Apple Stock Forecast: Algorithmic Forecast For Second Half Of 2015 (AAPL)

Apple Stock Forecast

Apple Inc. (NASDAQ: AAPL) has had a great year, with the stock price increasing 44.71% over the last year. The iPhone 6 was a major success and continues to sell well, playing a major role in the stock price’s rise. Since February 10th, the stock price has stalled, trading in a range of $120 and $133 since then. The stock price is now poised to make another major jump all the way above $150, as a couple of catalysts are coming in the next month and the company’s current products continue to excel.

Figure 1. Source: YCharts

World Wide Developers Conference

The company’s biggest event of the year starts on June 8th. Traditionally, the company unveils new products while revealing upgrades to its operating systems. This year will be no different, with one of the biggest announcements being the new music streaming service. Apple redefined the music business with the iTunes store in 2003, and it currently continues to receive around 80% of music sales around the world.

But music streaming has become very popular, with Spotify leading the market presently. This field of music is experiencing solid growth, and Apple will announce its own music streaming service during the conference, powered by its acquisition of Beats by Dre last year. Apple is clearly late to this market, but it has an advantage over rivals like Spotify and Tidal, as it already has the credit card info of users of its iTunes store.

Converting these customers to convert to music streamers will be easier than it is for competitors to convince them to sign up for their service. The familiarity that customers already has with the company, as well as users’ loyalty to all things Apple, will allow the tech giant to bring music streaming into the mainstream. Apple will make certain songs and artists free to give potential customers a taste of the product, which will have the same $9.99 price as its main competitors.

The introduction of the new streaming service will provide Apple with a new revenue stream to make up for declining download sales. The company is not pinning all of its hopes on the pay-model streaming service, though, as it is also working to improve its iTunes Radio, a free streaming service that competes with Pandora Media (NYSE: P).

Apple is reportedly targeting big-name artists Drake and Pharrell Williams to be DJ’s on the new radio stations, which will also attract people to the paid streaming service. Being the market leader in music, Apple should not have much of a problem becoming the largest music streaming service on the planet due to its brand recognition and scope of its products, providing extra revenue growth and expanding the company’s ecosystem of products.

Another product that Apple was rumored to be releasing at the conference was the new Apple TV streaming service. This will not be released until later this year or possibly until 2016. The updated Apple TV with new hardware, the first update to the set top box since 2012, won’t be released until later in the year either, as it is still not ready. The eventual upgrade will include a better processor and Siri voice recognition, which could have huge implications for the company’s strategy of being present everywhere in consumers’ lives when the Apple TV is revealed, most likely at an event in the fall.

Figure 2. AppleTVHacks

The Siri recognition present in the new Apple TV will have the capability of working with Apple’s HomeKit devices, which just started hitting the market. The HomeKit compliant devices that have hit the market so far include a WiFi-connected thermostat from Ecobee, a smart plug that allows users to turn appliances on and off from iHOME, and a bridge device that makes it possible to connect the HomeKit to Lutron’s connected lighting system.

This type of technology will grow exponentially in the future as more and more products capable of working with home systems such as HomeKit are made. The ability to control these devices using voice commands through Siri on the Apple TV will allow users to make their own settings for different situations, such as having the lights dimmed when entering into movie mode, or making sure all the windows are closed and the thermostat is lowered when leaving the house. This will increase Apple’s presence in users lives, increasing the company’s value.

Current Products Shining

While the new products being released during the conference next week could provide a stimulus to send the stock price higher, it will mean nothing if the iPhone does not continue to sell units at a rapid pace. Samsung Electronics Co., Ltd. (OTC: SSNLF) released the Galaxy S6 and Galaxy S6 Edge smartphones on April 6th, and the phones were seen as a response to the increased screen size of the newest iPhones. There was some worry that the Samsung phones would dent the incredible performance of the iPhone, but that does not seem to be the case.

In the three weeks after Samsung’s new phones were released, it sold about 6 million units. While this number is an improvement for the company compared to its sales of its phones in the previous year, it is nowhere near the 10 million units Apple sold of the iPhone in just its first weekend. Further, based off of Wall Street’s estimates for iPhone sales during the current quarter, Apple would have sold 15 million units in April. The fact that the iPhone would have more sales in the month compared to Samsung’s new models, even though the Galaxy phones were released in the middle of the month, is incredible considering the fact that the iPhone was released 6 months ago.

This trend shows the demand for the new iPhone is not waning as much as it has in the past, even before a new operating system or new iPhone 6s is released. The increased screen size has been a huge hit in China, and current iPhone users are still upgrading from older models to the larger-screen phones. When a new version is released, another upgrade cycle could take place where sales blow away expectations again.

The sales for the Apple Watch will most likely be addressed during the upcoming developers conference as well, while the company will help developers create better apps for the wearable device to make it more useful for consumers in everyday use. Trip Chowdhry, an analyst of Global Equities Research, has estimated that Apple has already received orders for 7 million devices so far based off of developers he has spoken with, while 2.5 million have already been delivered.

This would put Apple on track to sell 40 to 42 million devices by the end of the year. I believe that the current estimates might be higher than actual orders, as Apple has yet to reveal any such information, but do believe that Apple could easily meet that amount of sales by the end of the year. One reason why is the new technology is still not available for sale in stores yet, a fact that could be changing soon. When the devices are made available for in person purchase, sales should pick up. Apple is also working with partners to drive more sales of the device in enterprise, an area of emphasis for the company lately.

More importantly, sales should pick up heavily during the final quarter of the year, when holiday demand for them will be enormous. The fourth quarter of the year has traditionally been Apple’s best due to the holiday season, and Apple Watch should be the biggest beneficiary of the trend this year. The device will have demonstrated its value by that time and will be surpass the average prediction for sales in the first year on the market.

Bond Offering And Analyst Opinion

While Apple’s current product outlook is strong and there is already enough reason to be optimistic regarding the stock price, a new bond offering provides further support to the belief that the stock price will continue to climb. It was reported last week that Apple would issue $1.6 billion in Samurai bonds, which are what bonds issued in the Japanese market by non-Japanese firms are called.

The capital being raised provide good value due to the Bank of Japan’s monetary easing program, as Japanese bond yields are currently amongst the cheapest in the world. The program will also provide the company the ability to continue to return value to shareholders, as much of its $193 billion in cash sits offshore and would be taxed when brought back into the states. Some could also be used to expand the company’s operations in China.

The reason this news is noteworthy is that Apple’s stock price has increased by an average of 19.4% in the six months following the company dipping into the bond market in the past, which Apple has done four times in the past. This would move Apple well above the $150 price level, and the trend could continue here. The extra cash overseas should also be mentioned, as I believe it offers more upside potential for the stock. If repatriating the cash with a tax-break is made possible, the stock price would jump quickly. Such a move could be made possible after the next presidential election and should be taken note of.

Figure 3. Source: Yahoo! Finance

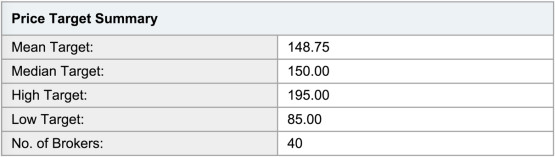

Market analysts also tend to be bullish regarding Apple’s stock price. Analysts have assigned a mean recommendation of buy according to Yahoo! Finance, with a mean target price of $148.75. With the stock price currently trading at $129.96, that represents upside of 14.5%, which I believe is on the low side. The stock price should be able to surpass $155 within the next three months, providing plenty of earnings to warrant purchasing this stock.

Algorithmic Analysis

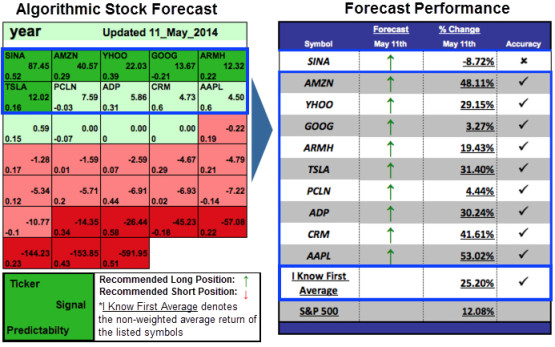

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

I Know First has had success predicting the behavior of Apple’s stock price in the past. In this one-year forecast from May 11th, 2014, the stock was included in the top 10 tech stocks forecast. The company had a signal strength of 4.50 and a predictability of 0.6. In accordance with the algorithm’s prediction, the stock price increased 53.02% during that time.

I Know First published a bullish articles on Apple on Guru Focus (1, 2, 3). Having explained how I Know First’s algorithm works and an example of it predicting Apple’s stock price in the past, it is worthwhile to see if the algorithm agrees with the bullish fundamental analysis of the company. The three-month and one-year forecasts for Apple are included.

Apple has slightly bullish signal strengths in both time horizons, with the signal stronger for three-months. This makes sense considering how much the stock price has already increased over the past year. While the signals are only slightly bullish, the stock price is set to increase due to new developments from its World Wide Developers Conference, the continued success of the products it already has on the market, and the bond offering it is making in Japan. I Know First is bullish on the stock during these time horizons, believing the stock price will continue to increase.