AT&T Stock Forecast: Algorithmic Perspective: After a Bearish Start, Bullish in the long Term

While algorithmic analysis is not to be considered conclusive, it can prove a useful tool when combined with traditional techniques.

I Know First uses an advanced self-learning algorithm based on artificial intelligence, machine learning, and artificial neural networks to predict the flow of money in almost 2000 markets from 3-days to a year. This algorithm provides traders with a trend they can use to identify when to enter and exit the market; though it may be used for intra-day trading, the predictability of this trend becomes stronger in 1-month, 3-month, and 1-year forecasts; as such, it can – when coupled with traditional analysis and careful reasoning – effectively be used to analyze the value of such stocks as T. While I Know First’s algorithm should not be regarded as a stand-alone testament to T’s value, the algorithm has seen an high degree of accuracy, and as such is, at least, a useful complement to independent analysis.

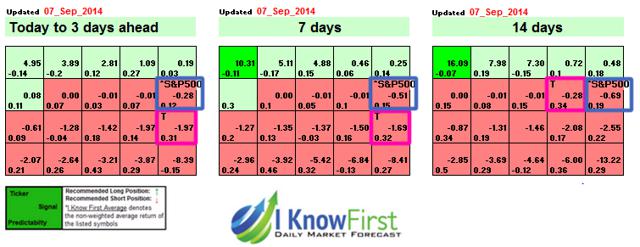

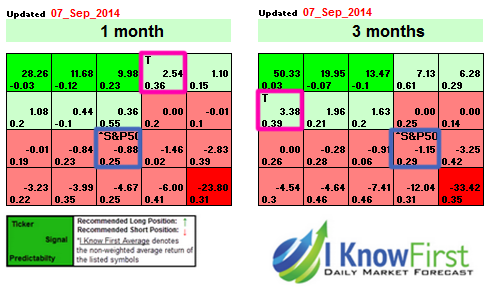

The new forecast generated by the I Know First algorithm, updated on September 7th, is shown below (Figures 4 and 5). Bright green signifies a highly bullish signal; light green also indicates that the forecast is bullish, but not as strongly so. Bright red, in turn, signifies a bearish forecast; correspondingly, light red indicates a bearish forecast as well, but not as negative a forecast. Each compartment contains two numbers: the strength of the signal itself (represented by the number in the middle of each box, to the right), and its predictability (found in the bottom left corner, this is the approximate level of confidence the algorithm has in the forecast). Taking all this into consideration, the ticker symbol for AT&T – “T” – may be seen as bearish in the three to fourteen-day horizons (Figure 4). Later, as the algorithm gains reliability, it becomes bullish in the 1-month and 3-month time frames (Figure 5).

Figure 4. I Know First’s most recent 14-day forecast for AT&T. T is boxed in magenta, and shown to be bearish. For comparison, the S&P 500 is boxed in blue. Please note that a negative predictability indicates high risk, and that the algorithm is significantly more reliable in the 1-month and 3-month time frames than it is on a day-to-day basis.

Figure 5. I Know First’s most recent 1-month and 3-month forecasts for AT&T. T is boxed in magenta, and shown to be bullish. For comparison, the S&P 500 is boxed in blue. Please note that a negative predictability indicates high risk, and that these forecasts are significantly more reliable than that shown in Figure 4. The latter is provided merely to give readers a more complete picture of the present situation.

This bullish forecast for the long term coincides well with recent developments in T’s plans, network expansions, technologies, and subscriber count. Given analysts’ mean “Hold” recommendation and T’s activities in the last year, it may be wise to consider keeping T in one’s portfolio until further change makes it either a buy or a sell.

Conclusion

While T’s recent DirecTV acquisition is not without potential flaws, and while it has not as yet met Wall Street’s expectations in terms of revenue, the stock is not one to steer entirely clear of. T’s new postpaid plans (specifically, Next), expanded networks, reduced pricing, and Android, Windows Phone, and Apple-specific offers have captured the interest of customers old and new, lowering its churn and boosting its subscriber count. This could, in time, increase revenue. In addition, T has plans for cutting-edge technologies, namely, connected cars, homes, wearables, and mobile payments, that are of interest to customers, and has the partners to actualize these ideas. If these schemas are successful, T could see success in new markets and new localities (e.g., Europe). While investing in certain projects could prove unprofitable, T’s acquisitions and capital spending (including investment initiatives like Project VIP) bring it public support and increased subscriptions. Concurrently, an increased U.S. smartphone penetration rate and T’s steady dividend further nurture T’s potential to succeed. Analysts and the industry are taking note of this; specifically, analysts’ recommendations have grown more positive in recent months, with mean recommendations going from strong holds to weak ones, and in some cases, even to moderate buys. In addition, I Know First predicts that T will be bullish in the 1-month and 3-month time frames. While none of these facts independently point to T’s becoming an irresistible buy, it would be wise to avoid completely disregarding the stock. It is decidedly not the entirely irredeemable investment it is often broadcasted as.