AMD Stock Forecast: Advanced Micro Devices Will Rebound Sooner Than Expected

AMD Stock Forecast: Summary

The article was published on June 10 2015

- Advanced Micro Devices has not posted a profit since 2011, and the stock price has fallen 43% in the past year as the company faces a tough road ahead.

- Management has taken the first steps to turning the company around by narrowing its focus, no longer wasting resources on low-margin markets with high competition.

- Growing market share in the markets it has targeted will be a challenge, but market conditions should improve during the second half of the year giving the company some time.

- I Know First is bullish on Advanced Micro Devices in the long-term.

Advanced Micro Devices, Inc. (NASDAQ: AMD) is a global semiconductor company. Its stock price has fallen roughly 43% in the last year, as the company is facing some daunting challenges. The declining PC market, from which the company gets most of its revenue, has been a burden in recent years, and the company has lacked a focus.

Figure 1. Source: YCharts

In the PC market, it is a secondary player to Intel Corporation (NASDAQ: INTC), which has increased its market share with superior chips. Intel’s standing as the market leader is only growing at this point, as evidenced by its recent acquisitions while AMD continues to see its cash holdings decrease quarter after quarter. The company is also losing market share to Nvidia Corporation (NASDAQ: NVDA) in the GPU market.

It had become clear to everyone that the company’s prior strategy was not sustainable, as the company has not been profitable since 2011. Now, the company is trimming its operating costs while sharpening its focus in specific markets. This is a bullish sign for the company’s stock price, as AMD will now attempt to become profitable by doing fewer things better, instead of being a distant also-ran in many different fields. The stock price, while a risky choice, could offer considerable upside to patient investors.

New Strategy Will Improve Market Share

During AMD’s first conference for Wall Street analysts since 2012 in early May, CEO Lisa Su outlined a roadmap for a more focused company going forward. This was an overwhelmingly positive step for the company, as the current setup was losing money with no way to turn things around in sight. AMD’s cash holdings fell below $1 billion during the last earnings report, dropping $134 million to $906 million.

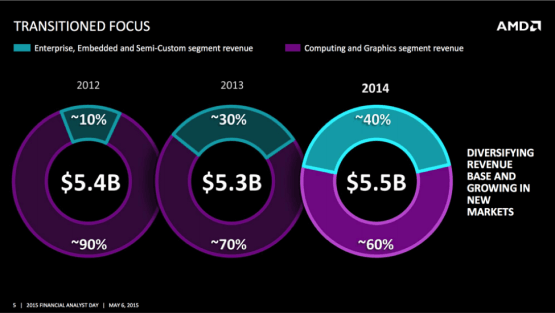

By narrowing its focus, the company can now spend its money on the markets where it can grow market share and draw substantial profits from in the future. AMD will stop throwing resources at markets with low profits and high competition. Some of the markets that it will no longer going after or reducing its emphasis on include the smartphone and tablet markets, the low-end PC market, and the Internet of Things endpoints.

These are the right decisions, as there is plenty of competition and entrenched players in these markets that AMD will not be able to take market share from. In order to turn profits around during the second half of the year and beyond, the company will have to avoid these costly battles, instead identifying changing market trends and grow market share in areas that are overlooked.

The fact that the company has identified this problem is a big step, but carrying out the plan is a whole other matter. AMD has identified three high-margin, high-growth markets to focus on: gaming, virtual and augmented reality platforms, and data centers. In the CPU market, the company is only focusing on the high-end of the PC market, and the key to this strategy is the new high-performance core called Zen, which are expected at this time to be released in 2016.

AMD will compete with Intel in the high-end PC market with these chips, where there is currently no other competition. The lack of other competitors in this market will allow AMD to take market share, as these chips will be competitive with Intel’s offerings. Zen will also by key to the company’s server strategy, where it aims to gain market share by 2017.

Its offerings in the GPU market also show that the company is focusing on market trends and inflection points, as the new chips will be the first with high-bandwidth memory. As part of the shift away from low-end PC sales, the company is focusing more on gaming devices, and these new chips will give the company a leg up on competitors in terms of gaming with 4K resolutions.

Better Second Half Performance

Whether AMD’s narrowed focus allows it to gain market share in the long-term or not, the company’s stock price should improve during the second half of the year based off of basic market trends. A large part for its poor financial performance can be blamed on the weak PC market in general. The release of Microsoft Corporation’s (NASDAQ: MSFT) should drive demand during the second half of the year, helping AMD’s revenues improve.

Su is very optimistic about the company’s performance during the second half of the year, believing the company will return to profitability at that point. This shouldn’t be taken at face value, considering the company hasn’t been profitable in such a long time, but if profits do turn around during the second half of the year, the current price would be deemed way too low.

The turnaround is not expected to come until the second half of the year, as the company will experience another loss during the coming quarter. But losses should decrease during the current quarter before possibly turning positive. With a narrowed focus for the future and a stabilized PC market in which the company can increase its market share, AMD’s stock price offers solid upside potential to investors who acknowledge that the right steps are being taken.

Analyst Opinion

Analysts have wildly diverging opinions on this stock, as its future is anything but certain. According to Yahoo! Finance, the consensus recommendation is hold. The price targets vary wildly, with a low-target of $1.50 and a high-target of $5.00. The mean target of $2.63 offers more than a 13% premium on the stock.

Figure 3. Source: Yahoo! Finance

Gus Richard with Northland Capital Markets set the $5.00 price target for the stock, agreeing with the idea that the company will turn things around. The most interesting part of this analysis is the potential of an acquisition by another company if AMD’s management were unable to successfully transition the company’s focus in the future. Its chips are Intel’s only rival in the data center market for servers, which would make the company an attractive target for an acquisition, limiting its downside potential.

Advanced Micro Devices Stock Predictions: Algorithmic Analysis

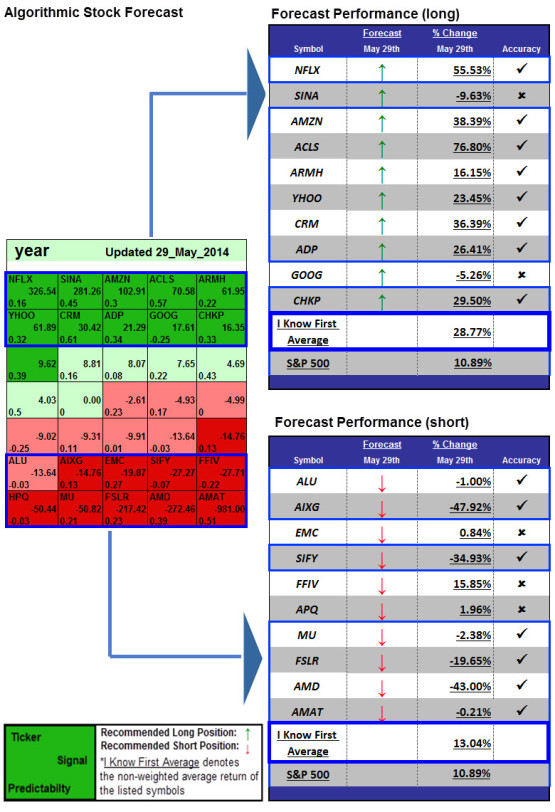

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

I Know First has had success predicting the movement of Advanced Micro Device’s stock price in the past. In this one-year forecast from May 29th, 2014, AMD had a strong bearish signal strength of negative 272.46 and a predictability indicator of 0.39. In accordance with the algorithm’s prediction, the stock price decreased 43.00% during that time.

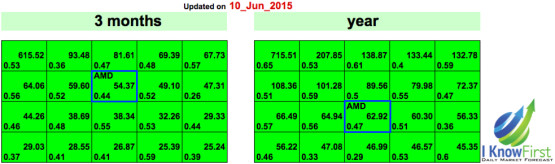

Impressively, the algorithm was also able to predict that the stock price would rise in this one-week forecast from May 31st of this year. AMD had a signal strength of 11.09 and a predictability indicator of 0.36 for this forecast. In the following week, the stock price increased 2.19% as the algorithm predicted.

I Know First published a bullish article on AMD, a global semiconductor company, on Seeking Alpha. Having explained how I Know First’s algorithm works and providing an example of its success in the past, it is worthwhile to see if the algorithm agrees with the bullish fundamental analysis of the company. The three-month and one-year forecasts for AMD are included.

AMD is among the top stock picks for both time horizons. The strong, positive signal strengths indicate that the stock is currently undervalued and provide solid upside potential to investors. This is in agreement with the strong bullish fundamental analysis of the company. AMD’s financial performance should improve during the second half of the year, and the company has narrowed its focus to increase market share in high-growth markets going into the future.

Positive signal strength does not mean investors should automatically buy the stock. Dr. Roitman, who created the algorithm, created rules for entry for a stock such as AMD. Using this trading strategy, an investor should buy a stock if the last 5 signal strength’s average is positive and if the last closing price is above the 5-day moving average price. When both of these conditions are met, it is a good time to initiate a position in the stock.

Conclusion

The rapid fall of AMD’s stock price over the past year more than makes sense considering its falling revenues and lack of profits. However, the company has now taken the correct steps to turn it around, and patient investors could realize solid returns from the devalued stock. The next earnings report will still be uninspiring, but that is already factored into the stock price. Starting in the second half of the year, the stock should start rising as the company returns to profitability increases its market share in high-growth areas. I Know First is bullish on AMD for the long-term time horizon, believing the stock price will rebound in the second half of the year and continue climbing from there.