BlackBerry’s Stock News: Buyout Rumor Makes Stock Skyrocket

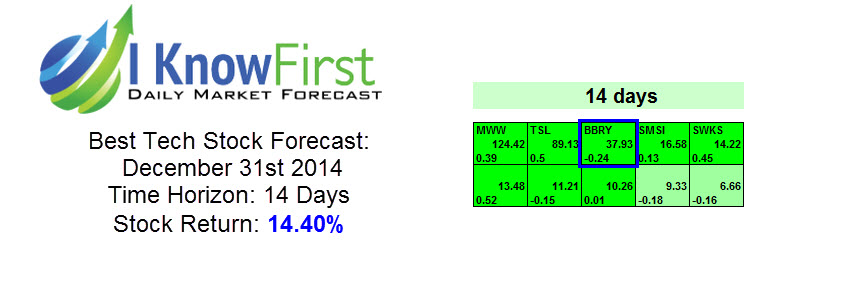

Blackberry was a top 5 stock to long based on predictive algorithm recommended to I Know First subscribers on both December 31st 14 days prediction and January 7th 7 days prediction. On the first one, Blackberry had a signal of 37.93 and a predictability of -0.24 (as seen on the table below), while on the second one it had a signal of 15.95 and a predictability of -0.23.

The positive signal seen on both I Know First Forecast Package meant that, even though the stock here mentioned was in a fairly negative trend since December 30th, our prediction model pointed out a turnaround, suggesting investor to long on this stock.

Blackberry was part of the stock forecast that can be found in the “Tech Stocks” Package.

The full Top 10 Tech Stocks forecast includes a daily prediction for a total of 20 stocks with bullish and bearish signals:

- Top ten stocks picks to long

- Top ten stocks picks to short

As said before, until January 13th Blackberry’s stock was in a negative trend, plummeting from around $11 per share price, to a $9.70 per share, resulting in a 11.81% loss. The negative movement was driven mostly by negative outcome on surveys regarding Blackberrys market acceptance, according to Morgan Stanley analyst James Faucette, despite the company’s heavy marketing effort and new product launch, the Blackberry Passport.

However, breaking news released on Reuters on January 14th indicated rumors about a possible Samsung take over of Blackberry, with an initial price range of $13.35 to $15.49 per share. That offer represented a premium of 38% to 60% over BlackBerry’s current trading price. That rumor had an immediate effect on Blackberry’s share price, skyrocketing to a peak of $ 12.52 per share on January 14th, confirming the I Know First Prediction for this stock.