Algorithmic Trading Methods

![]() Tomer Solel is a Financial Analyst at I Know First. He graduated from Cal Poly Pomona with a bachelor’s degree in applied mathematics.

Tomer Solel is a Financial Analyst at I Know First. He graduated from Cal Poly Pomona with a bachelor’s degree in applied mathematics.

Algorithmic Trading Methods

Summary

- There are different types of algotrading, it is used with artificial intelligence, machine learning, deep learning, and more.

- Classic artificial intelligence combines knowledge with programs.

- Deep learning uses a machine simulating neural networks.

- Machine learning refers to biological networks with machines representing our brains.

- Hedge funds are now also using algorithmic trading to seek an edge in the market.

- The I Know First uses artificial intelligence, machine learning, deep learning, and other sophisticated devices in its algorithm.

Introduction

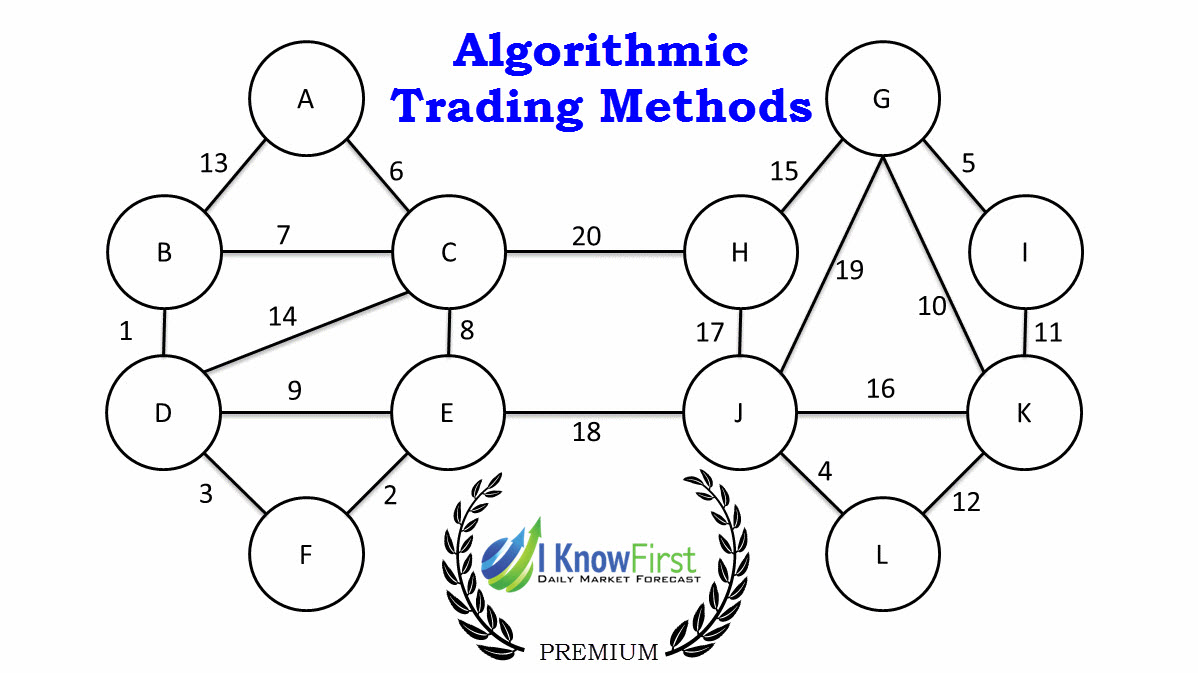

There are different types in which algorithmic trading is used, each a little different than the other. Algorithmic trading is used and implemented in many different ways. It can be used with machine intelligence, machine learning, deep learning, artificial intelligence, volatility, and more. This article will outline the differences between those different topics which can all be based on algorithmic trading. Outlining those differences can be hard as distinguishing between technologies can be a difficult matter.

(Source: thegoldendoilguy.com)

The Classical Artificial Intelligence Approach

Artificial intelligence is one famous approach in which algorithmic trading is used. At first, AI was used for problems that humans could solve, but the results of that proved to be disappointing. At that point, experts developed advanced systems, combining computer programs with expert rules in order to solve problems. That developed specific AI programs for specific problems. A good example of a classic AI system is Watson which was developed by IBM. Watson is a cognitive system enabling a new partnership between people and computers. This great product involves AI with expert knowledge. The history of AI started with this classical approach.

(Source: www.hswstatic.com)

Neural Networks and Deep Learning

The next step was an approach with neural networks, or the deep learning approach, exceeding the capabilities of classic AI. The simple neural networks approach creates a machine which simulates networks of neurons. Since the start, neuroscientists have learned a lot about neural anatomy and physiology but have not made many adjustments to the artificial neural networks. The biggest change is that it moved from the aspect of biological realism to learning more about data without human supervision. The biggest advantage of simple neural networks over classic AI is that simple neural networks rely solely on data, not requiring expert rules. They are able to look at large bodies of data, extract statistics, and classify results.

Biological Neural Networks

The next approach is known as the biological neural network approach. We know that the brain uses a Sparse Distributed Representation (SDR), essential for generalization and creativity. All truly intelligent machines are based on that. They are a foundation upon which everything else depends on. Biological neurons are far more sophisticated than the sample neurons which are used in the simple neuron approach. In order to get machine intelligence, we must throw away simple neurons, and start over with biological neurons. Hierarchical temporal memory is the best example of the biological neural network approach. They learn continuously with from unlabeled data and are able to learn the structure of streaming data, make predictions, and detect anomalies. Machine learning is another one of the many areas of artificial intelligence. It deals with designing and developing algorithms to evolve behaviors based on empirical data. Machine learning seeks to generalize limited data sets. They are able to adapt to new circumstances and extrapolate data.

(Source: numenta.com)

Hedge Funds Use of Algorithmic Trading

For hedge funds seeking an edge, using all forms of artificial intelligence is the next big thing. Hedge funds now use trading robots. A team in China built one such trading robot, and they hope that the three years and millions of dollars that were spent will start paying off, turning financial and linguistic data into unique investment opportunities. This robot, we hope, will teach itself to adjust to volatile markets, without assistance from humans. Algorithmic trading is extremely close to this machine learning. Algorithmic trading is designed to react extremely quickly to market changes, exploiting windows of trading opportunities measured in milliseconds. Many orders of the stock market are now placed using automated algorithms. These algorithms work at superhuman speeds, but the bottom line is they only do what humans program them to do. But AI systems are a lot different, they are able to learn and adapt. Algorithmic trading is becoming very common in many different companies.

Conclusion

The term artificial intelligence has been used so many times that it has become confusing. People don’t seem to be able to differentiate between AI, deep learning, and machine learning. The biological neural network approach is the one that is fastest and most direct path to truly intelligent machines. The I Know First algorithm uses all intelligence forms including the classic AI, deep learning, machine learning, and more. Looking at a 1 year forecast from 01/12/15 – 01/12/16 of stocks using machine learning, the algorithm returned an average of 39.19% for the long position, and 28.98% for the short position, both easily beating the S&P 500 performance which actually brought investors a loss of 5.19% for the same time horizon. This shows that the I Know First algorithm gets a big aid from machine learning in its predictions. The predictive algorithm provides daily forecasts of six different time horizons from over 3,000 different markets. Different forms of AI all play a big role in the success of the AI algorithm.