AMD Stock Prediction: Stronger GPU Sales Is Helping Boost AMD’s Stock

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

AMD Stock Prediction

Summary

- I called for investors to go long on AMD last month. I am again rating this stock as a Buy.

- I announced last month that my 12-month price target for AMD was $4.50. The stock has hit this price target.

- A Recent report revealed that AMD took GPU market share from Nvidia in Q1 2016.

- Investors should appreciate that AMD’s next-generation 14nm Polaris GPU design will it continue to steal market share from Nvidia GPUs.

- I Know First is currently bullish on AMD stock movement.

I made a strong call for investors to go long on Advanced Micro Devices (AMD) last month. This was after AMD’s stock price went up more than 50%. Well, my call was a winning bet. AMD’s stock surged to $4.60 last week. This feat has beaten the 12-month price target of $4.50 that I made for AMD last month.

(Source: Finbox.io)

I’m raising my 12-month price target for AMD to $5. I like the positive reaction from Wall Street last week when it learned AMD took market share in GPUs from Nvidia. The big rally for AMD’s stock since May 24 is likely due to the report that AMD increased its market share in GPUs at the expense of Nvidia (NVDA). As per the report of Mercury Research, AMD posted a substantial Year-over-Year increase of +7.3% in mobile (laptop) GPU sales, while Nvidia’s share decreased from 68.6% to 61.3%.

(Source: Mercury Research)

Likewise, AMD also saw a modest +1.8% gain in desktop GPU sales while Nvidia declined from 79.1% to 77.3%. The reason why Nvidia’s stock price surged last year was mainly due to its strong GPU sales. Now that AMD is showing improved sales numbers for its Radeon GPU division, I expect that more retail and institutional investors will continue to remain bullish on AMD.

The upcoming 14-nm Polaris GPU products will further boost AMD’s presence in the high-end discrete GPU market. Right now, Nvidia still has an overpowering 70.6% share in the discreet ($150-$1000 price range) GPU business. Releasing the Polaris 10 and Polaris 11 before school opening might help AMD take more share away from Nvidia.

(Source: Mercury Research)

A Healthy Radeon GPU Business Is Great For AMD

Ars Technica reported last month that the upcoming Polaris Radeon GPUs will be mainstream, not high-end, video cards. This is a good strategy for AMD. There is really no compelling reason to rush the high-end versions of Polaris GPUs this year. Sticking to low-end and mid-range GPUs will help keep AMD’s momentum in discreet GPU sales.

Like I said earlier, investors will likely focus more on whether AMD can maintain its growing market share in GPUs. It doesn’t really matter if Nvidia’s Pascal GPUs have a slight lead in performance over the 2016 versions of Polaris Radeon video cards.

Videocardz.com leaked the Polaris 10 GPU benchmark scores and one model (with CrossFire) allegedly beats Nvidia’s current flagship $1,111 Titan X GPU. The Polaris Radeon R9 480x with CrossFire is almost as good as Nvidia’s upcoming flagship Pascal GeForce GTX 1080.

As per the 3DMark Graphics chart above, the GeForce GTX 1080 is only 7.3% faster than AMD’s Polaris 67DF:C7 CF (Radeon R9 480x with CrossFire). Such a small difference in benchmark scores is not going to influence PC manufacturers. If AMD sells cheaper Polaris GPUs than Nvidia’s upcoming Pascal GPUs, I expect more PC manufacturers to use 14nm Radeon R9 graphics in their desktop and laptop computer products.

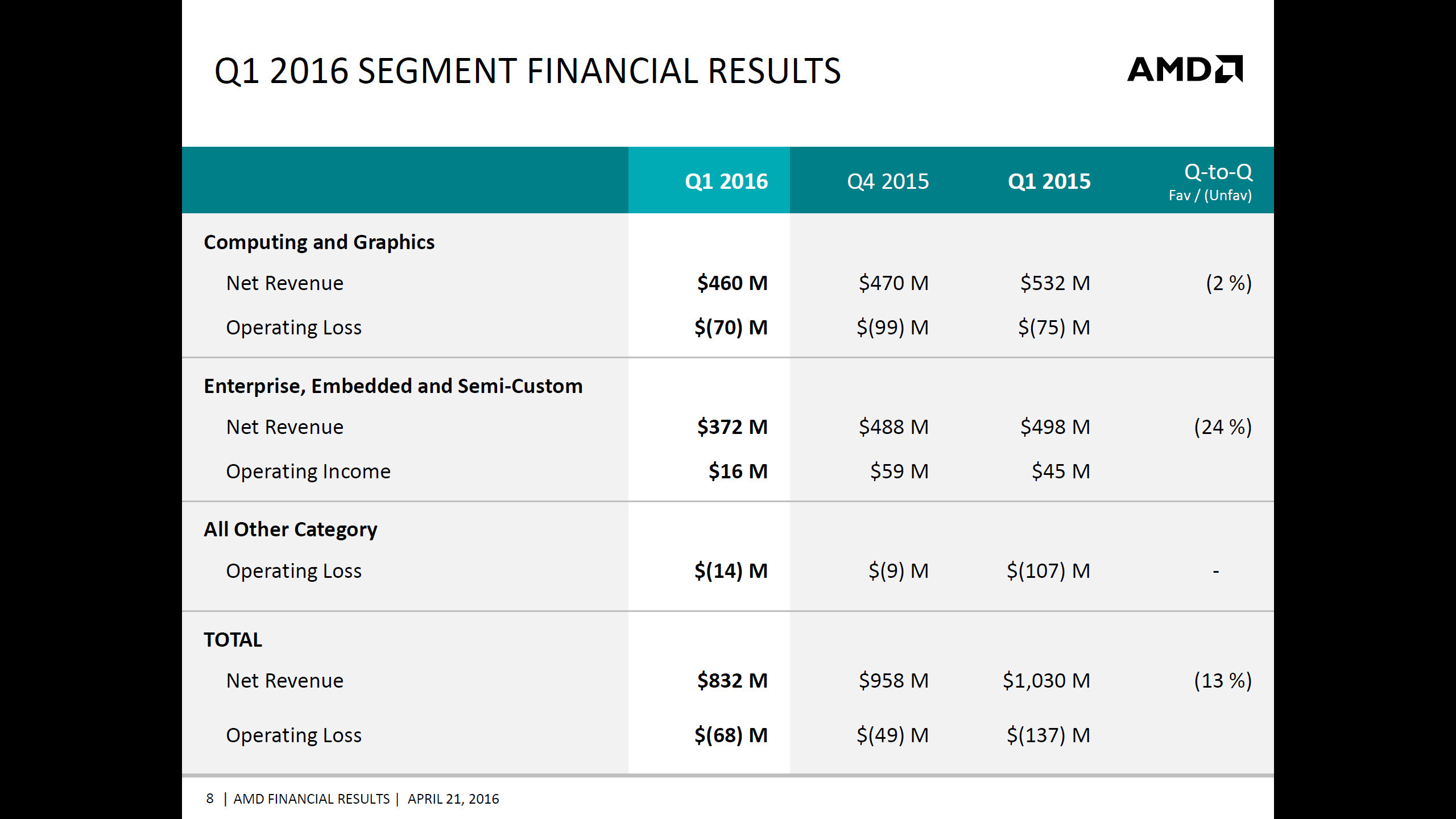

A bigger market share in desktop and laptop GPUs could help AMD finally post a net profit in its Computer and Graphics Segment. I believe that competing with Nvidia’s GPU is an easier task than AMD competing with the x86 processors from Intel (INTC). Another solid gain for Q2 in GPUs will certainly inspire Wall Street to go more bullish on AMD.

(Source: AMD)

The Pascal GPUs from Nvidia uses the 16-nm process. The smaller die size of Polaris GPU could give it a slight edge in power/energy efficiency score. Every little advantage that Polaris has it an important factor on whether more PC manufacturers will use AMD-made GPUs.

It is the PC vendors, not the gamers or PC buyers who largely determine the success of new GPU products. Having said this, I expect CEO Lisa Su to use her Chinese connection to persuade China-based Lenovo (LNVGY) to use more Radeon video cards in Thinkpad laptops and Lenovo-branded desktop computers.

Final Thoughts

I am also long NVDA but I feel AMD’s stock will outperform it this year. AMD had a terrible 2015 because it was stuck using 28-nanometer CPUs and GPUs. Now that AMD has upgraded its GPU to the 14-nm process, I expect it to retake more market share that it lost to Nvidia last year.

My buy recommendation for AMD is in line the positive long-term algorithmic signals of I Know First. AMD has a very high 1-year predictive algorithmic score of +672.67. This stock still has a lot of upside potential. Going long on AMD now is a good idea.

The long-term technical indicators also agree with the strong buy recommendation of I Know First for AMD. Check out Investing.com’s chart below for AMD.

I Know First Algorithm has previously predicted the stock movement for AMD like in this forecast from the 26th of April 2016 to May 26th showing the bullish signal of 73.02 and predictability of 0.33 achieving to return a fantastic 26.09% in just 1 month.