quarter as it begins to invest in launches across several European cities to expand its international segment and boost its topline. There are certainly some concerns about how these investments impact the company’s earnings growth, but these investments remain a growth driver for the company. For long-term investors, this is exactly what you want to see, however, because while these investments can hurt earnings in the short term, it will produce value over the longer time frame through a growing subscriber base, as well as greater value in the overall service. Currently, the I Know First self-learning algorithmic output has indicated a bullish signal for NFLX in the 1-year time horizon, but a bearish signal for the mid- and short-term time horizons. Due to expenses that encourage growth and enhance the quality of service but also put pressure on margins, shares will likely remain relatively stagnant but marginally lower for the forecasted short- and mid-term time horizons. For at least this provisional amount of time, share growth will likely cool off before regaining steam. Read The Full Analysis On Seeking Alpha

While Netflix has surpassed the 50 million worldwide subscribers benchmark, it is still well below HBO’s estimated 120 million worldwide subscribers. At least in the United States market, Netflix has more subscribers than HBO. However, HBO has shown that it can leverage its premium position for higher margins, but the tides could change as Netflix gears up its in-house series productions. Currently, Netflix has lowered its expected profit for the next quarter as it begins to invest in launches across several European cities to expand its international segment and boost its topline. There are certainly some concerns about how these investments impact the company’s earnings growth, but these investments remain a growth driver for the company. For long-term investors, this is exactly what you want to see, however, because while these investments can hurt earnings in the short term, it will produce value over the longer time frame through a growing subscriber base, as well as greater value in the overall service. Currently, the I Know First self-learning algorithmic output has indicated a bullish signal for NFLX in the 1-year time horizon, but a bearish signal for the mid- and short-term time horizons. Due to expenses that encourage growth and enhance the quality of service but also put pressure on margins, shares will likely remain relatively stagnant but marginally lower for the forecasted short- and mid-term time horizons. For at least this provisional amount of time, share growth will likely cool off before regaining steam. Read The Full Analysis On Seeking Alpha