Apple Stock Predictions: Will Apple’s Growth Concerns Ever End?

The article was written by Ayush Singh Tip Ranks #4 Financial Blogger – Senior Analyst at I Know First.

The article was written by Ayush Singh Tip Ranks #4 Financial Blogger – Senior Analyst at I Know First.

Apple Stock Predictions

Apple’s terrible earnings can put negative pressure on the stock in the short term.

Apple’s terrible earnings can put negative pressure on the stock in the short term.- Apple needs to focus on unlocking new emerging markets to start growth.

- The iPhone SE should help ease the short-term growth pains.

- Apple’s long-term future still looks bright, but investors should be patient and wait for a better entry-point.

- I Know First currently has a bullish signal for AAPL stock

Shares of Apple (AAPL) are off almost 30% from its all-time highs. The drop may seem confusing given that Apple is trading at a very conservative multiple, however I don’t find it surprising. Since the iPhone 6S has failed to outperform its predecessor, Apple’s sales are falling on a year-over-year basis.

Since there was a pent up demand for a bigger iPhone, the iPhone 6 was a huge success, which made it impossible for its successor, the iPhone 6S, to surpass its sales. Given the market’s obsession with year-over-year growth, the falling sales were expected to take a toll on Apple’s shares, which is why I warned investors back in November to book profits.

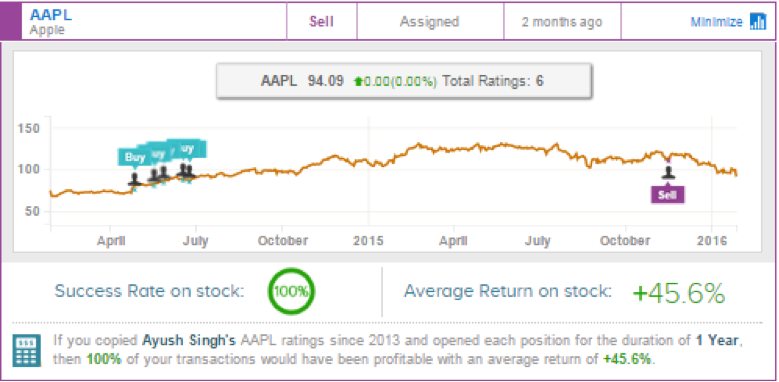

(Source: TipRanks.com)

Apple released its Q2 earnings yesterday, and the drop came in a lot more than the analysts were expecting. The company’s revenue dipped almost 13% whereas the high end of its revenue guidance for Q3 also came in 10% lower than the analysts’ estimate of 10%. As a result, Apple’s shares plunged over 7% and I expect the weakness to continue in the short term. After the terrible earnings, I expect Apple’s shares to fall $90. In my opinion, investors should be patient and buy the stock when it is a little closer to $90.

India is Apple’s new leading edge market

Greater China accounts for the most significant growth engine of Apple, as the company holds a robust position in the smartphone market in China. Now, the company is shifting its focus to India, as it accounts for the third biggest smartphone market around the globe. In the near future, India will likely be one of Apple’s most substantial and important markets. Over the last conference call, Apple’s management stated that it won’t shy away from expanding into markets that have huge untapped potential and I believe India will prove to be Apple’s next big market.

At present, India accounts for a small, but rapidly growing market for the company. In the prior year, the company generated just under a billion dollars in revenue from India, which accounts for 0.5 percent of the company’s overall yearly revenue. By comparison, Apple generated over 20% of its sales from China. However, despite India’s disappointing top-line figure, the company observed a massive growth in India.

Apple’s India revenue $980 million signifies an enormous 44 percent year-over-year growth and given that a lot of the market is still untapped, it represents great potential for Apple. In terms of iPhone sales, the company grew 55 percent in India previous year.

While Apple’s growth is strong, the company still needs to work on its pricing in India. As per many reports, the iPhones are most expensive to buy in India and given that Indians have less disposable income, it is no surprise that Apple has such a small market share. Hence, Apple’s future greatly depends on its ability to unlock key emerging markets.

Apple’s new iPhone SE

Recently, Apple launched its new iPhone model titled as iPhone SE. The company is taking a substantial gamble with the iPhone SE as billions of dollars in top-line are put at strut by terminating the iPhone 5s and placing the iPhone SE as its only small screen sized iPhone.

In the coming two years, the company assumes that it will be competent to offer an updated iPhone 5S to attract a definite percentage of the 240 million iPhone consumers still using small screen sized iPhones to upgrade. From a sales point of view, if the iPhone SE can endure grasping similar sales as that of iPhone 5S and iPhone 5C previous year, then iPhone SE will generate $7 billion of revenue this year.

On the other hand, iPhone SE comprises of all the features that are found in iPhone 6/6S, excluding 3d touch technology. Keeping in mind the iPhone SE qualities, the company’s bet could surge to $30 billion in terms of revenue in the approaching two years.

However, the iPhone SE will struggle in India again for the same reason. The iPhone SE is selling for a higher price in India and Apple really needs to work on the pricing problem in order to make headway into the Indian market.

A tough competitor

Apple’s major competitor Samsung recently launched its new flagship models Galaxy S7 and Galaxy S7

Edge. As per Bloomberg reports, Samsung shipped around 9 million units in the starting month, three times as many as compared to its previous model Galaxy S6. Samsung Galaxy S7 includes waterproof technology and microSD slot, which was absent in Galaxy S6.

Furthermore, Samsung played its card well by bundling its new VR gear headset with Galaxy S7 preorders. Due to this, the company experienced robust sales. Growing unit sales spell trouble for Apple as the company will now have lesser number of people to sell the iPhone 7 too.

If Samsung is able to triple high-end sales contrary to the milieu of a smartphone market that is only supposing to raise 7 percent on a yearly basis, Apple’s growth will take a hit. Apple’s revenue is already under pressure and the company needs to deliver a supreme product in the form of the iPhone 7 so as to not lose market share to Samsung.

Conclusion

Apple’s long-term future largely depends on the company’s ability to unlock key markets like India. I strongly believe that in the long-term, Apple will find a way to grow its market share in India, but for the short-term, the Cupertino giant may struggle. Tough competition from Samsung and falling iPhone sales along with increasing strength of the U.S. dollar are multiple headwinds that Apple faces going forward. However, I think long-term investors should continue holding the stock and should add to their positions when the stock falls towards $90 in the near future.

My long-term bullish outlook is echoed by the algorithmic signal of I Know First. I Know First uses an advanced state of the art algorithm based on artificial intelligence and machine learning to foresee market performance for more than 3,000 markets including stock forecasts, world indices, commodities, interest rates, ETFs, and currencies. The algorithm generates a forecast with a signal and a predictability indicator. The signal is the number at the center of the box. The predictability is the figure at the bottom of the box. At the top, a particular asset is identified. This format is standardized across all forecasts. The middle number indicates strength and direction, not a price target or percentage gain/loss. The bottom figure, the predictability, signifies a confidence level.

I Know First published an article predicting the 2016 bearish AAPL movement on October 11th, 2015. It argued that Apple is unlikely to hit $150 in 12-months is also supported by I Know First’s pessimistic algorithmic forecast for AAPL. The latest October 11 forecast for Apple says that even after 12 months, the stock is unlikely to move up from its current price of $112.

As you can see from the chart above, the green 98.88 forecast shows that the stock will head higher in the long-term. However, I think patient investors will have a better entry-point in the short-term. Hence, I think investors should wait for Apple to retract on growth fears before buying the stock for the long-run.

In addition, previously I Know First Algorithm correctly predicted AAPL stock movement. In this stock forecast, we can observe how Apple had a bearish signal of -0.57 and a predictability of 0.2 on Nov 15th,2015 and in just 3 months the stock managed to go down to 15.88% as the algorithm correctly predicted.

Apple’s terrible earnings can put negative pressure on the stock in the short term.

Apple’s terrible earnings can put negative pressure on the stock in the short term.