Abercrombie & Fitch Co. Stock Analysis: Investing When Things Look Bad But Are Unlikely To Get Worse (ANF)

ANF Stock Analysis

Abercrombie & Fitch Co. (NYSE: ANF) will report earnings Thursday, here is what to expect. On average analysts estimate a net loss of $0.34 per share. The company’s net income decreased by -77% in 2013 and another -5.14% in 2014. They spend an average $60 million on dividend payments a year, and are scheduled to pay another $0.20 dividend on June 10, 2015. Furthermore, in the fourth quarter of 2014 the company reported $1.1 billion in revenues; analysts estimate this number would decrease 35% to about $730 million in the upcoming report.

Furthermore Abercrombie & Fitch is yet to replace the Michael Jefferies, a surprising delay. Investors seem eager to believe in the stock which is evident by the 8% jump following Jefferies stepping down. This could be a major highlight to investors and a matter we I will cover more later in the article. For those who are unaware of his history this man single handedly brought A&F to be a major brand name, and failed to recognize changes in perception which was shown through his unethical (if not horrible) comments about the brands beauty standards.

Shares are currently hovering around $21, which translates to a market cap of just $1.45 billion. This seems low when you consider the company’s current assets amount to $1.16 billion of which 520 million is cash. The company is in no risk of bankruptcy, The brand is still extremely valuable, and a new CEO can easily turn the brand image around. In simple terms, the stock’s price goes any lower and the balance sheet maintains itself the stocks would be far below its price to book value.

Now one can say this is a contrarian opinion, but why? A&F will announce a new CEO, when they do so the stock will likely go up 3-5%. Some say it is dependent on whether investors are happy or unhappy with the appointment, this is not necessarily true. This is the first reason that this stock is really interesting; it is a short term play which is almost guaranteed to pay off.

CEO candidates Abercrombie Brand President Christos Angelides and chief operating officer Jonathan Ramsden.

Secondly the expectations for this quarter are really low. The current price is adjusted to these negative expectations. If the company outperforms the price is likely to make a small recovery (2-3%), if it falls short than investors will not be surprised and will likely hold their positions until a new CEO is appointed. Of course the risk of the company falling significantly short of expectations is a serious risk, but then again it is almost at book value which is a worst case scenario. If you sum the risk of a bad report and recovery from a new CEO appointment you are likely to break even. If you take into account the performance could slightly recover the investment becomes a serious opportunity.

7 Analysts on Yahoo Finance recommend to buy while 27 recommend to hold or sell. Analysts on MarketWatch are a bit more divided. There are surprisingly 7 strong buy; however, 7 strong sells as well. Finally Seeking Alpha analysts have been very bearish as of light. Some of the larger institutions have price targets at $21 and below including Merrill Lynch ($19), Credit Suisse ($21), Morgan Stanley ($18) and Wunderlich ($17). These analysts are fairly low, and honestly seem to hold the emotional thinking in them – which is the major flaw human analysts make when predicting prices.

Algorithmic Analysis

One of the major advantages of using computers to make a forecast is not only do you have access to exponentially higher processing ability and information, but the removal of any emotion. Especially in a stock like A&F, were the brand is significantly damaged and people are angry, further undervalued by no standing CEO, a computer can make a much more objective analysis. The reason for this is that a computer does not Google “Abercrombie & Fitch CEO” only to be bombarded with horrible articles and blogs of rightfully upset shoppers and organizations.

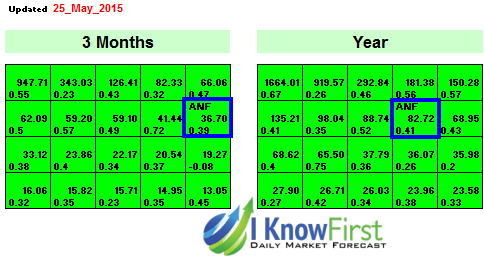

I Know First uses a state of the art stock screening algorithm to measure money flow and stock price pressure. Because A&F has a market cap below 2B it already falls into our small cap prediction universe. The stock has a very high annual predictability score of 0.41 (bottom number), which represents a very high historical accuracy. Furthermore, the signal is currently 82.72 (middle number), which represents significant up pressure on the stock.

Based on the currently low price to book ratio, positive CEO expectation and significant up pressure based on the algorithm we would recommend A&F. Whether to invest before or after the report is a different matter. If you are willing to take a little swing than go for it, else let it play out and invest after the price rebalances.