Big Data In Banking: Bitcoin, Blockchains, and Big Data

Tali Soroker is a Financial Analyst at I Know First.

Tali Soroker is a Financial Analyst at I Know First.

Big Data In Banking

Bitcoin, Blockchains, and Big Data in Banking

Financial technology is now a booming industry, with investments in the sector rising 75% in the first three months of January alone against the total investment numbers for 2015. The innovations that are being pioneered using these extensive investments are challenging existing brick-and-mortar banking corporation to remain competitive by adopting new systems of information sharing and payment processing platforms.

Bitcoin is a wildly unconventional and controversial form of internet currency that uses multiple APIs, or application programming interfaces, and blockchain technology as a basis. APIs allow for the exchange of data between users and enable them to transfer money (in the form of bitcoins) amongst themselves. The blockchain is then a collection of every transaction that has been made between two users of the Bitcoin system. While Bitcoin is thought by many to be a dying currency, losing popularity and support, open-sourced APIs and the blockchain technology used to document transactions are now the target of new innovation in the banking world.

The EU is hoping to be a leader in financial technology specifically in the area of open banking regulation. EU and UK banks are championing the practice of open bank APIs to allow for the exchange of customer data among banks and third-party applications with the aim of driving competition and in some cases increasing security. With this new advancement, customers will be able to more easily switch banking services without losing years of deposit and transaction history, forcing banks to remain competitive in order to keep their clientele. This new form of information exchange will also change the way third-party banking apps access customer banking information. Currently, most third-party banking apps use something called screen scraping to access customer banking data, which exposes customers’ account login information and risks the security of their personal account.

Blockchain Technology

Blockchain technology, the technology behind bitcoin transactions, is now attracting the attention of major banking corporations such as Citi, Credit Suisse, and JPMorgan.  Last September, these banks along with a number of other high-profile corporations joined a coalition led by a firm called R3 in order to work towards implementing blockchain technology in conventional banking. Microsoft has also teamed up with this conglomeration of banks to provide support and services for R3’s blockchain labs. The potential for blockchain technology in the banking sector is huge. As developments continue, these large banks are hopeful that blockchain will be useful in trading anything from remittances to securities exchanges. Outside of the financial world, it’s possible that this technology will also be useful in advancing current voting systems, vehicle registrations and insurance claims, wire fees, and gun checks.

Last September, these banks along with a number of other high-profile corporations joined a coalition led by a firm called R3 in order to work towards implementing blockchain technology in conventional banking. Microsoft has also teamed up with this conglomeration of banks to provide support and services for R3’s blockchain labs. The potential for blockchain technology in the banking sector is huge. As developments continue, these large banks are hopeful that blockchain will be useful in trading anything from remittances to securities exchanges. Outside of the financial world, it’s possible that this technology will also be useful in advancing current voting systems, vehicle registrations and insurance claims, wire fees, and gun checks.

One particular example of a non-financial institution using big data, though not blockchain technology specifically, is the United Parcel Service’s (UPS) use of tracking package movements over the last three decades. The company has made many advancements in their analysis of package movements using big data through the creation of their operations research project called On-Road Integration Optimization and Navigation, or ORION. By 2011, UPS had saved more than 8.4 million gallons of fuel after eliminating 85 million miles off their daily routes through their optimization project.

Additionally, big data has many uses in the financial world outside of the realm of Bitcoin and blockchain technology as well. Wall Street has been benefitting from big data analytics for years with advanced algorithms designed to track and predict the stock market. Many investors are unaware of the ways in which they can take advantage of this technology because until recently these types of algorithms were accessible only by large institutional trading funds. I Know First, along with other financial tech start-ups, has started to change this by making these predictive algorithms available to retail investors as well.

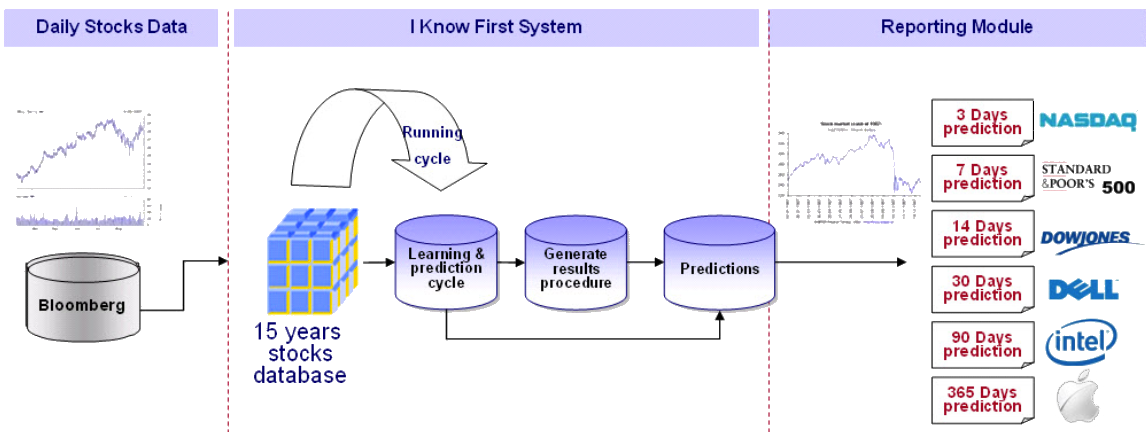

I Know First’s algorithmic system is based on artificial intelligence and deep learning technology that is capable of consuming large data sets and creating, modifying, and deleting relationships between different financial assets. The system is able to interpret and analyze patterns in market data that humans are incapable of seeing and, in doing so, it can create a model of the market and produce predictions for future stock trends. Each day information is added to an existing database of 15 years’ worth of financial market data, and the algorithm learns from its successes and failures and increases its accuracy in future predictions. By implementing this predictive algorithm, I Know First’s 2015 portfolio outperformed the S&P 500 picks by an outstanding 96.4% margin.